Senior Managing Director

Focus Management Group

Companies are creative when accounting for unusual items such as the CARES Act, including the Payroll Protection Program (PPP). By the time we all arrive at year-end accounting and related adjustments, many lenders already will have made decisions based on interim inhouse financial statements.

Income Statements and the PPP

Let’s consider a company that receives $1.8 million under the Payroll Protection Program, and let’s assume the company’s performance remains unchanged from the prior year. The first accounting option is to report revenue and expenses in the same manner as the prior year while recording the PPP loan forgiveness as an extraordinary item. The second option is reporting revenue in the same manner as the prior year and reducing expenses for payroll, rent and utilities by the amount of funds attributed to the calculation for each category.

Although at the end of the year, outside accountants may require all companies to report the PPP in essentially the same manner, the creativity for inhouse accounting statements could result in misleading information being presented to and reviewed by a lender.

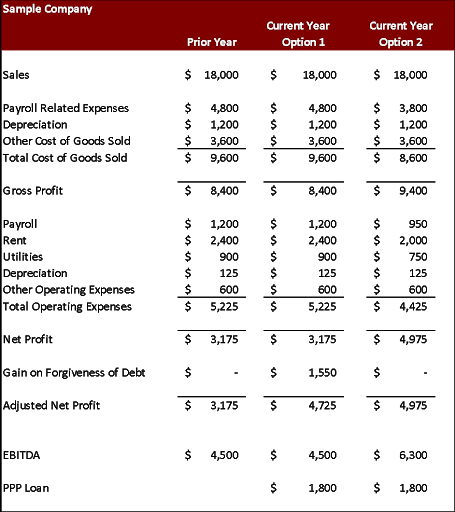

The table below shows a sample company, its prior year performance and its current year performance under two reporting options.

Using option one, the company reports an EBITDA of $4.5 million, consistent with prior year performance. Using option two, the company reports improved performance with an EBITDA of $6.3 million.

A lending decision made during the year when the second option is used could be based on perceived improved performance which did not actually occur. Although the company received cash from the PPP to offset expenses, performance did not improve and future results would be more in line with the prior year’s performance.

This is a clean example and more easily identified. In reality, the accounting will not be that clear. Changes in payroll could be impacted by short term layoffs, furloughs, reduced sales and related direct costs. Changes in rent and utilities could be impacted by moving locations, temporary shutdowns or other matters.

Questions to Consider

Asking questions is going to be very important. Here is a short list of questions to ask:

- How much did the company receive under the PPP?

- How was this amount allocated between payroll, benefits, other payroll related expenses, rent, utilities and/or other expenses?

- How much of the loan has been or is expected to be forgiven?

- How was the forgiven amount allocated between these same expenses?

- What were the debits and credits used for accounting for the PPP loan?

- What were the debits and credits used for accounting for the PPP loan forgiveness?

If anything you ask and have answered is not clear, ask for further clarifications. It is not that a borrower will intentionally mislead a lender, but accounting is not black and white. As a user of the financial information, you need to be sure you understand how the PPP program is impacting financial performance.

Understanding the impact of COVID-19 on sales and expenses is key. Encourage your borrowers to be prepared to discuss sales and expenses with you going forward. When possible, require reporting in various categories such as sales impacts, including reduced sales by customers, expected sales recovery by customers and adjusted product lines, as well as expense impacts to payroll, rents, leases and other expenses.

Working Capital and the PPP

Now let’s consider working capital impacts for the same example company from earlier. First, let’s analyze the impact of the company keeping its cash versus the company using the cash to pay down the line of credit. Then, let’s analyze the impact of a slowing in the accounts receivable, inventory and accounts payable turnover rates and the company borrowing under its line of credit to fund its working capital.

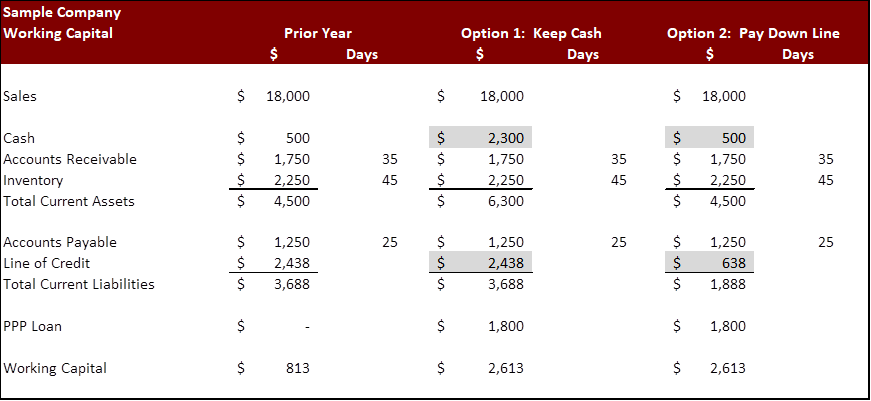

The table below shows a sample company with a simple change. In option one, the company keeps its cash and its line of credit outstanding. In option two, the company pays down its line of credit. Assuming the accounts receivable, inventory and accounts payable turnovers stay the same, the company would either have a higher cash balance or additional availability under the line of credit which could be used to fund expenses.

