Analyst

FischerJordan

Senior Engagement Manager

FischerJordan

The coronavirus pandemic has impacted lives and livelihoods worldwide. Along with the unprecedented human toll, it has triggered an economic crisis, with severe contractions in global GDPs.

This crisis has heavily impacted small medium enterprises and small medium businesses, which have suffered one of their worst financial hits in several decades. Forbes reported that in Q2/20, small businesses revenues were cut in half on a year-over-year basis. Additionally, the latest Yelp Economic Average report showed a surge in business closures, many of which will become permanent. All in all, SMEs are in dire need of external financial help to survive.

By drawing on learnings from the 2008 crisis in conjunction with new insights from the ongoing pandemic, banks have further toughened their lending criteria for SMEs, as reflected in the declining approval rates of commercial loans by banks. As a result, the chances of subprime borrowers getting loans from banks (prime lenders) are in a downfall. This results in a golden opportunity for fintechs to offer much-needed commercial financing to SMEs but not without some creative thinking. To truly seize this opportunity, commercial fintech lenders must rethink their existing strategies to make inroads with a new customer segment while battling the numerous challenges triggered by the pandemic.

Fintech Lenders

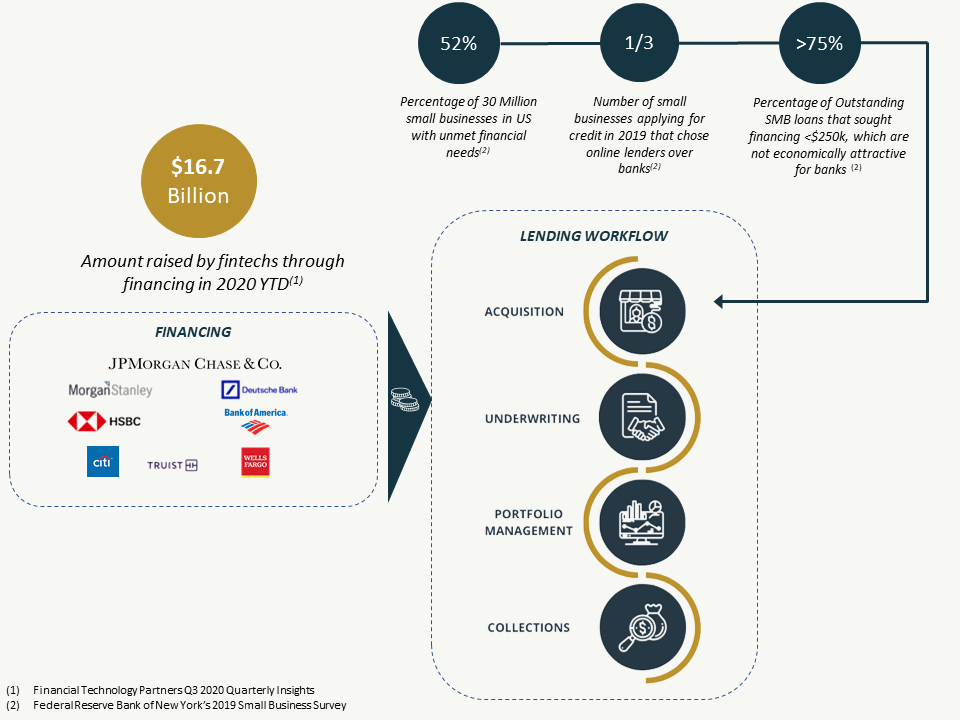

Fintech lenders have been witnessing a significant increase in their share within the small business lending marketplace. The Federal Reserve Bank of New York’s 2019 Small Business Credit Survey showed that roughly one third of small businesses applying for credit in 2019 chose alternative lenders over banks. With banks continuing to tighten their credit guidelines — partially fueled by COVID-19 — this trend is expected to grow manifold in years to come. Unfortunately, the past 11 months have been a roller coaster ride for alternative lenders, and while things became better in the fall than the spring of 2020, few lenders have recovered from the crisis, with only half of the pre-existing players originating loans in today’s marketplace in Q3/20 (Figure 1).

As the COVID-19 pandemic continues to cause uncertainty, fintechs are still under stress in every aspect of their business, including financing, acquisition, underwriting, portfolio management and collections. (Figure 2). Consequently, COVID-19 has forced all types of alternative lenders to readjust their strategies to not only survive but also capitalize on growth opportunities provided by this crisis. Let’s take a look at how fintechs have gone about their business to tackle this crisis and what could be the way forward for them.

Capital Struggles

Alternative lenders fund their loans from several sources, the most lucrative of which is an asset-based security (ABS) or securitization, as they are low-cost capital sources. An ABS is secured after meeting different levels of performance metrics, and lenders that utilize this funding source are legally obliged to maintain those performance levels to keep the ABS in active mode.

