Golub Capital BDC, a business development company, reported financial results for fiscal Q3/20, including:

- Net investment income per share of $0.23 compared with $0.24 for the quarter ended March 31, 2020. Excluding $0.05 per share in purchase premium amortization from the GCIC acquisition, adjusted net investment income per share for the quarter ended June 30, 2020 was $0.28. This compares to adjusted net investment income per share of $0.33 for the quarter ended March 31, 2020 when excluding $0.09 per share in purchase premium amortization from the GCIC acquisition.

- Net realized and unrealized gain per share for the quarter ended June 30, 2020 of $0.71. Adjusted net realized and unrealized gain per share was $0.66 when excluding the $0.05 per share reversal of net realized loss and unrealized depreciation resulting from the amortization of purchase premium. The adjusted net realized and unrealized gain per share for the quarter ended June 30, 2020 primarily resulted from a partial reversal in unrealized depreciation in the fair value of some of Golub’s portfolio company investments that were recognized during the three months ended March 31, 2020, primarily due to the adverse economic effects of the COVID-19 pandemic. The partial reversal in unrealized depreciation for the three months ended June 30, 2020 was primarily attributable to the U.S. economy reopening sooner than expected and portfolio companies generally performing better than expected during the period, especially those in COVID-impacted sub-sectors, as well as private equity sponsors that have generally stepped up to support their portfolio companies. The fiscal Q3/20 results compare with net realized and unrealized loss per share of $1.95 during the quarter ended March 31, 2020. Adjusted net realized and unrealized loss per share for the quarter ended March 31, 2020 was $2.04 when excluding the $0.09 per share reversal of net realized loss and unrealized loss resulting from the amortization of purchase premium.

- Earnings per share for the quarter ended June 30, 2020 of $0.93 compared with a loss per share of $1.66 for the quarter ended March 31, 2020. Adjusted earnings/(loss) per share for the quarter ended June 30, 2020 was $0.94 compared with $1.71 for the quarter ended March 31, 2020.

- A decrease in net asset value per share to $14.05 at June 30, 2020 from $14.62 at March 31, 2020.

- The payment on June 29, 2020 of a quarterly distribution of $0.29 per share and on Aug. 4, 2020, the quarterly distribution of $0.29 per share, which is payable on Sept. 29, 2020 to stockholders of record as of Sept. 8, 2020.

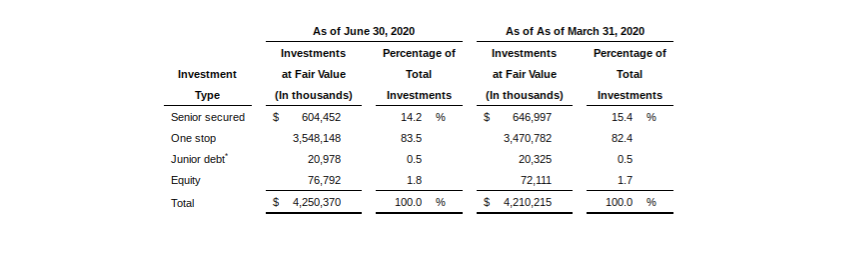

As of June 30, 2020, Golub had investments in 254 portfolio companies with a total fair value of $4,250.4 million. This compares with the company’s portfolio as of March 31, 2020, which included investments in 257 portfolio companies with a total fair value of $4,210.2 million. Investments in portfolio companies as of June 30, 2020 and March 31, 2020 consisted of the following:

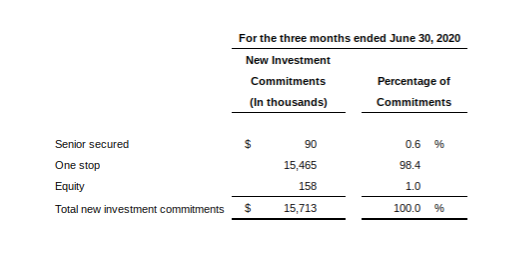

The following table shows the asset mix of Golub’s new investment commitments for the three months ended June 30, 2020:

Total investments in portfolio companies at fair value were $4,250.4 million at June 30, 2020. As of June 30, 2020, total assets were $4,391.7 million, net assets were $2,350.1 million and net asset value per share was $14.05.

For fiscal Q3/20, Golub reported GAAP net income of $142.1 million, or $0.93 per share, and adjusted net income of $142.1 million, or $0.94 per share. GAAP net investment income was $35.1 million, or $0.23 per share, and adjusted net investment income was $42.6 million, or $0.28 per share. GAAP net realized and unrealized gain was $107.1 million, or $0.71 per share, and adjusted realized and unrealized gain/(loss) was $99.5 million, or $0.66 per share.

Golub’s liquidity and capital resources are derived from the company’s debt securitizations (also known as collateralized loan obligations or CLOs), U.S. Small Business Administration debentures, revolving credit facilities and cash flow from operations. The company’s primary uses of funds from operations include investments in portfolio companies and payment of fees and other expenses that the company incurs. Golub has used, and expects to continue to use, its debt securitizations, SBA debentures, revolving credit facilities, proceeds from its investment portfolio, proceeds from offerings of its securities and its dividend reinvestment plan to finance its investment objectives.

As of June 30, 2020, Golub had cash, cash equivalents and foreign currencies of $30.4 million, restricted cash, cash equivalents and foreign currencies of $89.7 million and $2,008.6 million of debt outstanding. As of June 30, 2020, subject to leverage and borrowing base restrictions, Golub had approximately $259.5 million of remaining commitments and $185.9 million of availability, in the aggregate, on its revolving credit facilities with various banks. In addition, as of June 30, 2020, Golub had $100 million of remaining commitments and availability on its unsecured line of credit with GC Advisors and $29 million of unfunded debenture commitments available to be drawn, subject to customary SBA regulatory requirements.

On Aug. 7, 2020, Golub’s indirect wholly-owned and consolidated subsidiary, Golub Capital BDC CLO 4 LLC, priced a 12-year, $297.4 million term debt securitization.

Golub Capital is an externally-managed, non-diversified closed-end management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940. Golub Capital BDC invests primarily in one-stop and other senior secured loans of U.S. middle-market companies that are often sponsored by private equity investors. Golub Capital BDC, Inc.’s investment activities are managed by its investment adviser, GC Advisors, an affiliate of the Golub Capital group of companies.