Hancock Whitney agreed to sell $497 million of energy loans to certain funds and accounts managed by Oaktree Capital Management. The sale includes reserve-based (RBL), midstream and nondrilling service credits. Hancock Whitney expects to receive proceeds of $257.5 million from the sale of these loans upon satisfaction of certain closing conditions.

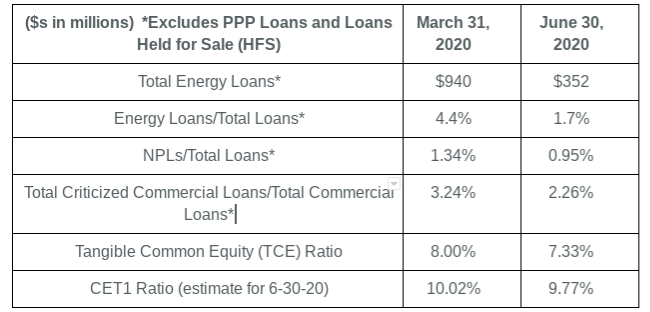

All loans included in the transaction were reclassified as held for sale as of June 30, 2020, and any write-downs and charge-offs associated with the sale are reflected in Hancock Whitney’s second quarter results. A special provision for credit losses related to the transaction of approximately $160.1 million (pre-tax), or $1.47 per diluted share (21% tax rate), will be included in the company’s Q2/20 earnings results.

“The primary objective of this sale is to continue de-risking our loan portfolio by accelerating the disposition of assets that have been impacted by ongoing issues within the energy industry, and have now been further complicated by COVID-19,” John M. Hairston, president and CEO of Hancock Whitney, said. “While operating from a solid capital base, we decided to be opportunistic and sell these assets today, significantly de-risking our balance sheet. As a result, both nonperforming assets and criticized loans will show significant improvement, which should position us to report asset quality metrics in line with our peer groups. Additionally, we currently expect lower provisions for loan losses in the second half of 2020 due to both improved asset quality and after proactively building reserves for potential COVID-19 related issues in the first half of 2020. We also believe this transaction should position the company for a faster recovery in both earnings and returns to our shareholders.”

In addition to the special provision, Hancock Whitney continued building its reserve for potential losses related to COVID-19 with a second quarter provision of $146.8 million. The total provision for the loan portfolio for Q2/20 is $306.9 million. As a result of the transaction, and the COVID-19 related reserve build, the company will report a second quarter net loss of $117.1 million, or $1.36 per diluted share. Pre-provision, net revenue is $118.5 million for the second quarter, up $2.8 million, or 2.4%, linked-quarter.

Hancock Whitney offers financial products and services, including traditional and online banking, commercial and small business banking, private banking, trust and investment services, healthcare banking, certain insurance services and mortgage services.

Oaktree Capital Management is a global investment manager specializing in alternative investments, with $113 billion in assets under management as of March 31, 2020.