Senior Managing Director

Focus Management Group

by Juanita Schwartzkopf, Senior Managing Director, Focus Management Group

For businesses to traverse the performance hurdles of 2023, which include interest rate increases and lingering issues from 2022, they’ll need to perform thorough and objective financial analyses and adjust forecasts for the rest of the year and 2024 accordingly.

In 2020 and 2021, most business problems were related to the COVID-19 pandemic. Toward the second half of 2021 and into 2022, the major issues facing businesses were related to the supply chain, although 2022’s major hurdles eventually turned into oversupply of inventory and weakening working capital.

In 2023, the most prevalent themes have been working through excess inventory and managing working capital (carrying over from 2022) and the impact of interest rate increases. In this environment, companies are experiencing combination of weakened EBITDA performance and cash/availability shortfalls contributing to loan covenant compliance issues.

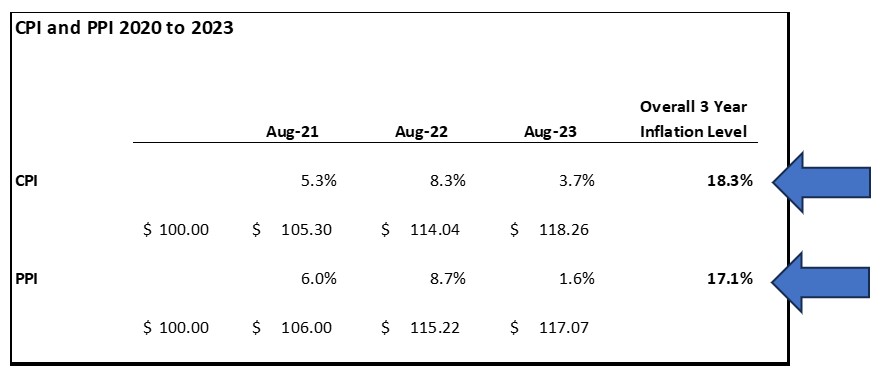

The August 2023 Consumer Price Index and Producer Price Index were published by the Bureau of Labor Statistics on Sept. 13 and Sept. 14, respectively. Politicians and pundits had been speaking about lessening inflation for the past several months, but with the August CPI at 3.7% and the PPI at 1.6%, concerns about inflation, interest rates and recession are increasing.

If inflation has eased, why are businesses continuing to feel stress in financial performance?

The key to answering this question is the change in costs from 2020 to 2023, which is coupled with the influx of government stimulus money that masked concerns in 2020 and 2021 and lingered into 2022. Considering the inflation levels from 2021 to 2023, it is clear costs have increased approximately 18% from the 2020 base level, with the he three year average inflation rate in the 20% range during 2023.

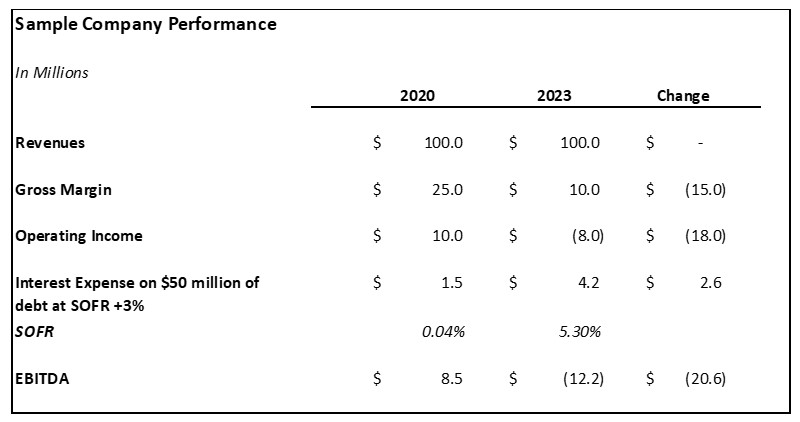

A $100 million company experiencing 20% increases in costs of goods sold and operating expenses would experience an $18 million decrease in operating income if it was unable to pass along price increases to customers or otherwise improve its cost structure. In addition, considering the increase in SOFR from 0.04% in May 2020 to 5.3% in August, assuming $50 million of debt at SOFR plus 3%, the company would have had its $8.5 million EBITDA decrease to a $12.2 million EBITDA loss.

