Co-Head of Healthcare Investment Banking, Managing Director

Matrix Capital Markets Group

Co-Head of Healthcare Investment Banking, Managing Director

Matrix Capital Markets Group

Director

Matrix Capital Markets Group

Analyst

Matrix Capital Markets Group

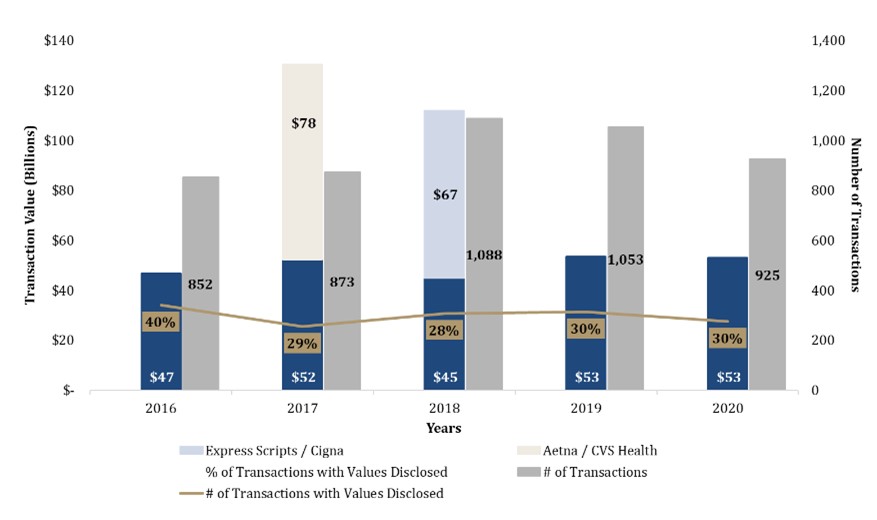

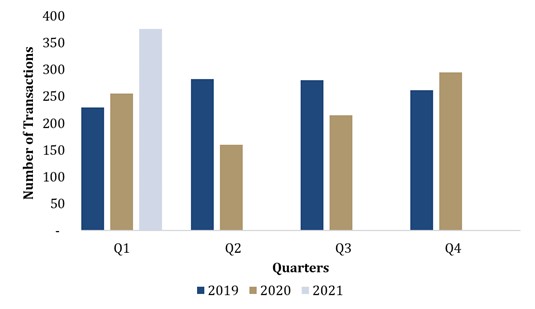

Through any lens, 2020 was a tumultuous year. As healthcare services businesses were thrown into the forefront of a global pandemic in March, mergers and acquisition activity ground to a temporary halt. Early reactions and restrictions created “cash crunches” for organizations across the continuum, regardless of size, credit quality, or investment portfolios. However, as technology solutions were implemented, new logistics were employed, CARES Act funds were distributed and restrictions eased, the worst-case scenarios predicted for many organizations were narrowly avoided, spurring a revival of M&A activity. The significant M&A rebound later in the year offset much of the earlier lull, resulting in more than 900 announced transactions in 2020, which was only slightly below the prior high levels seen in 2018 and 2019. This momentum has further accelerated into 2021, with more than 375 transactions announced in the first quarter.

Although deal volume dipped slightly in 2020, the aggregate transaction value (which only includes transactions with published valuation data) remained consistent with prior years when adjusted to exclude material outliers, such as CVS Health’s acquisition of Aetna in 2017 or Cigna’s acquisition of Express Scripts in 2018.

While variances in healthcare regulation and IT needs across many sectors have driven differing patterns of consolidation over the last decade, much of 2020’s M&A activity can be broadly categorized into three buckets: (i) vulnerable targets feeling pressured to act quickly, (ii) targets well-positioned for COVID-19 capitalizing on enhanced valuation metrics and (iii) buyers reacting swiftly to pursue strategic M&A to adapt to COVID-19 and its aftermath.

