Lender Account Manager

Export-Import Bank of the United States

Working capital and its lifeblood, cash flow, are essential building blocks for successful and growing businesses. While the domestic market provides these companies with vast and dynamic opportunities, greater expansion possibilities lie beyond U.S. borders where 95% of the world’s consumers reside. Despite this potential, export markets can present new financial risks and working capital challenges that businesses need to navigate carefully in partnership with their lenders.

Traditional commercial bank financing may not always be sufficient to meet the needs of U.S. exporters, especially given the repayment risk associated with international sales. An exporter’s internally generated capital and traditional bank financing can initially fund export sales growth, but the company eventually may need to explore additional funding alternatives, including trade finance solutions and export credit agency support, to maximize growth potential.

An asset-based lender (ABL) is well-equipped to support growing companies as they seek additional export finance options. Many ABLs can readily structure eligibility of export-related accounts receivable, as well as finished goods and raw materials inventories, into a borrowing base. In addition, ABLs have strong visibility into the company’s cash position and insight into suppressed availability within the company’s borrowing base formula.

Those support options can include the full range of services available through the Export-Import Bank of the United States (EXIM), the nation’s official export credit agency with the mission of supporting American jobs by facilitating U.S. exports. To advance American competitiveness and assist U.S. businesses as they compete for global sales, EXIM offers credit support including export credit insurance, working capital guarantees and loan guarantees to companies of all sizes. As an independent and self-sustaining federal agency, EXIM contributes to U.S. economic growth and supports jobs in exporting businesses and their supply chains nationwide.

Through EXIM’s working capital loan guarantees, U.S. exporters can obtain financing from participating lenders when traditional commercial financing is otherwise not available or when borrowing needs are greater than credit standards will allow.

Delegated Authority Lending: EXIM’s pre-qualified commercial bank lenders, using delegated authority, can expedite the loan process by committing export-related working capital loan guarantees without prior approval from EXIM. The six levels of delegated authority range up to $10 million per exporter, with larger and more experienced ABLs utilizing fast-track authority to approve individual credits up to $25 million per exporter. Credits beyond $25 million are subject to independent underwriting and approval by EXIM’s Board of Directors. For lenders, the delegated authority program provides a significant credit enhancement in the form of a U.S. government direct, conditional guarantee of 90% of principal and accrued interest on the credit facility to the U.S. exporter.

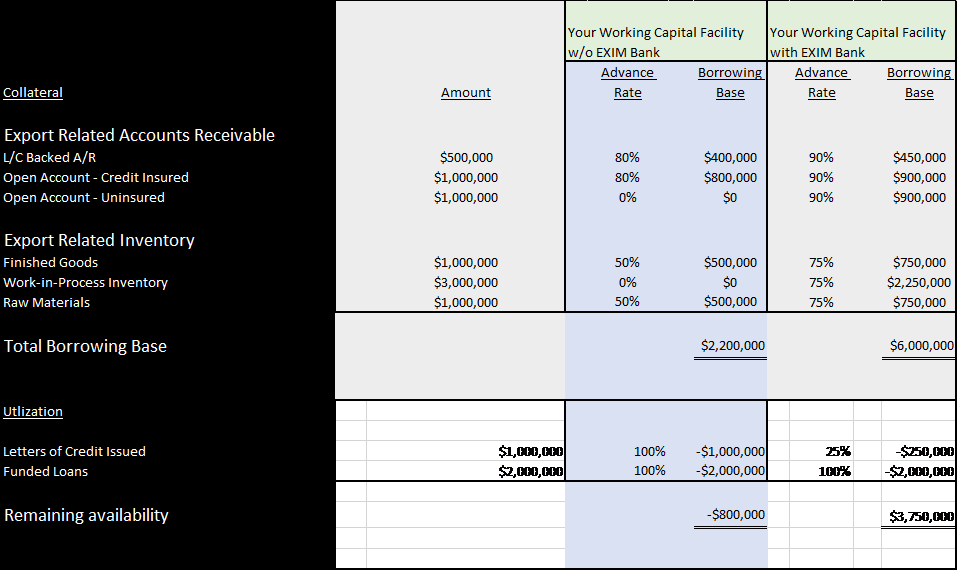

Higher Advance Rates: The U.S. exporter may be able to access higher advance rates — up to 90% against eligible export-related accounts receivable and up to 75% against eligible export-related finished goods, work-in-process, and raw materials inventories. Funds may be used to finance the cost of manufacturing, producing, and purchasing eligible items to be exported. The guaranteed financing also may be used to support the issuance of commercial and standby letters of credit related to an export order.

