Senior Managing Director

Focus Management Group

By Juanita Schwartzkopf, Senior Managing Director, Focus Management Group

The convergence of geopolitical tension, continued disruption to the supply chain and the labor market as well as the lingering presence of the COVID-19 pandemic is pushing transportation costs into the stratosphere, meaning businesses must alter their approaches to survive.

Currently, rising food commodity prices and oil prices are stressing consumers and companies. Meanwhile, lenders are concerned about income statement performance, debt service capabilities and leverage and debt service covenant compliance, while businesses are worried about increasing costs on nearly every line item of their income statements.

Against this backdrop, it can be easy to become mired in a wait-and-see approach while feeling out of control when managing financial performance impacts. To provide some reassurance, this article will examine the impact of trucking costs on the financial performance of a business.

The Key Metrics

Trucking Costs Per Mile

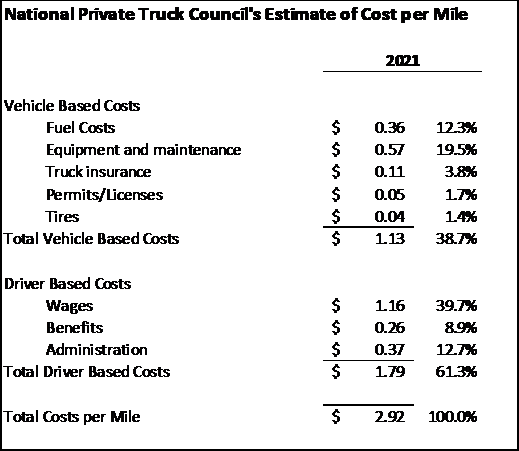

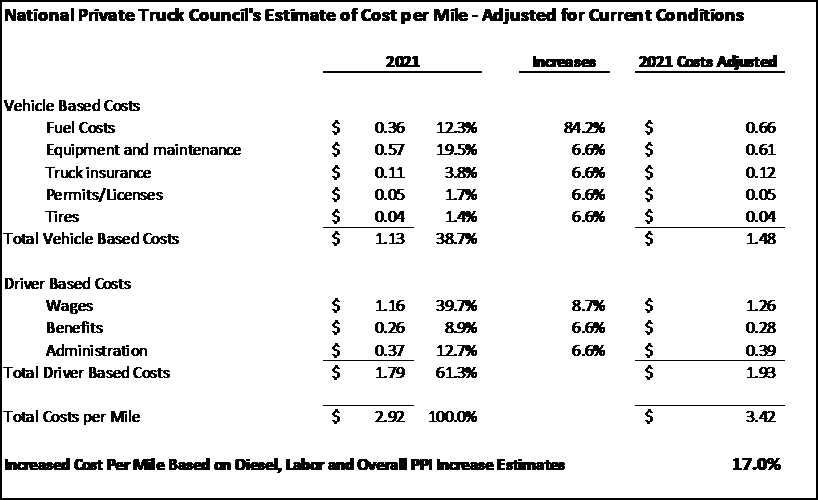

The National Private Truck Council produces an estimate of the trucking cost per mile on an annual basis. For 2021, it reported a cost per mile of $2.92.

Fuel Costs

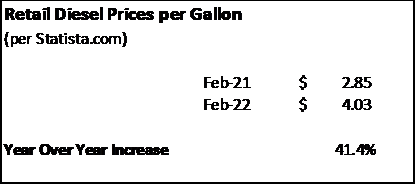

Some of the most important factors in the cost-per-mile calculation are fuel costs and driver costs. The price of diesel fuel, comparing February of 2021 to February of 2022, has increased 41.4%.

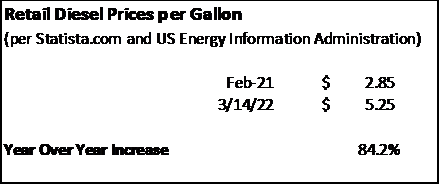

This increase does not consider the recent impact of the Ukraine/Russia conflict. According to the American Automobile Association, the retail cost of diesel on March 15 ranged from $6.277 per gallon in California to $4.651 per gallon in Colorado. Meanwhile, the U.S. Energy Information Administration reported the average cost of diesel as of March 14 was $5.25 per gallon, which was an 84.2% increase compared with February 2021.