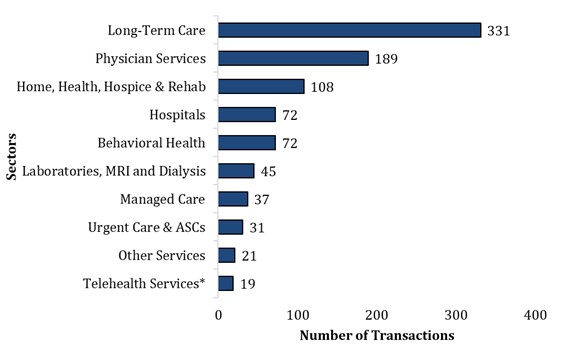

Activity in a few key healthcare sectors warrants a closer look:

Acute Care

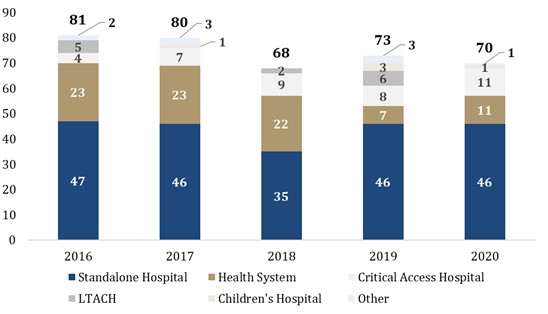

Acute care organizations have maintained a steady pace of consolidation over the last five years, with 70 transactions announced in 2020. The profile has been consistent: The majority of targets were standalone hospitals, while more than half of targets were not-for-profits and more than two-thirds of acquirers were not-for-profit health systems. However, a new trend in 2020 was an increase in critical access hospital transactions to 16% compared with 10% historically, excluding several transactions in which critical access hospitals were acquired as part of a portfolio.

Reactions to the COVID-19 pandemic have been split between the “haves” and the “have nots.” The “haves” (larger organizations with robust balance sheets) experienced an initial cash crunch, but due to their size and higher level of resources, they have mostly adapted and driven business decisions strategically. Most either had existing telehealth platforms or access to the resources/infrastructure to quickly implement and integrate a telehealth model into their care protocols. Many realigned their strategies with an increased focus on their key service lines and markets. Several large transactions (e.g. Beaumont/Summa, Beaumont/Advocate Aurora, Intermountain/Sanford) were called off as focus adjusted inward. As larger organizations focused on their core, a few portfolio rationalization transactions also were announced (e.g. CommonSpirit’s 14 Midwest hospitals, Ascension’s seven Wisconsin hospitals, UnityPoint’s Iowa hospital). Going forward, this strategy is likely to continue and prompt an increase in divestitures of non-core assets and service-line specific joint ventures in 2021.

Meanwhile, the “have nots” shared the experience of the initial cash crunch but without the same ability to adapt and with CARES Act funding providing only temporary relief. The larger of these may be able to rebound in 2021 while remaining independent. However, an increasing number, especially rural or critical access hospitals, need to start carefully assessing future strategic options. While additional COVID-19-related federal relief funding could continue to delay this necessity, many may need to look toward potential sale or partnership opportunities or consider restructuring. Reactions to the COVID-19 pandemic have been split between the “haves” and the “have nots.” The “haves” (larger organizations with robust balance sheets) experienced an initial cash crunch, but due to their size and higher level of resources, they have mostly adapted and driven business decisions strategically. Most either had existing telehealth platforms or access to the resources/infrastructure to quickly implement and integrate a telehealth model into their care protocols.

So far in the first quarter, 15 hospital transactions have been announced, including one Chapter 11 filing. This pace is likely to accelerate as 2021 continues.

Behavioral Heath

Behavioral health has been highly impacted by the COVID-19 pandemic, which significantly increased the demand and need for services and generated heightened levels of anxiety, depression and substance use across the country.

