Senior Managing Director

Focus Management Group

The definition of the operating cycle is the amount of time a company needs to convert inventory to accounts receivable and accounts receivable to cash, offset by the amount of payables that can be maintained. The operating cycle is often calculated for a loan approval memo and everyone learns how to calculate it in lending school or from their accounting textbooks.

However, the operating cycle is much more than a simple calculation. It is a view into how a company manages its working capital and how suppliers and customers are interacting with the company. Companies in the same sector operate with quite a variety of vendor and customer relationships, and different management approaches to differentiate on service and products.

Working capital management is the key to survival for every business. Negotiations and relationships tied to accounts receivable have impacts on what a company is able to accept from vendors and accounts payable, as well as inventory management. For some companies, unique aspects related to one component impact how it can deal with other components. For example, if customers pay quickly to garner discounts, the company can more quickly pay accounts payable or have higher levels of inventory.

How to Approach the Operating Cycle

At Focus Management Group, our method of analysis makes an adjustment to the standard calculation to improve the understanding of the operating cycle.

Calculate the days sales invested in accounts receivable, inventory and accounts payable. Use sales rather than cost of goods sold to focus on the number of days sales invested and to eliminate differences in how a company records cost of goods sold year over year.

With this change, the operating cycle tells how many days sales are invested in working capital components key to an asset-based lending relationship.

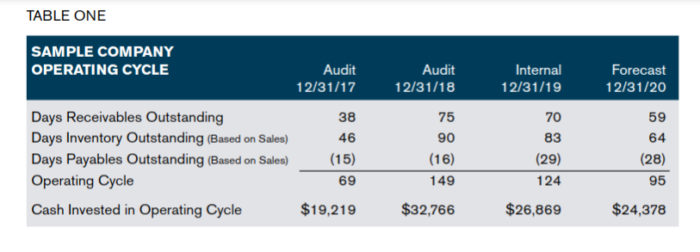

Table one shows the operating cycle for a company over three years and a forecast. Of note, this company provided a forecast for 2020 but did not provide a cash flow forecast. Balance sheet forecasts are often single page forecasts based on average year-end balances or other calculated values. Without a roll forward of accounts receivable, inventory, accounts payable, cash or the line of credit, the simplistic approach to balance sheet forecasting may disguise problems.

One way to test the balance sheet forecast is to consider the operating cycle components in conjunction with the forecast line of credit balance.

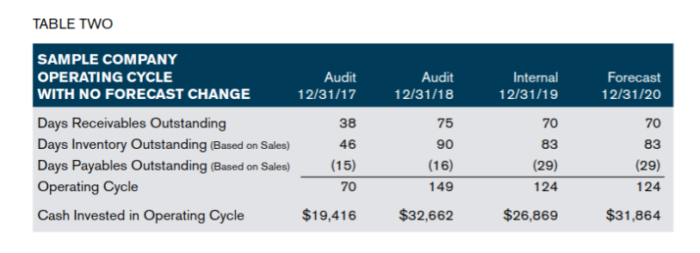

Using the same turnover in 2020 as occurred in 2019, the cash invested in the operating cycle changes from $24.4 million to $31.9 million, for an increased cash need of $7.5 million (see table two).

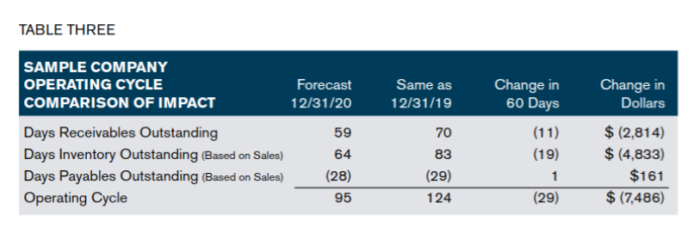

Looking at this increased need for cash by working capital component, the proposed improvement in accounts receivable collections provides $2.8 million of cash, the proposed improvement in inventory provides $4.8 million in cash and the payables turnover is essentially unchanged (see table three).

The proposed changes in the operating cycle have a material impact on the cash needs of the business.

