EVP,

AloStar Bank of Commerce

“Keep your eyes on the road, your hands upon the wheel” – Jim Morrison

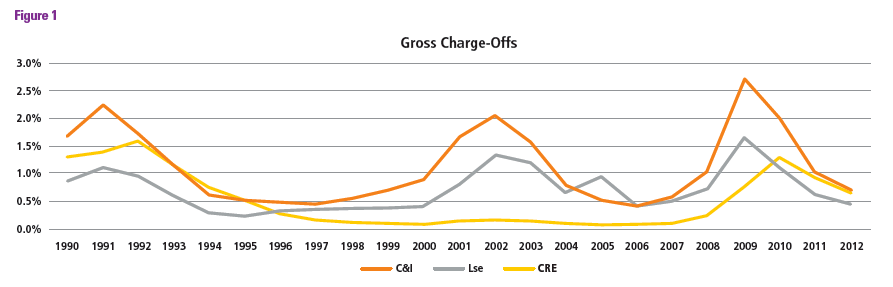

As the Doors’ Roadhouse Blues lyrics suggest, keeping your eyes on the road and hands upon the wheel may just have been the type of principled insight needed by bankers during the last several recessions. Loan performance statistics over the last ten years indicate that, in general, monitored and well-underwritten credit performed much better than other bank assets and specifically during periods of economic stress (See Figure 1).

During the last two recessions, the prolonged Great Recession and the continuing slow recovery, credit quality and collectability of commercial-related lending (commercial and industrial loans, equipment leasing, asset-based lending) in the nation’s banks outperformed other asset classes. Many industry leaders and economists have stated that this was a “consumer-based” recession. Indeed, the preponderance of issues in some way impacted the housing bubble and its ripple effects on other loan categories. But business did slow dramatically, unemployment soared and GDP and job growth have had anemic recoveries.

C&I Performance

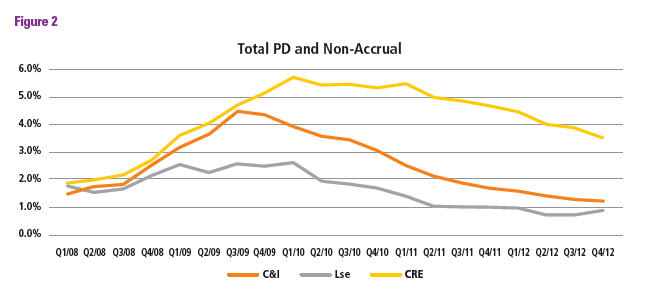

Figure 2 is a comparison of the “big three” commercial type loan assets derived from data from the FFIEC. ABL loan performance is not illustrated separately. The effects of the Great Recession left very few banks unscathed. However, banks with a diversified concentration of assets were not as severely affected as those that had concentrated portfolios in real estate — albeit, often banks with diversification were not generating the significant growth and fees as others that were financing the construction and residential development fee-rich activities.

At what is generally considered the general peak of the credit crisis (Q3/09), measured by delinquencies, approximately 2.46% of leases were past due or on non-accrual status, compared to 4.44% of C&I loans and 4.62% of investor (as opposed to owner-occupied) commercial real estate (CRE). As of September 30, 2013, total past due and non-accrual leases had recovered to their lowest level since 2006 (0.89%) and continued to outperform other forms of lending; C&I was at 1.02% and CRE was at 2.68%. Not only did equipment leasing portfolios, and C&I for that matter, perform well by relative standards, they rebounded quickly to pre-recession levels or better.

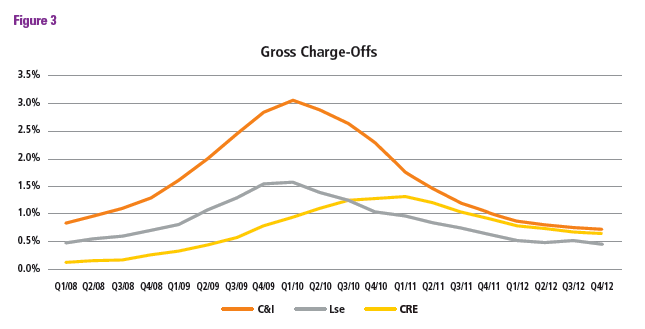

Figure 3 illustrates gross charge-offs, annualized on a trailing four-quarter basis. During the Great Recession, gross charge-offs also increased in conjunction with the deteriorating credit quality.

Peak C&I TTM charge-offs were 3.03%, leasing was 1.56% and CRE was 1.30%. However, as of December 31, 2011, leasing had improved significantly to pre-recession levels (0.08%; 0.32% annualized) while quarterly C&I and CRE net charge-offs remained elevated (0.20% and 0.24%, respectively). Over the period illustrated, the performance of the ABL segment of C&I generally mirrored the performance of lease assets and significantly outperformed overall C&I and CRE.

The ABL Borrower

Many bankers have the belief that ABL lending is not for the faint of heart, rather a lender of last resort. Indeed, the industry has historically accommodated those borrowers who could not get conventional C&I financing, those “fallen angels,” and it has been used to fund mergers and acquisitions — including a period in the ’90s where hostile acquisitions and public-to-private capital market transactions dominated the headlines and gained the ire of the regulators. However, there has always been a segment of business borrowers whose risk characteristics dictate secured lending, whether lightly monitored (ABL Lite) or high control/high monitor. These businesses possess common traits and if managed properly, statistics have shown these loans to be sound bankable assets.

ABL Quality — Why?