In both situations it will be key for a lender to track the cash balances, the working capital components and the line of credit, especially during the eight weeks immediately after funding of the PPP.

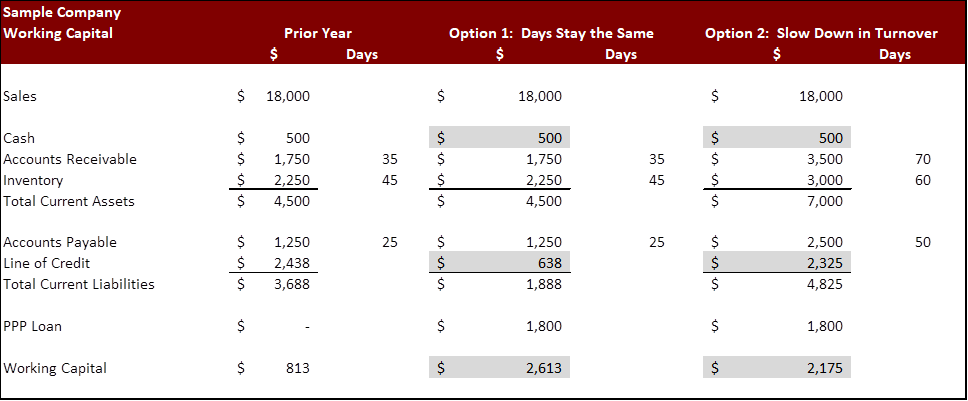

In the next table, we’ll consider a company using its PPP loan to pay down the line of credit and then the line of credit needs with a slow down in the turnover of accounts receivable, inventory and accounts payable.

In option one, the line of credit is paid down to $638,000 and the company would borrow money under its line availability to fund its operating expenses.

In option two, the receivable turnover increases from 35 days to 70 days and inventory turnover increases from 45 days to 60 days. At the same time, the company is able to stretch its accounts payable and increase the days outstanding from 25 days to 50 days. Even though the PPP loan proceeds are used to pay down the line of credit, the slowing in the turnover of working capital components means the company needs to borrow nearly the same amount under the line of credit to support working capital needs.

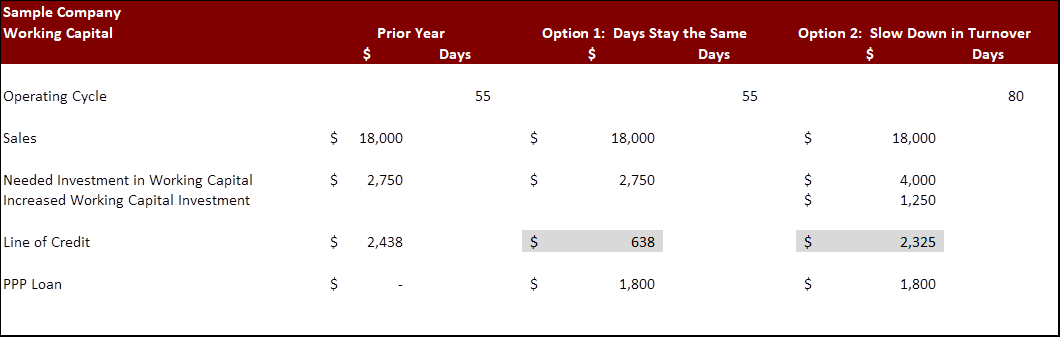

In the next table, these two options show the difference in outstandings under the line of credit and the increased need for working capital. The company needs $1.25 million of additional access to cash for working capital. If the lender continues to use the previous advance rates and does not impact availability for growth in accounts payable, the line of credit could increase by approximately $1.7 million and the PPP loan could be used to fund operating expenses.

The concern is that the underlying assumptions of collectability of accounts receivable, salability of inventory and ability to grow accounts payable would put a working capital lender at potential risk.

