Part one of this three part series demonstrated that the typical dilution calculation (Dilution Rate = Dilution/Gross Sales for trailing 12-month period) often does not adequately measure the level of dilution in A/R. The second part of this series discussed possible methods of identifying and measuring this additional dilution exposure. The final part of this series examines certain specific cases where the standard formulas for dilution and credit lag do not necessarily apply.

Is there a limit to the lag? Let’s assess through the following example if there is a limit to the Bbase exposure related to credit lag.

Example #3 Annual Cleanup of A/R

Assume a company has sales of $100 per month, an average collection period of 31 days, and average customer rebates of 5% of gross sales. Customers make payments net of rebates and the company issues credit notes for the residual A/R balance at year-end.

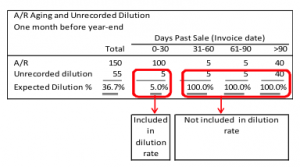

Let’s examine below what the A/R aging and effective dilution would be the month prior to year-end.

The A/R one month prior to the year-end cleanup of A/R would include ten months of unrecorded dilution in addition to the outstanding invoices for the current month ($100) for a total A/R balance of $150. While the dilution rate would be 5% of sales, the effective rate is significantly higher at 36.7% of A/R.

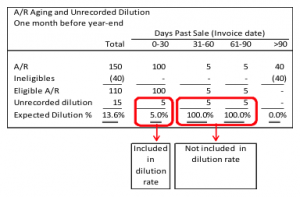

However, the typical Bbase holds all accounts over 90 days ineligible. As a result, credit notes and write-offs are effectively recorded on the Bbase on day 91 as demonstrated below:

While applying the standard Bbase methodology reduces the effective dilution to 13.6%, it is still greater than the annual dilution rate of 5%. This example clearly demonstrates that the incremental dilution exposure for credit lag on the Bbase is limited to 90 days.

We can now re-examine the formula proposed in part 2 of our series to estimate the credit lag ineligible:

Bbase credit lag ineligible = average credit notes per day X [credit lag in days – average collection period]

If the Bbase holds invoices greater than 90 days ineligible, then the credit lag in the above formula should be maxed at 90 days.

Rebates

Now that the formula for credit lag ineligibles has been fine-tuned, let’s examine if it holds up in all situations. What happens when a customer requests a credit on an invoice that has been previously paid? The credit could be offset against a current receivable leading to additional dilution.

Example #4

In the previous example, customers paid the net balance after rebates were deducted. The next example assumes that customers pay the gross invoice and rebates are cleared annually through a reduction of current receivables.

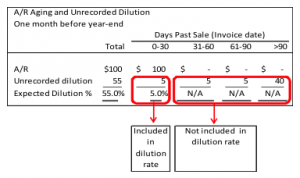

The company’s A/R aging and effective dilution the month prior to the annual clean up would be as follows:

No receivables are aged over 30 days as customers pay the gross balance due in 31 days. As payments are not reduced for sales rebates, customers are in effect overpaying during the year and receiving a refund on annual basis through a reduction in current receivables. In the month prior to the granting of the rebates, customers would be owed 11 months of rebates or $55 (11 months *$100 sales/month*5% rebate), resulting in effective dilution on A/R of 55%.

These examples demonstrate that no formula, no matter how sophisticated, can replace a proper understanding of a company’s business when assessing its collateral. With respect to dilution, understanding the nature and timing of the various types of credit notes recorded is critical.

Seasonality

The examples we have reviewed to date assumed that sales were constant throughout the year. What happens if a company experiences significant seasonality?

Example #5

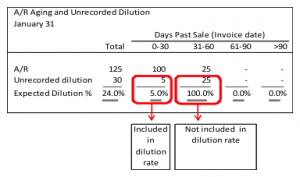

Assume a company generates sales of $500 in December and $100 per month for the remainder of the year, has a dilution rate of 5%, a collection period of 31 days and a credit lag of 61 days. What would the A/R aging and effective dilution be at the end of January?

The 0-30 day column represents invoicing for January of $100 and includes $5 of anticipated dilution. December sales of $500 have already been collected, leaving only anticipated dilution of $25 ($500 X 5%) in the 31-60 day column.

While the annual dilution rate is 5% of gross sales, the effective dilution is significantly greater at 24% of A/R. This example demonstrates that seasonally adjusted advance rates or Bbase ineligibles could be required in the months following peak seasonal sales. The above example also reinforces the need to hold all potentially dilutive items (unprocessed credit notes and charge backs) as separate ineligibles on the Bbase.

