Analyst

FischerJordan

Senior Engagement Manager

FischerJordan

By Tanvi Anand and Sachin Goel

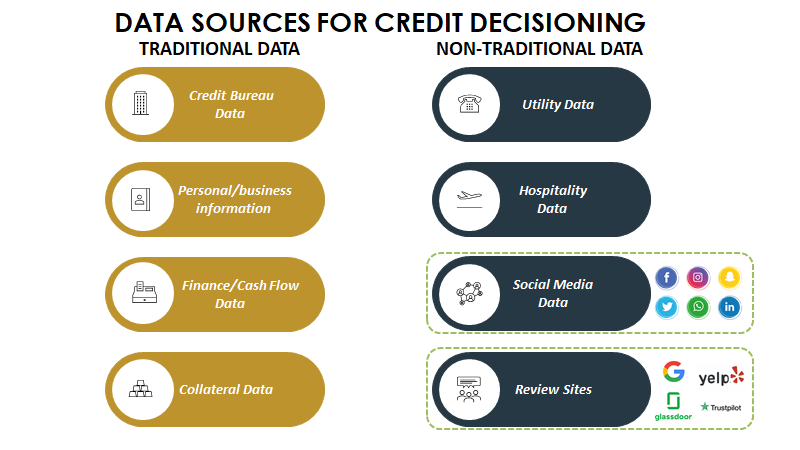

As a rule, evolution tends to move forward, not backward. Automated credit decisions, which are now almost 50 years old, have gone through its own version of evolution and presently seems to change with every new loan, data source and modeling technique introduced. Particularly in the context of the COVID-19 pandemic, lenders are now more cautious than ever and are looking to utilize every data source available, both traditional and non-traditional (see Fig. 1), in deciding whether to approve a loan and how to size and price it.

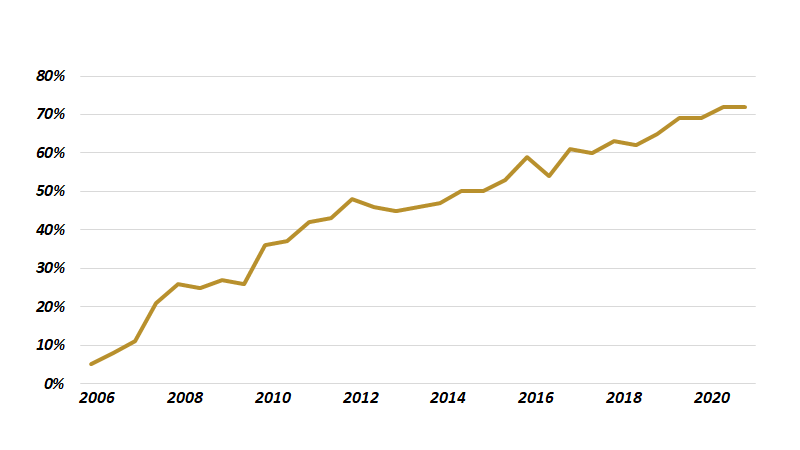

The pandemic has catalyzed an escalation in internet consumption, which was already rising sharply before the pandemic (see Fig. 2). As a result, the global digital footprint has increased multifold in a compressed timeline. In a recent Harris Poll survey, social data was cited as “a primary source of business intelligence” by 85% of executives. On the consumer side, the survey showed that a positive interaction on social media would make more than three-quarters more strongly consider purchasing from a company in the future. Furthermore, a recent CMO survey revealed that the share of social media spending in marketing plans ballooned by 74% between February 2020 and June 2020, reaching a mark of 23.2%. This is expected to increase further in years to come.

Overall, social media platforms have become huge oceans of data. For example, if Facebook users constituted a country, the social networking site would surpass China and India as the most populated country on earth. With such massive numbers, many lenders are considering or have already incorporated web presence data (which includes social media, review sites and so on) as credit decisioning inputs.

However, including web presence data in credit decisioning can act as a double-edged sword. Web presence provides invaluable information about borrowers, but it challenges lenders on many fronts. Weighing the benefits, opportunities and challenges of such an initiative is a key consideration for lenders before they undertake any large-scale effort to add web presence data to credit decision making.

Benefits/Opportunities

Real-Time Access to Customers

Traditionally, lenders have relied heavily on credit bureau data to make accurate credit decisions. However, there is always 30- to 45-day lag in credit bureau data, according to TransUnion. This lag has widened during the COVID-19 pandemic because the CARES Act does not allow lenders to report certain types of delinquencies on time. In this situation, lenders have had to start relying more on non-credit bureau data in their underwriting processes. As more businesses have started increasing their digital footprint via digital marketing or even for running daily business activities, web presence data has become a powerful channel for non-credit bureau data.