Due to COVID-19 concerns, the ratings of 29 securitizations representing $2.1 billion across different alternative lenders were placed on “watch downgrade” by Kroll Bond Rating Agency after experiencing early delinquencies. Since most borrowers failed to pay their debts on time, lenders like Kabbage, Fora Financial and Rapid Finance could not avoid defaulting on their ABS, resulting in what is also known as a rapid amortization event, which is a call to liquefy bonds and give back investors’ money. These RAEs resulted in lenders losing the ability to fund new loans through securitization, causing many lenders to lose capital and lending potential.

Many lenders avoided going into RAE by formulating an effective approach in a timely manner. For example, as part of its approach, Credibly (previously known as Retail Capital) reached out to its securitization bondholders and acquired crisis-demanded amendments, thereby allowing the Michigan-based lender to provide tailored reliefs to its merchants. As of Aug. 30, 2020, Credibly successfully repealed the amendment and also retained its bond ratings, which placed it in a prestigious list consisting of only two lenders (Kapitus was the other) whose ABS was not downgraded due to COVID-19.

Overall, lenders have had to think beyond established and proven strategies to save their financing through this crisis. Furthermore, as banks have again started to see an increase in deposits, some might consider deploying their money into the market through fintechs. This will result in new financing options for alternative lenders.

Stalled Sales & Marketing Attempts

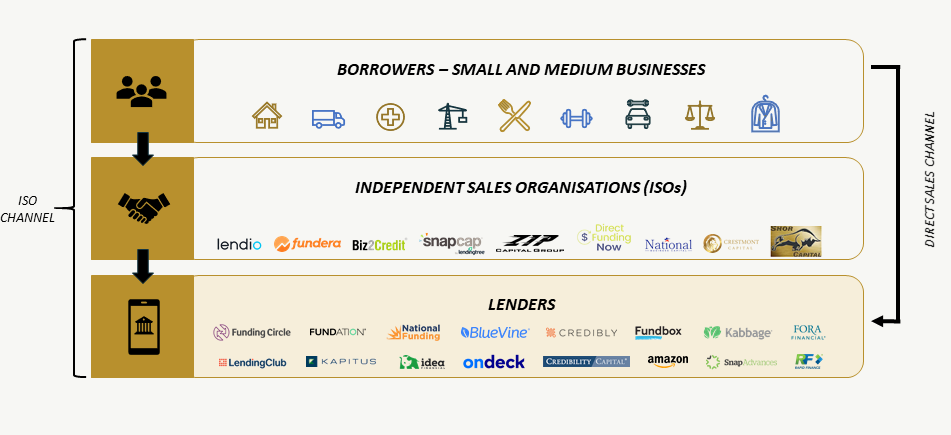

Traditionally, alternative lenders rely on two channels for their lead generation: internal (or direct) sales and marketing teams and/or external sales organizations/partners, which are sometimes referred as independent sales organizations (ISOs). The ISOs act as a bridge between borrowers and alternative lenders in the acquisition of customers, as shown in Figure 3.

To reduce expenses, lenders like OnDeck halted ongoing expenditures that were directed to marketing, for both internal and external channels. Numerous lenders also furloughed a significant number of employees in the wake of drastically changing business conditions.

Early in the crisis, demand for commercial loans dwindled with mounting business closures, and many lenders halted new loan approvals. Many ISOs, particularly the smaller ones, could not bear the brunt of the ongoing crisis and stepped back from marketplace lending. Large ISOs like Lendio or Fundera had to resort to providing a platform for Paycheck Protection Program (PPP) loans for survival.

Now that there has been an upswing in demand for commercial loans from alternative lenders as banks continue to employ more conservative credit guidelines, alternative lenders have refocused on sales and marketing, benefiting both internal and external sales teams. Moreover, lenders who are currently not able to originate loans have chosen to work as an ISO for other lenders in order to stay afloat.

Tightened Credit Guidelines

Underwriting is the soul of commercial lending. In the past 11 months, financial institutions have adjusted to the changing dynamics of borrowers’ credit levels by introducing more rigorous underwriting procedures and changing the minimum qualifications for securing an advance. BlueVine exemplifies this approach, increasing its minimum monthly average revenue requirement for commercial borrowers to $40,000 from its pre-pandemic range of just $10,000 to $15,000, as per BlueVine customer service.