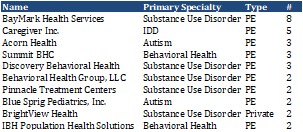

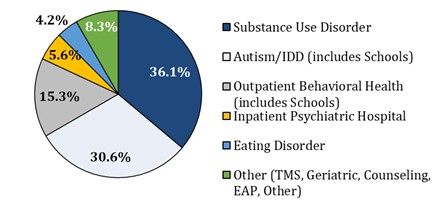

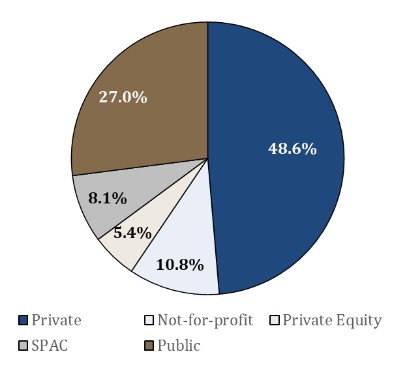

PE investment has increased considerably with mental health parity changes over the last decade. In 2020, PE investment continued to dominate the space, particularly across certain niche specialty areas. Of the 72 announced transactions, 34 represented PE acquirers, including BayMark Health Services, which was the most active acquirer with eight acquisitions. In addition, a more recent entrant into the autism specialty, Blue Sprig Pediatrics, created by KKR, acquired Florida Autism Center and Fusion Autism Center for $120 million. The year’s largest announced transaction was a PE combination: TPG’s acquisition of a majority stake in LifeStance Health, an outpatient and telepsychiatry provider backed by Summit Partners and Silversmith Capital Partners, valued at $1.2 billion.

Increased demand is likely to continue to drive M&A activity in 2021. In Q1/21, 33 behavioral health transactions were announced, with a maintained focus on substance use disorder and autism/IDD companies. In addition, SpringStone, which has been backed by Welsh Carson for the last decade, also is rumored to be exploring a $1 billion or greater sale.2020 also featured the initial acquisitions by the Kindred Behavioral Health platform (established in 2019), which took over the management of Riverside Medical Center’s 64-bed behavioral health unit in Illinois and acquired two Texas psychiatric hospitals from WellBridge. Kindred also is actively exploring JV opportunities, similar to UHS and Acadia, and plans to grow its bed capacity.

Managed Care

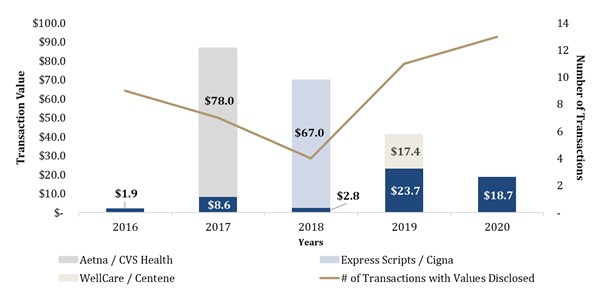

In recent years, the managed care sector has been transformed by “mega merger” announcements. However, 2020 lacked a “mega merger” announcement comparable in scale to Aetna’s acquisition by CVS in 2017, Express Scripts’ acquisition by Cigna in 2018 and WellCare’s acquisition by Centene in 2019 (completed in January 2020).

However, by number of transactions, 2020 was the most active year of the past five years, with 37 announced transactions. Many were driven by heightened interest in Medicaid and Medicare membership, including Molina’s three announced transactions totaling $1.25 billion: Affinity Health Plan, a metro-New York Medicaid plan; the Medicaid and Dual Eligible Special Needs Plan membership of Kentucky-based Passport Health Plan; and Magellan Complete Care, which managed the Medicaid and Medicare health plans of Magellan in six states.

Strategic buyers drove M&A activity in 2020. MetLife’s acquisition of vision-care focused Versant Health for $1.675 billion from Centerbridge Partners and FFL Partners was notable. Further, 2020 marked two new entrants in the public market via SPACs, with $11 billion MultiPlan, a technology-enabled provider of cost management solutions that partners with payors, and $3.7 billion Clover, a Medicare Advantage plan.