Labor Costs

Driver wages have continued to increase. The American Truckers Association estimates there is an 80,000-driver shortage right now. With drivers in short supply, labor costs have been climbing. The National Private Truck Council’s benchmarking survey reported average labor increases from $69,754 in 2020 to $75,796 in 2021, making for an 8.7% increase.

Matt Hart, executive director of the Illinois Trucking Association, estimated that the trucker shortage will continue and could exceed 160,000 by 2030, with specialty transport drivers and long-haul drivers continuing to present staffing challenges. Industry experts consider wage increases to be a continuing requirement if the trucking industry hopes to recruit and retain drivers.

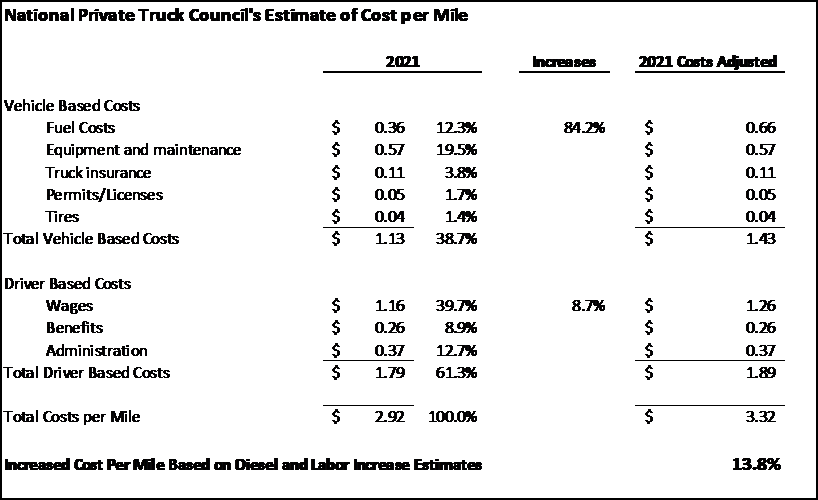

Updated Estimate of Cost Per Mile

In the next table, the 2021 cost per mile metric is updated to include the 84.2% increase in fuel costs and the 8.7% increase in labor costs we just discussed. With such updated data, the chart shows the cost per mile, otherwise known as the cost of transporting goods, has increased 13.8% from 2021 levels.