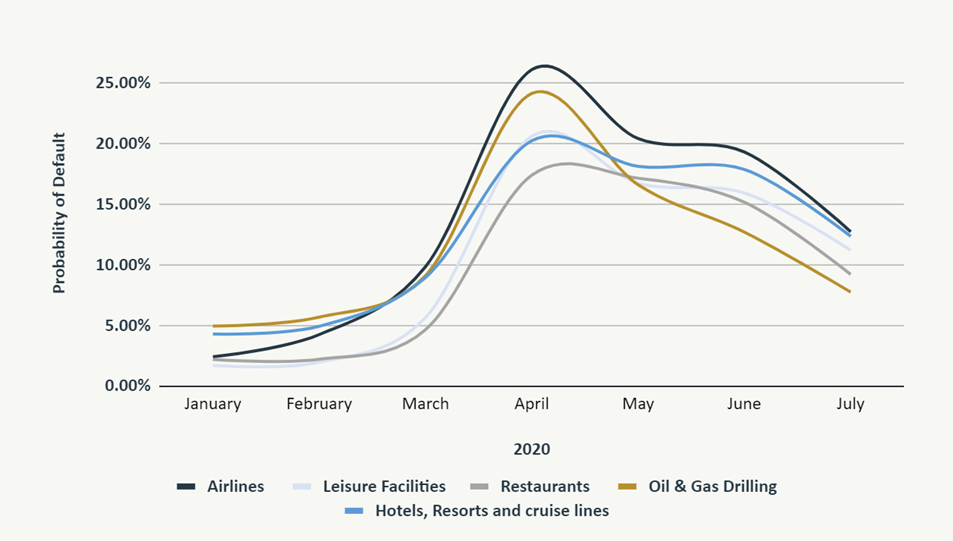

Since probability of default (PD) models employed in underwriting were developed prior to COVID-19, these models were/would be unable to measure the risk accurately during/post the COVID-19 crisis. Accordingly, lenders have had to adjust their PD models by tuning the model inputs. The creditworthiness of borrowers differs enormously by sector. For example, sectors like ed-tech and pharmaceuticals have fared better due to higher demand of their products. On the other hand, industries like airlines, leisure facilities, restaurants, oil and gas drilling, and hotels/resorts/cruise lines have been struggling to cope with side effects of the pandemic, leading to higher PDs, as shown in Figure 4. This has resulted in lenders pausing lending in these adversely impacted industries.

Moreover, the CARES Act passed by the U.S. government amended the Fair Credit Reporting Act (FCRA) to stop adverse credit reporting during the COVID-19 crisis under specific circumstances. According to the amendment, if a creditor/lender makes an accommodation because the borrower was affected by COVID-19 during the covered period, that lender must report the account as current to the credit reporting agencies, so long as the borrower wasn’t already delinquent on payments. This change renders usual credit scores a less reliable metric for a borrower’s creditworthiness and paves the way for alternate creditworthiness criteria.

As commercial delinquencies continue to increase and credit bureau data continues to lag and be inflated to some extent, alternative data can help lenders make a more accurate decision by gaining a holistic view of borrowers’ credit histories. For example, according to Experian, core lending decisions can be improved via social media and macro event data.

Inadequate Focus on Portfolio Management

Portfolio management is a key element to a lender’s success, as is focusing on individual borrowers and the underwriting process. Strong and effective portfolio management enables lenders to identify and promptly counteract early signs of frauds to minimize final losses. While banks are known to give an equal weightage to their portfolio management as part of their lending business, many fintech lenders failed to realize its gravity before the pandemic. As the pandemic set off, few lenders were prepared to fight it off due to lack of a strong portfolio management team, but the ones that were attribute part of their success to such a team.

Historically, lenders have emphasized portfolio management, especially in times of a crisis. Credibly and Kapitus are two of the alternative lenders that have stayed afloat during the pandemic. These alternative lenders realized the importance of portfolio management early on and moved over a significant percentage of their staff to the portfolio management team as the pandemic worsened. Furthermore, lenders with a strong portfolio management team could service distressed portfolios for extra revenue.

