By 1790, Alexander Hamilton was on a roll. The star of a classic rags-to-riches story, Hamilton was born out of wedlock and orphaned as a child in the West Indies. He was the embodiment of “The American Dream.” He rose to prominence based on his talent, not his parentage, becoming a Founding Father of the U.S. and chief staff aide to George Washington. As the first Secretary of the Treasury, Hamilton wrote many economic policies of the Washington administration. He was particularly adept at maintaining friendly diplomatic relations with England while cleverly circumventing England’s pre-Revolution ban on domestic manufacturing in the U.S. In doing so, the foundation was laid for the fledgling U.S. economy to quickly catapult over England.

As Treasury Secretary, he took the lead in the funding of the states’ debts by the Federal government. Part of his strategy was to impose the “whiskey tax.” It was the first tax on a domestic product levied by the newly formed federal government. Although the tax applied to all distilled spirits, whiskey was by far the most popular distilled beverage in the 18th century. Resistance was fierce. Tax collectors were routinely tarred and feathered. The rebellion came to a climax in July 1794, when a U.S. Marshal arrived in Western Pennsylvania to serve writs to distillers who had not paid the excise. The alarm was raised, and more than 500 armed men attacked the fortified home of tax inspector General John Neville. In response to rumors that more than 7,000 rebels were armed and agitating near Pittsburgh, General Washington himself rode at the head of a 13,000 strong army to suppress the insurgency. Civil war was averted.

The whiskey tax was a classic case of the unintended consequences of a political calculation. It would not be the last case.

Pound Pounded After Brexit Vote

Fast forward to the UK General Election of 2014. The Conservative Party decided to head off the Eurosceptic UKIP party, which was seeking to grab the right wing of the British electorate. To do this, the Tories pledged to put EU membership to a public vote in 2016. Even Conservatives felt that this was a straw political stratagem that would never cross the finish line. On the eve of the vote on June 23, 2016, the British pound rose to £1.5 to the U.S. dollar, anticipating a vote to remain in the EU.

Minutes after the news broke that Brexit was actually happening, the British pound took its worst beating in 50 years and dropped nearly 12%. By October, the pound was down nearly 16%. Shares of UK commercial property REITs fell by an average of 23% the day after the referendum. In the following weeks, when it became clear that the Tories had no economic plan to support Brexit, economic uncertainty reigned.

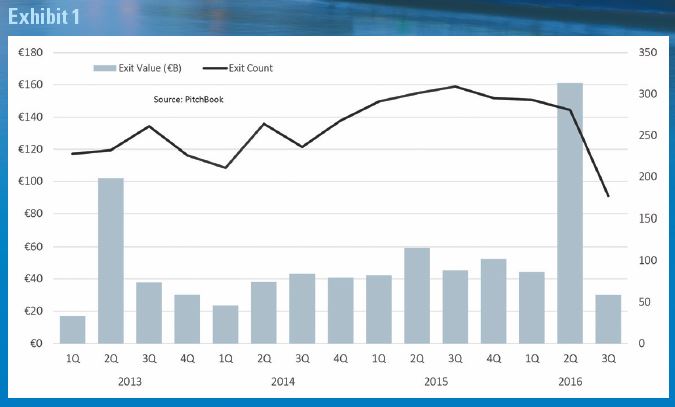

Private equity-backed exits jumped dramatically in Q2/16, then dropped precipitously in Q3/16, as shown in Pitchbook’s chart (See Exhibit 1).

Nate Land at Clear Landing Capital in New York says, “Pan European M&A seems to be slowing down while PE groups fully digest the operational and financial implications of Brexit. This will affect the deal flow of both ABL and cashflow lenders.”

Private Equity Market Slows

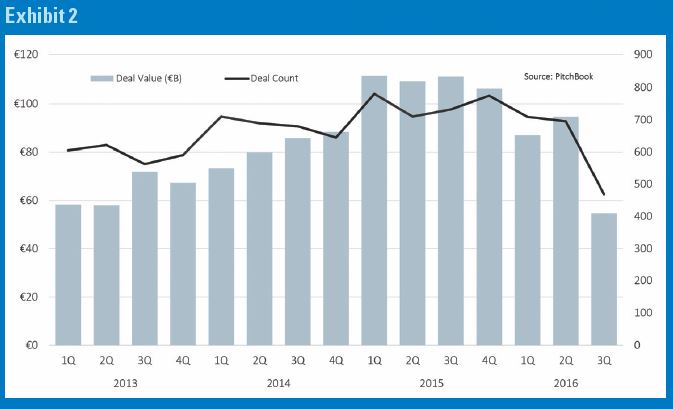

At Pitchbook in London, Garrett Black adds: “The European private equity buyout cycle is likely to continue slowly trending downward, as evidenced by this graph, which shows Q3/16 deal count and value” (See Exhibit 2).