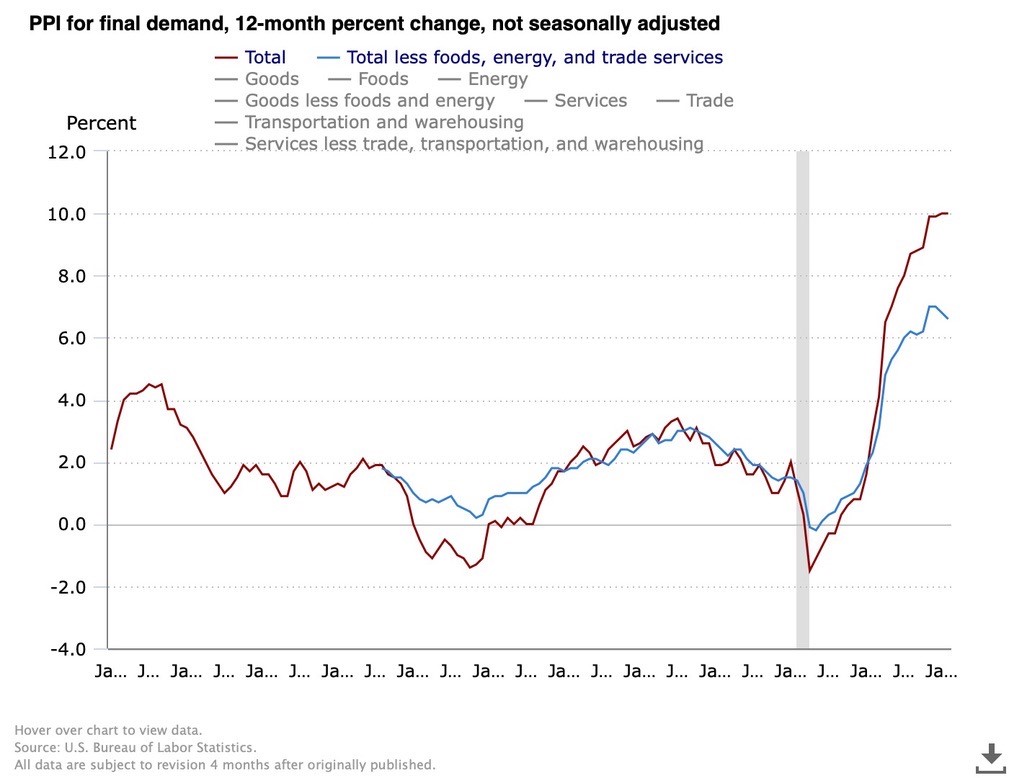

Overall Inflation

In addition to fuel and labor, overall costs have increased, according to the Consumer Price Index and the Producer Price Index. The February PPI was released on March 15 and showed on overall reading of 10%. The total when taking out food, energy and trade was reported at 6.6%.

Updated Cost Per Mile with Overall Inflation Included

A 6.6% increase in all costs besides fuel and labor leads to an adjusted increase in cost per mile from $2.92 in 2021 to $3.42, as of March 15, making for a 17% year-over-year increase in trucking costs.

How to Use This Information

Companies can use the information detailed above when forecasting financial performance in 2022, as they should be anticipating increased costs in line items that include the transportation costs of moving goods. Identifying those line items and anticipating a 17% cost increase for trucking would be an appropriate starting point for planning and analysis.

This estimated cost increase may be the tip of the iceberg. Companies are experiencing difficulty scheduling loads with drivers and getting drivers to show up when expected. These issues are further driving prices up, forcing companies to pay since they need to ensure goods are moved on time.

DAT Trendlines reported that overall spot load costs increased by 24% from February 2021 to February 2022, with van spot rates increasing by 28.5%, flatbed spot rates increasing by 23.8% and reefer spot rates increasing by 30.7%.

In addition, companies are reporting transportation rates doubling year over year, with uncertain availability of trucks when they are needed.

What Should Companies Do Now?

Companies will need to evaluate their ability to pass along cost increases to existing customers. Additionally, during any contract revision discussions or when entering any new contracts, companies may want to evaluate their supplier and customer contracts to consider which party pays for transportation costs.

These costs are not going to reduce quickly, if at all, and businesses need to adapt to this new expense structure. Loan covenant defaults and waiver requests for fixed charge coverage ratios, EBITDA performance levels and other financial covenants should be anticipated. Borrowers will need to reforecast 2022 and 2023 performance to anticipate the impact of these trends and negotiate achievable loan covenants.

The working capital impacts of transportation cost increases and problems with scheduling are impacting inventory levels, sales and delivery schedules. At the same time, lines of credit are being stressed by the working capital impacts of these increases. Companies experience cash flow shortfalls when inventory is not converted to accounts receivable when planned, and the payment of those receivables will be delayed if delivery is delayed. Unfortunately, inventory levels are choppier right now, as increased costs and difficulties with delivery and pick up scheduling are impacting the receipt and sale of goods.

Businesses need to reforecast their cash flow and working capital needs and anticipate the need for increased levels of inventory and accounts receivable. They also need more flexibility in the structure of their lines of credit in terms of overall size and asset category caps and relationships.

The current economic environment of inflation, labor shortages, transportation and supply chain issues, commodity price fluctuations and political and geopolitical uncertainty will continue through 2022. This requires a level of planning and analysis that has not been needed in decades.

This article first appeared at focusmg.com.

Juanita Schwartzkopf is senior managing director of Focus Management Group.

Schwartzkopf has more than 35 years of experience in commercial banking, business management and financial and management consulting. During her career, she has handled projects involving financing strategies, strategic planning, forecasting, cash management, creditor relationships, information management, bankruptcy, crisis management and business plan development.

Schwartzkopf has held key operating and management positions in many types of companies, from startup to mature businesses. Throughout her career, she has worked on improving performance in severely troubled and stable, healthy companies. She has negotiated lending arrangements on behalf of both creditors and debtors.