The table below illustrates how EXIM’s financing can enhance a working capital facility.

ABL Support: From an ABL perspective, the primary mode of support that can be achieved with a working capital guarantee tends to come not from the specified advance rates, but from the inclusion of work-in-process inventories and higher inventory reliance caps as well as allowable account debtor concentration.

EXIM does not specify a concentration limit with respect to export-related accounts receivable and permits reliance on inventories up to 75% of the aggregate borrowing base (100% under a transaction-specific format). In addition, working capital guarantees can support indirect U.S. exports that are part of a supply chain — such as when the account debtor on an account receivable is a U.S. domestic account debtor — in which shipment is destined for U.S. export. Typically, an EXIM borrowing base is structured under either a sister facility or a sub-facility to the ABL facility, which allows greater availability and borrowing base capacity for the company.

Structuring Financial Tools to Address Specific Exporter Needs

U.S. businesses that can benefit from EXIM working capital financing typically have common characteristics, including:

- A need to grow export revenues, with relatively tight liquidity, cash flow or other resources causing missed export sales.

- A need to extend more favorable credit terms to foreign buyers.

- A need for additional working capital funding availability.

- A need for export-related working capital support in relation to work-in-process inventory or to costs-over-billings less billings-over-costs under percentage of completion accounted for export orders.

- Creditworthy U.S.-based operations (which can be foreign owned) with goods and services manufactured and performed in the United States.

- At least 50% U.S. content incorporated into export items.

- A large export contract in relation to the exporter’s balance sheet.

- A requirement to issue performance-related standby letters of credit and/or bid bonds.

EXIM financing can be structured to meet these and other exporter needs, as illustrated by the following customer stories:

Creating a Transaction-Specific Facility: A company that historically operated as an original equipment manufacturer (OEM) to larger companies selling internationally saw an opportunity to bid directly into a large public tender abroad, but needed to address the working capital implications of such a large order. Working together with EXIM, the company and its lender structured an eighteen-month, $10 million credit facility, which allowed for issuing bid and performance standby letters of credit as well as funding working capital through the lifecycle of the underlying project. In addition, the company’s indirect exports as an OEM further qualified for EXIM support.

Providing Fast-Track Authority: A manufacturing company had access to a large syndicated ABL credit facility with its primary bank and wanted to be prepared for any potential mergers or acquisitions. Working together with EXIM, the ABL built a $25 million bucket for an EXIM working capital guarantee into the permitted indebtedness covenant in the credit agreement. When an acquisition opportunity arose, the deal team quickly identified the export-related accounts receivable, finished goods, work-in-process and raw materials embedded in the combined balance sheet, structuring the EXIM working capital guarantee as a sub-facility to the overall five-year ABL revolving credit facility. Because the deal closed in line with the proposed timeline, the company was able to execute a successful business combination event.

Overcoming Cash Flow Obstacles: A company serving as an international distributor acquired products from U.S. manufacturers to sell to buyers in emerging economies, but it was forced to shrink its balance sheet and miss sales when uncommitted bilateral credit facilities from several international banks dried up. Understanding the benefits of EXIM’s working capital guarantee, the company’s U.S. bank offered a one-year, committed $5 million asset-reliant borrowing base structure to lend against the export-related accounts receivable and inventory on the company’s balance sheet. In addition, the company utilized EXIM’s export credit insurance to offer competitive open account terms to both longstanding and new international customers.

When traditional commercial bank financing is not sufficient to fund a company’s export sales growth, alternative support in the form of EXIM’s working capital loan guarantees may be a viable option. Asset-based lenders who participate can help companies obtain the liquidity needed to fund their export business activity and grow their international sales, even during tough economic times.

Luis Noriega, CICP, has more than 20 years of experience in risk, credit product and relationship management roles in commercial banking and is a lender account manager for the office of small business at the Export-Import Bank of the United States. In this role, Noriega works with more than 50 delegated authority lenders across the United States in support of U.S. exporters. He can be reached at [email protected]. Learn more at exim.gov.