Increase in Losses

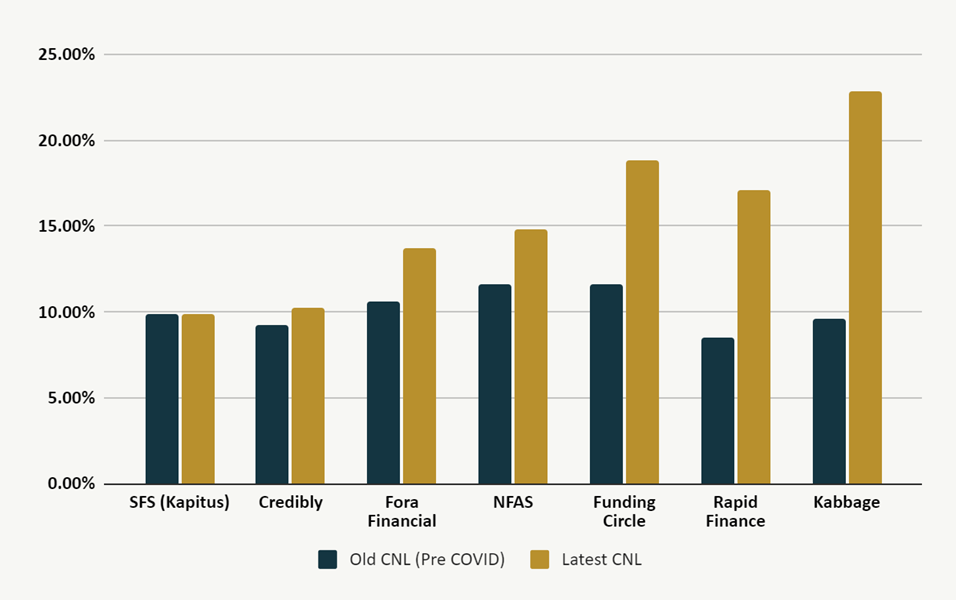

COVID-19 has halted a record-length period of economic expansion. With the threat still unresolved, economic disruptions from pandemic containment measures will keep affecting lending. With lenders’ capital, profit-and-loss and liquidity positions being hit hard, most of them have seen a huge increase in their losses due to COVID-19. Recently published surveillance reports by KBRA show cumulative net losses (CNL) have increased by as much as double pre-COVID-19 loss levels (Figure 5). Kapitus emerged as the only lender whose CNL remained the same, while Credibly saw a difference of only 0.96%.

The Way Forward

The COVID-19 crisis has adversely impacted lenders, but it also has opened new avenues for growth. Some of those opportunities include:

Strategic Partnership(s) in Demand

Now that major leaders like OnDeck and Kabbage have been acquired by Enova and American Express, respectively, and the gap between prime lenders and subprime borrowers further widens, we are likely to see new players entering the market. These could either be newcomers or pre-existing companies from other sectors expanding into the space.

We also have witnessed partnerships between leading banks and retailers to help out small businesses. Goldman Sachs’ Marcus partnered with Amazon and Walmart to provide lines of credit to their respective sellers. Biz2Credit and Lendio, two market-leading ISOs, partnered with different firms supporting SMEs to help their SME clients attain easy credit. With 60% of credit unions and 49% of banks in the U.S. expressing interest in forging partnerships with fintechs, more partnerships are expected, and the anticipations are now further fueled by the COVID-19 crisis.

Distressed Portfolios Available for Servicing

This crisis also has opened doors for companies in the portfolio servicing industry, especially for the distressed ones. Many lenders have gone out of business or been acquired, and their portfolios were left without a servicing platform. For example, American Express acquired Kabbage’s technology and human resources but left out the portfolio. Distressed portfolio servicing is an attractive market for enterprising players looking to capture a new market.

Quicker Decision-Making Through Digital Accounting Systems

With the world shifting online, digital payments are increasingly favored over cash transactions, with an accompanying increase in innovative partnerships. In September, PayPal and Visa joined forces to improve the payment process for SMEs and consumers. Digital payments not only will make access to capital easier but also will help lenders with solving one of their long-standing problems: how to have direct and easy access to cash flow information of a SME, which will, in turn, help lenders expedite their decision-making on credit. Online platforms like QuickBooks are already and will continue to play an important role on this front.

SBA-Approved Lending in Limelight

PPP loans from the U.S. Small Business Administration under the CARES Act were more than just a lifeline to struggling SMEs/SMBs. They also presented an opportunity for alternative lenders to grow their customer base and portfolios. For example, Kabbage deprioritized its usual lending practices and focused on issuing PPP loans, augmenting its portfolio with more than 200,000 approved PPP loans. Through the PPP program, more lenders and borrowers became educated about SBA loans. Consequently, an increase in the volume of SBA loans is expected, especially 7a loans meant for small businesses, along with an anticipated increase in the number of SBA approved lenders.

Conclusions

COVID-19 has severely impacted small and medium-sized businesses. This may also cause a ripple effect in communities, especially in smaller towns with economies heavily dependent on small shops and businesses. Many businesses depend on other businesses, and as some pull the shutters down forever, more will follow.

In summary, many SME owners are still uncertain about their business future. Thus, SMEs are looking to lenders for extra capital in order to survive. However, banks continue to tighten their credit guidelines for commercial loans, thereby making it harder for SMEs to acquire a loan from prime lenders. This opens a door for alternative lenders to capture a new market segment but not without some out-of-the-box thinking. Many lenders are already breaking barriers, adjusting their functioning and operations to meet the needs of small and medium businesses that are suffering. What remains to be seen is whether lenders have weathered the full storm or just the first wave.

This article originally appeared originally appeared on FischerJordan.com.