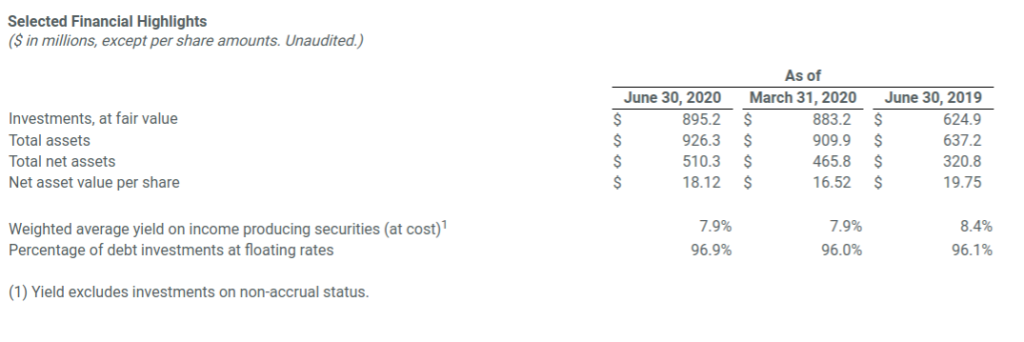

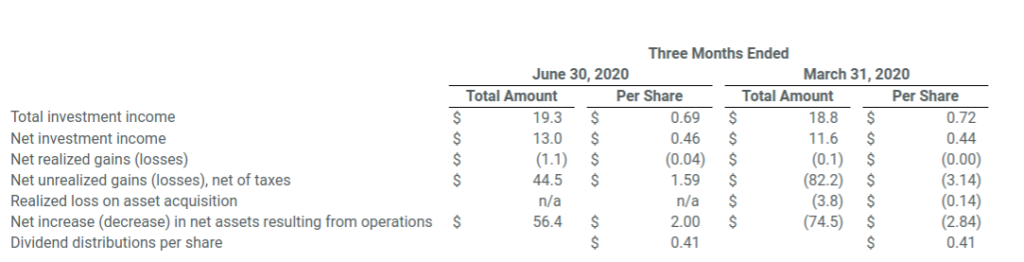

Crescent Capital BDC reported net investment income of $13 million, or $0.46 per share, and a net increase in net assets resulting from operations of $56.4 million, or $2 per share, for Q2/20. Reported net asset value per share was $18.12 at June 30, 2020 compared with $16.52 at March 31, 2020. The increase in net asset value for the second quarter was primarily driven by unrealized gains from the impact of credit spreads tightening relative to the end of the first quarter.

Crescent Capital BDC’s board of directors declared a Q3/20 dividend of $0.41 per share, which will be paid on or around Oct. 15, 2020 to stockholders of record as of the close of business on Sept. 30, 2020.

Portfolio and Investing Activity

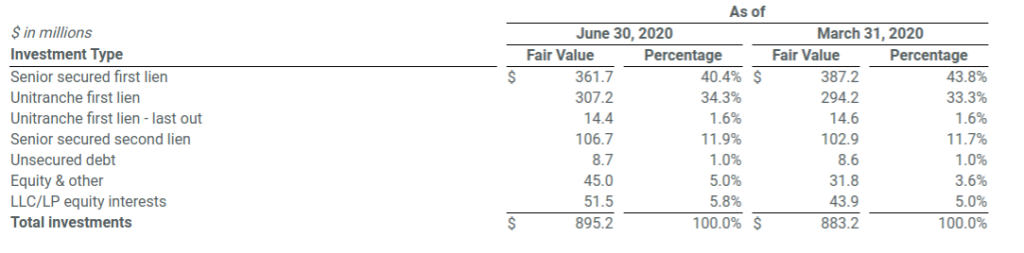

As of June 30, 2020 and March 31, 2020, Crescent Capital BDC had investments in 124 and 127 portfolio companies with an aggregate fair value of $895.2 million and $883.2 million, respectively. The portfolio at fair value was comprised of the following asset types:

For the three months ended June 30, 2020, Crescent Capital BDC invested $26.4 million into one new portfolio company, one refinancing and several follow-on revolver and delayed draw fundings. For this period, the company had $60.4 million in aggregate exits, sales and repayments.

For the three months ended March 31, 2020, excluding assets acquired in the Alcentra Capital acquisition, Crescent Capital BDC invested $117.4 million across seven new portfolio companies and three existing portfolio companies. For this period, the company had $73.8 million in aggregate exits, sales and repayments.

Results of Operations

Investment income increased to $19.3 million for the three months ended June 30, 2020 from $18.8 million for the three months ended March 31, 2020. The increase was due in part to three months of investment income from Alcentra portfolio investments that Crescent Capital BDC acquired on Jan. 31, 2020.

Total net expenses, including income and excise taxes, decreased to $6.4 million for the three months ended June 30, 2020 from $7.3 million for the three months ended March 31, 2020. The decrease was primarily due to lower interest and other debt financing costs as the weighted average interest rate on Crescent Capital BDC’s weighted average outstanding debt decreased from 4% for the three months ended March 31, 2020 to 3% for the three months ended June 30, 2020.

Liquidity and Capital Resources

As of June 30, 2020, Crescent Capital BDC had $11.6 million in cash and cash equivalents and restricted cash, and $166.1 million of undrawn capacity on its revolving credit facilities, subject to borrowing base and other limitations. The weighted average interest rate on the company’s debt outstanding was 2.7% as of June 30, 2020. Crescent Capital BDC’s debt to equity ratio was 0.78x as of June 30, 2020.

On July 30, 2020, Crescent Capital BDC agreed to issue $50 million aggregate principal amount of 5.95% senior unsecured notes due July 30, 2023. Pro forma for this transaction, the company had more than $200 million of available liquidity as of June 30, 2020.

Crescent Capital BDC is a business development company that seeks to maximize the total return of its stockholders in the form of current income and capital appreciation by providing capital solutions to middle market companies. Crescent Capital BDC is externally managed by Crescent Cap Advisors, a subsidiary of Crescent Capital.