Accounts Receivable

Changing from a 70-day receivable turnover to a 59-day receivable turnover means the company will either have to change payment terms with its customers or change how it manages its receivable collection process and retrain its customers. Both of those options are difficult to implement. There may be contracts with customers that cannot change overnight. There may be standards of dealing that are firmly entrenched. Customer concentrations may limit the ability of a borrower to change the receivables turnover as the risk of losing customers is too great. The lender will need to ask detailed questions to determine how this forecast improvement in accounts receivable turnover could occur.

Inventory

Changing from an 83-day inventory turnover to a 64-day inventory turnover means the company will need to reduce its investment in inventory. This is difficult to accomplish as companies tend to accumulate slow-moving inventory over time, and the inventory that is easily sold is moving through the sales process quickly. Most computer systems today allow a company to generate an inventory aging. That is a key aging report often omitted from the information request list a lender generates. Supply chain issues can occur based on regulatory situations, strikes at ports, trucking staffing issues and health scares such as those experienced currently due to the coronavirus.

The lender will need to know how the company expects to deal with its supply chain, and how it evaluates its inventory aging and turnover.

Accounts Payable

While changes in the payable turnover are not forecast in this example, the company is forecasting its sales to increase from $80 million in 2019 to $95 million in 2020. A $15 million increase in revenues will require suppliers to allow additional amounts on trade lines of credit. If this additional funding is not provided by the trade, the lender may be asked to fund an additional amount. In this case, 30 days of $15 million of increased sales requires $500,000. If there is heavy reliance on a few vendors, the ability to stretch payment terms may be lessened. If inventory needs are uncertain, the company may need to pay faster for inventory to be at the top of the line at the suppliers.

The lender will need to understand trade lines of credit, payment terms and reliance on vendors. The lender also will need to evaluate check writing processes to ensure accounts payable are not understated because checks have been written but not mailed.

Operating Cycle

As a lender, numbers like the operating cycle seem like obscure digits on a page. Looking behind the numbers at the financial impact, such as the $7.5 million increase in working capital noted earlier, or the changes in relationships with supplier and customers or inventory management, it is clear those obscure digits are difficult for a company to manage. A company that does not pay attention to each of these components of working capital is at more risk of performance problems.

Cash and the Line of Credit

A change in working capital management on the accounts receivable, inventory and accounts payable side of the business directly affects cash balances and the line of credit. In a quickly prepared or high-level balance sheet forecast, it is easy to use cash or line of credit as a plug number. That is an additional risk for the lender. Using the line of credit as the balancing number does not forecast availability tied to accounts receivable, inventory and accounts payable. Forecasting the line of credit availability using roll forwards and increasing scrutiny on forecasts for ineligibles shows whether the asset base, and the company’s working capital management, will be sufficient to support the outstanding balance on the line of credit.

Summary

When a lender or financial advisor works with a company on its cash management, understanding the components of working capital is key. Getting behind the numbers and understanding vendor payment terms, vendor lines of credit, inventory ordering processes, inventory aging, customer contracts and customer payment terms are just a few of the critical considerations. When a company says this approach is too detailed, that may mean the company does not understand how serious these working capital management decisions are to survival.

For example, forecasting cash receipts in the first 13 weeks of a cash flow requires use of the detailed accounts receivable aging; a company cannot collect what it has not billed. In addition, accounts payable cannot be forecast based on monthly sales levels but rather based on what is outstanding in the accounts payable aging. Companies that have been slow-paying vendors may not be able to bring inventory in as timely as required to support customer needs. In its initial weeks, a cash flow forecast must be anchored in the reality of current working capital components. Then the forecast must move into the analysis of operating cycle trends with the backdrop of what could reasonably be changed. When diving into working capital management, attention must be paid to forecasting and managing working capital, and the operating cycle is an important clue in this analysis.

Juanita Schwartzkopf is senior managing director of Focus Management Group.

Schwartzkopf has more than 35 years of experience in commercial banking, business management and financial and management consulting. During her career, she has handled projects involving financing strategies, strategic planning, forecasting, cash management, creditor relationships, information management, bankruptcy, crisis management and business plan development.

Schwartzkopf has held key operating and management positions in many types of companies, from startup to mature businesses. Throughout her career, she has worked on improving performance in severely troubled and stable, healthy companies. She has negotiated lending arrangements on behalf of both creditors and debtors.