Reasons why ABLs should be viewed as a viable lending option include:

- Focus on Collateral Values — Maintaining collateral value relative to loan balance is a critical aspect of ABL loan management at loan initiation and throughout the life of the loan. The ABL collateral manager utilizes field audits, appraisals as well as diligent collateral and loan processing in conjunction with ABL-specific software to assure there is consistent and adequate collateral margin on the asset-based loan.

- Underwriting to Proven Cash-Flows — Borrower financial statements receive thorough examination to uncover core cash-flow generating capacity of the borrower to cover debt service requirements. Analysis includes verification of all adjustments and add-backs.

- Liquidating Asset — Revolving asset-based loans are structured to assure that as inventory is sold and receivables are collected, cash proceeds are utilized to pay down the loan, thus maintaining appropriate collateral value relative to the loan.

- Rapid Intervention — Loan covenants are structured to trigger early in the event of approaching problems to provide the lender an opportunity to apply solutions before the borrower’s operations and collateral values are irreparably compromised.

- Due Diligence — Thorough due diligence is undertaken on the sponsor, management, macro- and microeconomic factors, customers, collateral, industry, regulatory matters and financial performance.

- Experienced ABL Lender Availability — Since the ABL market has traditionally been serviced by commercial finance companies across the size spectrum, most Metropolitan Statistical Areas (MSAs) will have experienced ABL lenders in market that can be recruited by banks seeking to acquire this expertise.

A Shifting Market

There is a shift now underway in asset-based lending. What used to be the realm of commercial finance companies and large national banks is now catching the eye of community and regional banks. The pivot towards C&I and ABL can be traced in part to regulator action. When the OCC issued the commercial real estate concentration guidelines in 2006 (broadly adopted in 2012), the intent was to assure safe and sound credit risk management within banks, particularly those that were lending considerably outside the guidelines.

The impact of this guidance and subsequent examination and compliance led many banks to diversify their assets away from real estate concentrations. The natural entry point was commercial and industrial lending. Thus, many banks have been pivoting to a more balanced concentration of loan types.

Also contributing to this shift is the shrinking domestic bank population. The trend of consolidation, liquidation, failure and market exits has left the U.S. with a total of 6,891 banks, the lowest on record. This trend will continue. Consolidation leads to larger banks, larger loan limits and a need for even more balanced assets. The larger banks will have a tendency to broaden their commercial offerings and their risk appetites. C&I lending, long the foundation of commercial banking, will undoubtedly grow within the banking system. Within that growth is the expectation of greater bank involvement with ABL.

Options of Entering the ABL Market

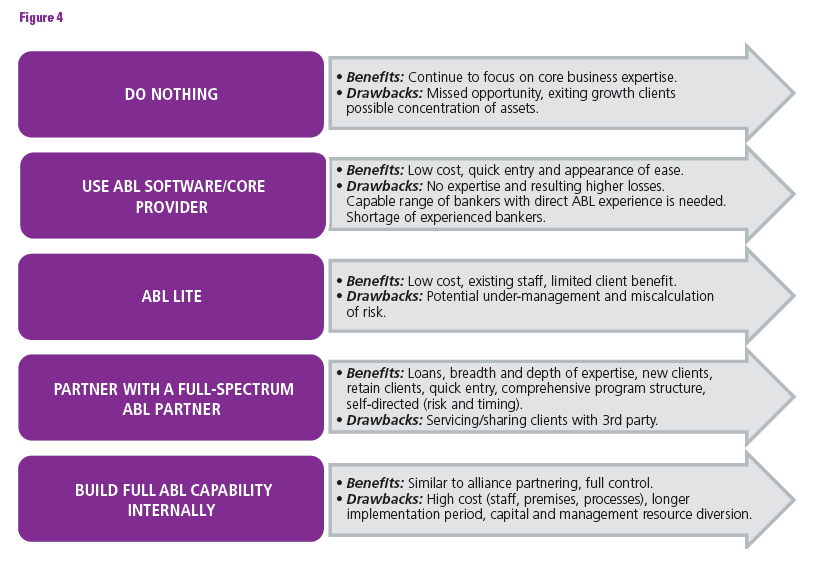

More and more, commercial banks are recognizing ABL for the opportunities that are available, and announcing strategies to move in that direction. However, how will these banks participate safely? They have several options (See Figure 4).

Entrance into the ABL competitive arena will involve most if not all of the following preparatory steps:

- Develop Formal Business Plan — The board of directors, regulators and senior management will require a plan that encompasses the rationale, requirements, risks and processes required to engage in an ABL initiative, including technology, counterparty, compliance, credit and operating risks.

- Create or Revise Credit Policy — The bank’s credit policy will require updating to manage the risk identification, underwriting, portfolio management and approval procedures for ABL credits.

- Staff Recruitment and Training — Depending on the level of ABL involvement, the training requirements could range from limited to comprehensive, potentially touching the areas of credit administration, accounting, marketing, compliance and human resources. Existing C&I bankers can learn and gain knowledge of ABL lending and manage relationships, but ABL lending support demands a high level of underwriting, collateral management, portfolio management, treasury management and risk specialists.

- Underwriting and Approval Processes — To address ABL-specific requirements and understand the competitive demands and tradeoffs to manage and control risk, including pricing for profitability.

- Revised Accounting Procedures — Revisions may include potential procedures required in working with a third party.

- Third Party Assessment — An assessment of any partner institution and service providers may be necessary to meet regulatory requirements.

- Receiving Approval — Board of directors approval and possible regulator review and approval.

- Incentives Consideration — These may vary from current marketing incentives.

- Sales Management — C&I and ABL borrowers are price- and structure-sensitive.

Although relationship management and local market knowledge are important, systems need to optimize all disciplines.

Randy Cameron is executive vice president at AloStar.