In January 2021, Centene also announced the acquisition of Magellan Health for $2.2 billion to establish a managed behavioral health platform. This announcement, along with 10 others in the first quarter, signals strong M&A activity in the sector for 2021.

Post-Acute and Long-Term Care

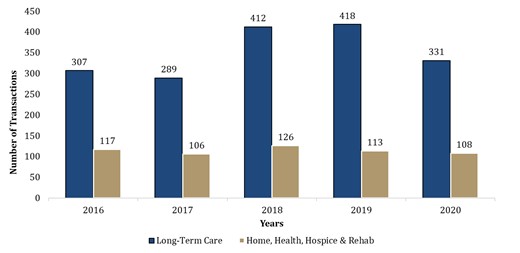

The severe disruption to utilization created by the COVID-19 pandemic in the post-acute and long-term care sectors was coupled with the intensity of exacerbating staffing challenges. An all-time low occupancy at skilled nursing facilities is expected to take more than a year to recover. With the marked shift in strategy and reallocation of resources made by many organizations to home-based/alternative models of care, as well as lingering patient safety concerns, traditional facility-based utilization may never return to pre-pandemic levels.

While M&A activity was lower, long-term care is still the most active sector by number of transactions within healthcare services, driven by continuing REIT activity. The added burdens of the pandemic to historically slim industry margins will continue to drive many smaller, standalone long-term care facilities to either pursue M&A strategies or discontinue operations. Nationwide surveys of skilled nursing facilities in the U.S. suggest that as many as two-thirds of them could close in 2021 due to COVID-19 related losses.

M&A activity in home health and hospice accelerated in late 2020, driven by swelling valuation metrics and limitations to organic growth, particularly in Certificate of Need states, where valuations are at a premium due to barriers to entry. In 2020, targets seeking to capitalize on all-time-high valuations were more likely to be smaller, independent agencies; however, monetization opportunities are now also being evaluated by larger players. Encompass Health and Brookdale Senior Living, both publicly traded organizations with operations spanning home health, hospice and facility-based care, announced separately in December that they are considering a divestiture of their home health and hospice businesses to take advantage of heightened valuations and generate an influx of cash to support their under-performing facility-based operations. In late February, Brookdale agreed to sell an 80% equity stake in its home health, hospice and outpatient therapy business to HCA Healthcare for $400 million.

The home health industry is evolving due to shifting payment models and patient patterns. In addition, PE activity in the space accelerating and many players are looking to diversify operations across the post-acute continuum of care. The December 2020 merger of Advent International-backed AccentCare, the fifth largest home health provider, and Seasons Hospice & Palliative Care, the fifth largest hospice provider, is a notable example.

Looking Forward

For the healthcare industry, the pandemic will be a catalyst for enduring change, bringing with it an expected increase in M&A activity as some companies refocus their strategies and others look to capitalize on growth. The pursuit of technology for both data and telehealth capabilities will continue to be a significant driver, with lines blurring between technology and services, as evidenced by United Health/Optum’s $13 billion acquisition of Change Healthcare, which was announced in January and is currently under stringent review by the Department of Justice. With the new presidential administration, it also is anticipated that antitrust reviews will have heightened scrutiny in 2021. SPAC prevalence has continued through the first part of 2021, but the trend may be poised to slow down as the space becomes increasingly crowded and investor scrutiny of these transactions continues to mount. M&A activity in 2021 is likely to continue accelerating, but the full extent remains to be seen, as it will be impacted by many still-evolving macro factors, including additional stimulus, regulatory changes and tax reform.

Founded in 1988, Matrix Capital Markets Group is an independent, advisory focused, privately-held investment bank headquartered in Richmond, VA, with additional offices in Baltimore and Chicago. Matrix provides M&A and financial advisory services for privately-held, private-equity owned, not-for-profit and publicly traded companies. Matrix serves clients in a wide range of industries, including automotive aftermarket, building products, business services, consumer products, convenience retail, downstream energy, healthcare and industrial products.