Most companies have had some ability to increase prices, but all companies have had labor cost and input cost increases. As interest rates have increased, reliance on debt has increased for many companies.

With these headwinds, the financial performance of companies has been negatively impacted and all stakeholders are trying to find ways to deal with weakened cash flow situations.

The previous table shows what inaction would mean to a company with a respectable $8.5 million of EBITDA on revenue of $100 million, which equates to an EBITDA of 8.5%. Such a company, should it have no plan to respond to increased costs and interest rates, could reduce performance to negative $12.2 million of EBITDA, marking a $20.6 million performance change.

How can businesses deal with the current environment?

Every business management team is struggling to respond to the current environment. Convening a task force to deal with every line item on the income statement and all components of working capital is going to be the key to success.

The first step should be an objective financial analysis beginning with financial performance from 2019 to the current period. This analysis consider:

- The realistic impacts of stimulus money in 2020, 2021 and 2022. Businesses should then evaluate EBITDA and operating performance without those funds.

- A realistic evaluation of the impact of the COVID-19 pandemic in 2020. An adjusted EBITDA and operating profit report should be prepared considering items such as:

- Sales lost during a shutdown period, if applicable

- Labor and other operating costs incurred during the shutdown period

- Labor raises required to bring people back to work after receiving stimulus funding

- Additional labor required to keep necessary staffing in place

- Additional costs to comply with any restrictions to coming back to work

- Any other costs associated the pandemic

- Additional revenue that may have occurred and the costs related to that additional revenue

- Contract reviews and evaluations: Maturity dates, repricing opportunities, automatic renewals, etc., need to be clearly laid out for discussion. Prices paid to vendors and prices received from customers need to be evaluated against market intelligence related to the competitive environment. Contract reviews should include:

- Customer contracts

- Vendor contracts

- Labor contracts

- Leases

- Rents

- Operating costs by line item, which need to be compared from 2019 to 2023 to evaluate costs against inflation. Some line items may have increased faster than inflation, while others may have increased at a slower rate. Based on this analysis, businesses may need to consider alternative suppliers and contract renegotiation.

- Opportunities to decrease a business’ footprint, including considering the number of offices, number of locations, number of warehouses, etc.

- Opportunities to increase automation

- Customer, product, supply channel and location profitability

- Working capital roll forwards, which should be conducted across the following:

- Accounts Receivable

- Payments against terms.

- Turnover by larger customers.

- Opportunities to reduce the investment in accounts receivable should be considered, as well as enforcing terms, changing terms, increasing discounts, etc.

- Businesses should evaluate customer profitability, including the cost to carry the accounts receivable for a customer.

- Inventory

- Open purchase orders.

- Turnover by SKU.

- Turnover by customer and supplier.

- Aged inventory. Businesses should consider obsolete styles and products.

- Opportunities to reduce inventory must be considered. Should inventory be sold at a discount to move old or obsolete inventory? Could payment terms or prices be changed to move excess inventory?

- Will inventory become ineligible based on current asset-based loan or borrowing base certificate terms?

- Are values of inventory inclusive of transportation costs or other one-time costs that will not be repeated and may result in write downs?

- If inventory levels are required by customer contracts, businesses should consider interest costs to carry that inventory level.

- Accounts Payable

- Payments according to terms.

- Turnover by larger vendors.

- Hidden tariffs in Free Trade Zones.

- Are credit lines sufficient?

- Interest Expense

- When will debt be repriced?

- What is the impact of an additional 0.25% interest rate increase? Business should consider the impact of at least two more 0.25% rate increases in 2023.

- Accounts Receivable

After conducting a thorough financial analysis, the second step is to evaluate forecasts for the remainder of 2023 and 2024 using the increased performance intelligence gained from said analysis. Evaluating each line item using the information gathered in the first step — the objective financial analysis — will allow a management team to consider changes needed to improve forecast accuracy and achievability for the rest of 2023 and 2024. The outcome of evaluating the forecast with the data from the objective financial analysis should result in a performance risk analysis that better identifies target performance levels and the range of performance possibilities.

How does a company do this?

Not taking action is a bigger risk that taking the time to perform this type of analysis. The analysis described in this article should take no more than three to four weeks to perform and should require time from multiple disciplines, with an emphasis on the finance and accounting staff. If the finance and accounting staff is stretched too thin, bringing in an additional resource to augment the process should result in an effective analysis at a reasonable cost.