Financial Statements and Working Capital

From a working capital perspective, asking questions and tracking changes over time is going to be very important. For accounts receivable, track the aging of receivables and the roll forward of receivables on a weekly basis. For inventory, to the extent possible, ask for an aging of inventory and receive that information weekly while also tracking the inventory by components such as raw materials, work in process and finished goods. In addition, track the outstanding purchase orders and ask for matching to the inventory. For accounts payable, track the aging of payables and the roll forward of payables on a weekly basis and also track supplier lines of credit and the amounts outstanding. Lastly, track book and bank cash balances weekly.

The Payroll Tax Deferral Program

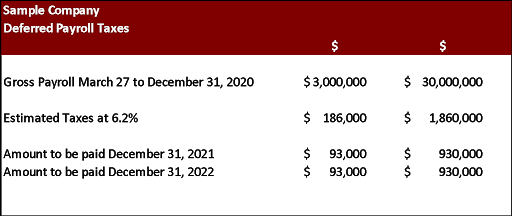

Companies will be able to defer payment of employer’s share of payroll taxes incurred from March 27, 2020 to Dec. 31, 2020. Of the total deferral, 50% will need to be paid by Dec. 31, 2021 and 50% will need to be paid by Dec. 31, 2022. The quarterly 941 reports will be amended to report the deferrals with the Q2/20. The deferral is the employer portion of the payroll taxes or 6.2% of payroll. Continued clarifications related to the Payroll Protection Program and debt forgiveness are occurring.

Third Party Payroll Preparation

If an employer designates an agent to deposit employment taxes, it is the employer who directs the agent to defer the payment of employment taxes who has the liability if the taxes are not paid by the deferral date (Dec. 31, 2021 and Dec. 31, 2022).

If a customer has a service contract with a certified professional employer organization (PEO) (sometimes referred to as an employee leasing company), the customer who directs the PEO to defer the payment of employment taxes has the liability if the taxes are not paid by the deferral date (Dec. 31, 2021 and Dec. 31, 2022).

While these rules allow a deferral of the tax payment, they do not change the personal liability of responsible persons for the trust fund portion of withheld taxes, such as employee income tax withholding and employee portions of Social Security and Medicare taxes.

Let’s consider an employer or customer of a PEO that has an annual gross payroll of $4 million, and one with $40 million. Using nine months of total payroll and estimated employer portion of taxes of 6.2%, the deferral could be $186,000 at $4 million of gross payroll or $1.8 million at $40 million of gross payroll.

Depending on the size of the employer and the amount of expenses comprised of payroll, this tax deferral could be a significant number impacting liquidity and availability under a line of credit.

If the company accrues for the liability by debiting payroll expenses and crediting accrued payroll taxes, the balance sheet of the company would report the liability in the accrued liability section of the balance sheet. If the company does not report the expense until it is due, the liabilities would be understated.

As with other PPP and CARES Act accounting processes, year-end financial reporting may be different from internal interim financial reporting. If a payroll service is used as an agent, the method the payroll service uses to invoice the company could affect the financial reporting. If a PEO is used, the method the PEO uses for invoicing the company would impact how the deferred payroll taxes would be reported at the company level.

Unpaid Payroll Taxes

The current guidance from the IRS indicates that the employee or company using the PEO is responsible for paying the deferred taxes. The question a lender will need to address is the priority position of this tax deferral if the deferred amount is unpaid when due.

Deferred Taxes

Relative to the deferred tax program, it is important to request additional reporting and ask questions about payroll and accrued liabilities.

For payroll, ask for a monthly payroll report showing all employees, the amount paid, the taxes incurred and the taxes deferred, and also ask for the 941 reports filed quarterly. In addition, track the deferred amount.

For accrued liabilities, ask for detail to support a single line item for accrued liabilities. Often a company reports a single line item for accrued liabilities on a balance sheet but is able to print a detailed listing of individual general ledger accounts making up that total accrued liability. In addition, ask the company to separately identify the deferred taxes, whether in current or long term accruals. Some companies may put a portion of the deferred amounts in current versus long term liabilities because amounts under the program may be deferred to Dec. 31, 2021 and Dec. 31, 2022.

Lenders should consider reserving an amount equal to the deferred taxes to ensure sufficient availability under a line of credit to make the deferred tax payments when they are due.

Next Steps

Lenders and investors are going to hear the COVID-19 excuse for the foreseeable future. We all know there are positive and negative impacts to businesses as a result of the virus and none of us should make light of the seriousness of the virus and the impact on business. But, as readers of financial statements, we all need to make sure we don’t hear what we want to hear, or make excuses for performance that are unfounded. Ask questions.