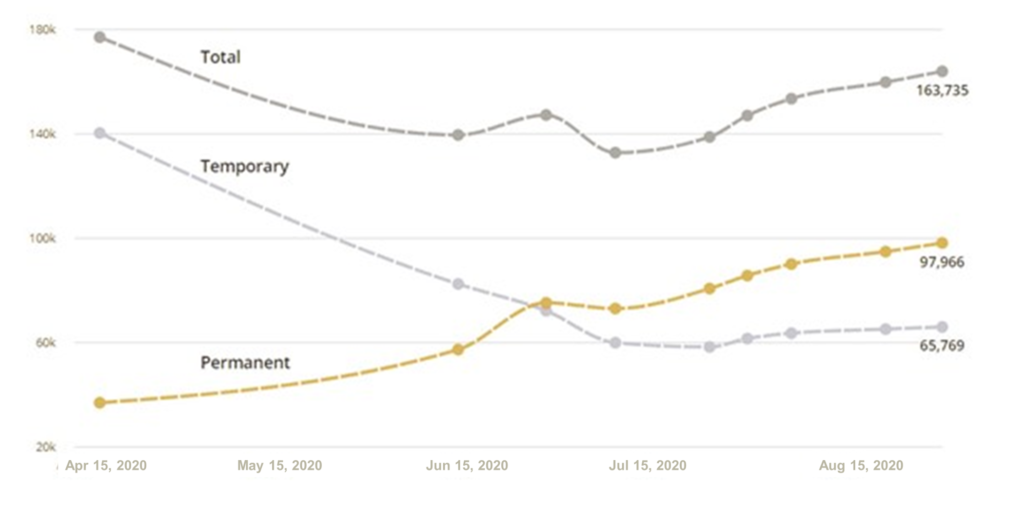

The biggest advantage of using web presence data is it provides real-time access to customers’ activities, unlike credit bureau data. The value of real-time data is especially important in response to sudden and unexpected global events, such as the shutdowns that have become a feature of the ongoing pandemic. For example, when many small businesses shut down at the beginning of the pandemic, the effects would not have been reflected in credit bureau reports until many weeks (sometimes months) later.

Potential Equalizer to Lending Inequalities

Historically, the most difficult borrowers for lenders to underwrite have been customers with scant or no credit history, such as people who recently emigrated from one country to another or who have minimal prior utilization of credit services from banks/lenders. As a matter of fact, having a certain amount of credit data is necessary to generate a FICO score, which one of the most significant variables assessed while approving a loan, but, according to the Urban Institute, about 50 million Americans don’t have such data.

More often than not, the lack of credit-decisioning information for these underbanked customers will keep lenders from extending credit lines or loans to them, even if they might actually pose far less risk as borrowers than they appear on paper. In these instances, web presence data could play an important role and enable credit access to a broader spectrum of people. For instance, a quick scan of a LinkedIn profile of a migrant business owner could provide access to their educational background and track record of their past endeavors and milestones, which, in turn, could be used in credit decision-making.

Glance into Customer Service Side

In today’s society, providing good customer service is just as important for customer retention as acquisition. Thus, customer service data can speak to the past and current status of a business while also offering a predictive window for future growth. Unfortunately, traditional data sources such as credit bureaus are unreliable for a business’ customer service reputation. Web presence data, by contrast, provides a much clearer picture. For example, Yelp/Amazon/eBay reviews can give someone a good idea of how well the owner(s) is(are) running the business and treating its customers. According to a Forbes report, when accessing the quality of a local business, 92% of consumers turn to online reviews. As a result, online reviews have an impact on those local businesses.

Challenges

Compliance Concern(s)

There is a rule called the Equal Credit Opportunity Act (ECOA) which states credit must be extended to all creditworthy applicants regardless of race, religion, gender, marital status, age and other personal characteristics. These details are often accessible with even a quick scan of an individual’s social media profiles. As a result, compliance officers are justifiably reluctant to let chief credit officers (CCOs) use social media data in credit decisioning. Any use of web presence data for credit decisioning purposes would have to be in full compliance with existing laws and consumer protections.

Reality vs. Falsehood

Web presence data can be easily manipulated. This may lead to less accurate or completely incorrect insights into a borrower. For example, an insolvent customer can still display an online reading history of financial articles, participate in educational videos and represent themselves as financially responsible on the web. Furthermore, unscrupulous actors or companies exist that falsely elevate or discredit a business’ image on social media through various means, including writing fake or spam reviews, artificially inflating follower counts or posing as verified buyers without acknowledging the company’s sponsorship. According to data from Sprout Social, 85% of consumers believe brands are at least somewhat disingenuous about their business via social media channels. Thus, the credibility and accuracy of web presence data should be thoroughly analyzed before being used for any predictive decisions.

Geographical and Generational Gap

A whopping 83% of the eligible population (aged 13 years or older) uses social media in the U.S., according to Backlinko. However, usage of different social media platforms is unevenly distributed by age, gender, location and so on. This makes social media data non-uniform. The challenge here is to normalize the differences by accounting for all factors for an unbiased final decision. For example, it is likely that a younger person (younger than 50 years old) will have a larger digital footprint than an older person (older than 50 years old). However, this does not mean that a younger person is less risky than an older person. Thus, this unevenness of web presence data needs to be accounted for in order to include them in credit decision making.

Conclusion

In the age of digitalization, more and more people are using some sort of digital platform(s) for personal as well as commercial purposes. As a result, digital footprints per user are rapidly increasing, a trend further escalated by the COVID-19 pandemic. In this web presence data ocean, there is so much “new” information available for lenders to make better credit decisions than traditional data alone once allowed. For example, web presence data enables lenders to provide credit to underbanked customers, which is a significant percentage of the total U.S. population. The importance of social media and web rankings is already being recognized increasingly, with top credit bureaus like TransUnion offering products like Social Media Basic Search and Comprehensive Report. Moreover, some banks have already started partnering with companies like Lenddo and Kreditech that study the digital footprint of borrowers to better estimate the probability of default.

However, it is not an easy task to decide on employing web presence data in the underwriting process, as it may put lenders at risk of violating certain lending regulations such as the ECOA, which prohibits a lender from discriminating against a borrower based on race, color, gender, etc. Once it is confirmed that lenders are abiding by all the lending regulations, web presence data can help lenders lower their losses and provide credit to more people, catalyzing overall growth.

This article originally appeared on FischerJordan.com.