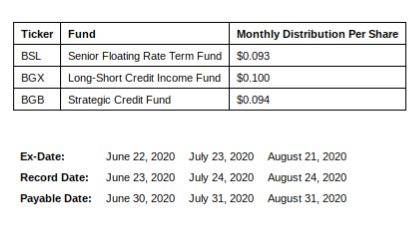

GSO/Blackstone Debt Funds Management, an affiliate of GSO Capital Partners, announced monthly distributions for three lclosed-end funds it advises: Blackstone/GSO Senior Floating Rate Term Fund, Blackstone/GSO Long-Short Credit Income Fund and Blackstone/GSO Strategic Credit Fund. The funds’ monthly distributions are set forth below. The following dates apply to the distribution declarations for the funds:

The funds declare a set of monthly distributions each quarter in amounts closely tied to the respective fund’s recent average monthly net income. As a result, the monthly distribution amounts for the funds typically vary quarter-to-quarter, and shareholders of any fund should not expect that fund to continue to pay distributions in the same amounts shown above. The distribution strategy provides GSO with greater flexibility to maintain portfolio credit quality in varying market conditions. In addition, the distribution strategy reduces the need to retain reserves from net investment income to support the stability of future distributions.

A portion of each distribution may be treated as paid from sources other than net investment income, including but not limited to short-term capital gain, long-term capital gain or return of capital. The final determination of the source and tax characteristics of these distributions will depend upon each fund’s investment experience during its fiscal year and will be made after the fund’s year end.

Blackstone is a global investment firm. GSO Capital Partners is the global credit investment platform of Blackstone. The company’s credit and insurance segment, which consists principally of GSO, has approximately $129 billion of assets under management. GSO is an alternative manager focused on the leveraged-finance, or non-investment grade related, marketplace. GSO seeks to generate attractive risk-adjusted returns in its business by investing in an array of strategies, including mezzanine debt, distressed investing, leveraged loans and other special-situation strategies.