PE buyouts are the sweet spot of U.S. asset-based lenders in the UK and Europe.

Floris Hovingh, head of Alternative Capital Solutions at Deloitte in London says, “Whilst the financial market sentiment has been business as unusual with a degree of caution, the fear is that Brexit is trickling slowly into the real economy as corporates are likely to stall major investment decisions and might become more cautious about incremental new hires. The fear is that longer-term business uncertainty will start to harm consumer confidence.”

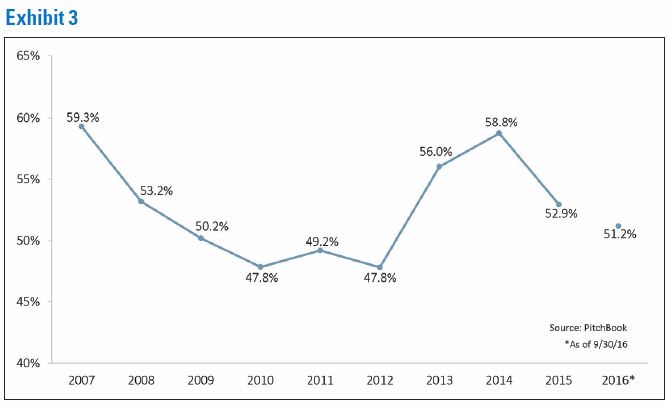

Leverage on PE buyouts has been decreasing from the high water mark of 58.8% in 2014 to 51.2% on September 30, 2016. According to Black, “Lower debt usage points to the impact of increased regulation as well as the deal sourcing environment, not to mention the quality of the typical company” (See Exhibit 3).

Bruce Sprenger, group president of MB Business Capital, says, “Anytime there is a global event like Brexit, it seems to foster an emotional response first, although the markets seem to be resilient after they realize what the true facts are. True asset-based lenders lend based on carefully evaluated collateral value and little emotion. Staying calm is key.” As they say in the UK, the best advice may be “Mind the Gap” and “Stay Calm and Carry On.”

“It is generally anticipated that Brexit will be a complex process of extraction, which could impact sterling volatility, as seen with the June vote and the March 2017 Article 50 announcement in October. Also, the continuation of low interest rates, which is encouraging for borrowers, could be seen as an opportunity and prompt further activity in the UK ABL space,” says Steven Chait, managing director and head of EMEA at Wells Fargo Capital Finance in London.

Sue Law, banking partner at Duane Morris in London, says, “Post referendum, there has been a phony war, but once the UK government gives notice to exit and negotiations with the EU begin, there will be serious battles and real pain. As we learn more detail about the form of Brexit, lenders and borrowers will look at the impact on their material adverse change and force majeure clauses in existing contracts, and attention will be focused on these clauses as new contracts are entered into in an uncertain environment.”

As the repercussions of the vote for Brexit unfold, much remains at stake. Banking and finance contribute more to the UK economy than any other sector. Around 35% of EU wholesale financial services activity takes place in London as well as 59% of international insurance premiums, helping to generate a trade surplus of £72 billion for the UK in 2014.

Foreign Banks Weigh Options

Foreign financial institutions such as Goldman Sachs, Citigroup, JPMorgan and Morgan Stanley are already weighing their com-mitment to the UK. Before the referendum in June, Jamie Dimon said JPMorgan could move as many as 4,000 of its 16,000 UK employees out of the country in a Brexit scenario.

“After the Big Bang, there was no doubt London was the global marketplace, where you had to be located. Post-Brexit, I think that cities such as Frankfurt, Paris and Zurich will take business at the edges but they don’t have London’s infrastructure or people that they would need to become Europe’s global financial center,” says Land.

“Another benefit that the UK offers to U.S. banking expats is high quality schooling. Someone from New York doesn’t have to worry that his or her child will have problems re-entering the U.S. education system after three years in England. That’s a massive advantage enjoyed by London over other European cities. But I hear that Germany is considering changing its labor laws to make Frankfurt a more attractive hub for banks looking to move staff out of London.”

In July 2016, Wells Fargo signaled its commitment to the UK when it completed its purchase of its new London headquarters building. The 11-story building near London Bridge is one of the biggest property deals since the vote. “Although there is a lot of uncertainty in the market, Wells Fargo has a healthy pipeline and balance sheet, and working closely with our customers, alongside their sponsors and debt advisors, we have a wide range of capabilities and financial solutions to provide bespoke facilities during these uncertain times,” says Chait.