Reserve, Reserve, Reserve

A one-size-fits-all formula for annual dilution or credit lag ineligibles will never adequately address every variation in seasonality, allowances, rebates, discounts and credit note recording processes. Specific accounting reserves for returns and rebates that take into account seasonality, sales volume and timing of recording of credit notes will often be more accurate than a formula or an ineligible based on a sample of credit notes.

Loan agreements often state that financial figures on the Bbase must be in accordance with GAAP and this covenant should be enforced vigorously. A company with an asset-based loan should be required to calculate A/R accounting reserves monthly and not just for year-end purposes. Systematic and rational dilution accounting reserves could then be validated by the field examiner and included as ineligibles on the Bbase. These ineligibles would also need to consider the potential impact of a liquidation.

If an accounting reserve, held ineligible on the Bbase, adequately addresses a certain category of dilution (i.e., discounts, volume rebates, etc.) then the annual dilution rate should be reduced.

Let’s assume a company had a reasonable accounting reserve for sales rebates held ineligible on the Bbase and had an annual dilution of 8%, of which 3% relates to sales rebates. To avoid any double counting, dilution for advance rate calculation purposes would be 5% (8% less the 3% for sales rebates). The 3% of rebate credit notes would be treated as nondilutive. In addition the average credit notes per day in the formula used to calculate the credit lag ineligible (from part 2 of this series) would also be reduced by these nondilutive credits.

The Final Rule: Include all systematic and rational A/R accounting reserves as BBC ineligibles and adjust the dilution rate accordingly.

Final Word on Annual Dilution, Credit Lag & Ineligibles

Certain Bbase ineligibles reduce the dilution rate used to calculate the advance rate (as just discussed) while other ineligibles reduce credit lag (See part 2 of this series).

There is a simple rule to determine which ineligibles reduce the dilution rate and which ones reduce credit lag. If a Bbase ineligible is calculated at the time of sale, it reduces dilution.This would be the case for sales rebates, discounts, and return allowances that are recorded at the time of sale.

If a Bbase ineligible is calculated after the sale then the Bbase exposure for credit lag is reduced, however the exposure for dilution remains. This would be the case for ineligibles for unprocessed credit notes, AR aged over 90 days and partial payments. When these ineligibles are included, the Bbase reserve for credit lag should be based on the date that these ineligibles are established as opposed to the date that the credit notes or write offs are recorded. By holding a Bbase ineligible for unprocessed credit notes the credit lag reserve will be reduced or possibly eliminated.

The final versions of the dilution rate and credit lag ineligible calculations are as follows:

Dilution Rate = (Dilution – less portion addressed by BBC ineligibles)/Sales

Bbase credit lag ineligible = average credit notes per day X [credit lag in days (based on date recorded as Bbase ineligible) – average collection period]

Summing it All Up

It is clear from our series of articles that a dilution rate based on sales may not be sufficient in estimating the collectability of A/R and that additional ineligibles are frequently required to ensure that all potentially dilutive items are captured. Our proposed solution is to include a combination of reasonable accounting reserves in addition to an estimate for credit lag on the Bbase. As always, it is critical to remember the overriding rule: The unique circumstances of a borrower must be considered when implementing Bbase ineligibles and advance rates.

Gilles Benchaya is a partner at Richter Consulting Inc., which has specialized over the past 20 years in financial advisory, turnaround and diligence in the retail, consumer goods and distribution sectors. He has led a number of multidisciplinary teams in North America and Europe providing fully integrated transaction support and advisory services to clients. He is a chartered accountant (CA) and graduate of HEC (University of Montreal) Business School. He can be reached at by e-mail at [email protected].

Gregory Anderson is a senior associate at Richter Consulting, Inc. Anderson has extensive experience as an advisor to financial institutions with specific expertise in asset-based lending. He has consulted on field examination and lender monitoring processes as well as loan workouts. Anderson is a CA and certified fraud examiner. He can be reached at by e-mail at [email protected].

Richter Consulting, Inc. is a member of the Richter Group, a full-service business advisory firm, founded in 1926, with over 40 partners and 400 professionals. The company provides a full range of consulting services delivered by a multi-disciplinary group of professionals. Its services include business assessment, financial reorganization, crisis management, turnaround management, transaction advisory, business valuation, insolvency consulting, forensic investigations, and litigation support.