The European chapters of the Commercial Finance Association and the Association for Corporate Growth in London are hosting panel discussions on Brexit. Jeremy Harrison, CFA-Europe chapter president and senior vice president at Bank of America Merrill Lynch in London says, “ Many banks are still analyzing which parts of their cross-border operations would be most affected by the various potential outcomes and, as Brexit may take many years, there are no quick answers or decisions. In panel discussions, opinion was divided over how much damage a hard Brexit would do to London and the UK. A commonly voiced concern is that a ‘hard’ departure would result in the loss of pass-porting rights, which are vital for companies to continue trading across Europe from the city.”

Separation with “Visitation Rights”

One panelist noted that none of the current off-the-shelf arrangements preserves existing pass-porting arrangements while giving the UK regulators the influence and control they want over financial services. Harrison said, “I look at Brexit as a separation with visitation rights rather than a hard stop divorce.”

Law points out, “While much attention has focused on the downside of Brexit — possible loss of pass-porting in financial services and less access to the single market — some businesses are actually set to prosper. Engineering, life sciences, agriculture and construction could all see growth — by becoming more competitive absent restrictive EU legislation and benefiting from the UK government diverting the multi-billion dollar annual EU budget contribution to infrastructure projects, R&D, more efficient farming and world-class engineering.”

The weaker pound and possible lighter regulatory burden may be the jet fuel for UK middle market companies targeted by American PE and ABL players in the UK. U.S buyout groups may view middle market targets in the UK with an altered investment thesis, now that the purchase multiples reflect the 16% decline in the British pound. More nettlesome will be the Pan European syndicated ABL deals, where cross border issues may loom large. For the past decade, Pan European middle market syndicated ABL deals have been catnip for the U.S. banks in London. However, very few deals have been completed due to a plethora of barriers and issues. Brexit may exacerbate those barriers.

Worries About Anti-Business PM

U.S. bank executives have been calling for the UK and EU to commit to a transition period to bridge any gap between Britain leaving the bloc and to create a new trade agreement to facilitate trade between the two. But bankers are becoming worried about the increasing anti-business rhetoric that the new Prime Minister Theresa May and her cabinet are voicing. For those individuals with the power to influence London’s future, the stakes are high. London’s advantages — its English language, rule of law and professional services infrastructure — won’t disappear overnight. But key questions are emerging as financial institutions weigh their future in a UK outside the EU.

The UK could reinvent itself. London could position itself as a Singapore of Europe — a less regulated offshore center. The UK already has a growing presence as a base for offshore renminbi trading. In April, London unseated Singapore as the second-largest currency clearing center after Hong Kong.

Brexit could improve London’s prospects of doing business in parts of the world, such as Asia and Africa, with significant growth potential, and where the ability to strike trade agreements may have been hampered by the EU. The challenge for U.S. asset-based lenders is how to capitalize on attractive ABL opportunities in those parts of the world. Many ABL lenders have analyzed whether Asian, African and Mexican middle markets are addressable, and more questions remain unanswered.

Primoz Krapenc, a corporate lawyer from Slovenia who represents multi-national companies in the EU comments on Brexit from an EU standpoint, “With everyone I talk to, no one is expressing doubt that the EU can carry on. I think a consensus is forming that the EU would survive another ‘exit’ as long as it’s a member state which is not in the Euro currency zone. Only a country in the single currency bloc which voted to leave would knock the union project out of bed. The negotiations around Brexit could be an opportunity to create a two-tier EU.

“The first tier could intensify closer political integration. The countries in the second tier would restrict themselves to economic participation. Creating two tiers of membership would allow the EU to continue to fulfill its two most important thrusts: preservation of the single market and the projection of European interests on the world stage. This could solve the Brexit problem, since the UK could fit easily into the second tier rather than leave the EU. In time, even non-EU members such as Norway, Turkey and Ukraine might join the second tier.”

The CEO of JPMorgan has a different view: “Brexit makes the chances of the Eurozone not surviving in the next decade five times higher.”

Until recently, Hamilton was notorious largely for his fatal pistol duel with Vice President Aaron Burr in 1804. When Burr ran for Governor of New York State in 1804, Hamilton crusaded against him relentlessly, calling the Vice President “a dangerous man, and one who ought not be trusted with the reins of government.” This was another political miscalculation on Hamilton’s part. Taking offense at some of Hamilton’s comments, Burr challenged him to a duel, which took place in the Heights of Weehawken in New Jersey, a popular dueling ground across the Hudson River from Manhattan. The Vice President mortally wounded Hamilton, who died the next day. The Federalist Party — already weakened by the defeat of its only successful presidential candidate, John Adams, in the election of 1800 — was greatly affected by Hamilton’s death. The party lumbered along and finally died in 1828.