In part one of this series we reviewed the typical dilution calculation (dilution rate = dilution/gross sales for the trailing 12-month period). Several examples were provided to demonstrate that the dilution rate frequently does not adequately capture the effective level of dilution in A/R. This measurement failure occurs when collections are being processed faster than credit notes and write-offs as illustrated in the following example;

Example 1

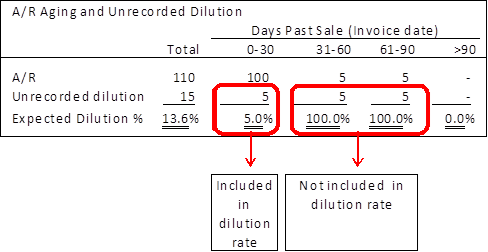

A company has $100 in sales per month, a collection period of 31 days and returns of 5% of gross sales each month (the dilution rate), which are recorded as credit notes 91 days after the invoice date (credit lag). An A/R aging and effective dilution rate based on these facts is as follows.

The dilution rate in this example is 5% of gross sales, but actually amounts to 13.6% of A/R (almost triple the dilution rate). The effective dilution is higher due to the $10 of unrecorded dilution in A/R ($5 on the 31-60 columns and $5 in the 61-90 day column) due to credit lag. This example provides the first rule of dilution:

If the credit lag is greater than the collection period, effective dilution on A/R will be greater than the dilution rate based on gross sales.

But where can evidence of this additional exposure for dilution be found in a company’s accounting records and what techniques are available to quantify it? Part two of this series of articles attempts to answer these questions.

Chargeback, Debit Memos and Partial Payments

When field examiners review an A/R aging they will often encounter chargebacks, debit memos, and/or partially paid invoices. Customers may short pay an invoice due to a return, a dispute or an inability to pay. For example a customer might owe a company $100 for an invoice but pay only $95. The company then has two options; remove the $100 invoice from the A/R aging and record the remaining $5 as a debit memo or a chargeback or leave the invoice on the A/R aging at a reduced balance of $5. In either case the field examiner has a dilemma. Should the unpaid balance of $5 be held ineligible or is it already captured by dilution?

The $5 balance represents a residual unpaid amount that is potentially 100% dilutive as the customer likely has no intention of making further payments on the invoice. Accordingly, this remaining A/R balance represents incremental dilution in excess of the dilution rate determined by using the gross sales method and should therefore be held ineligible on the borrowing base (Bbase).

Accounting Reserves

The $10 of unrecorded dilution found in the 31-60 and 61-90 day columns in Example 1 may have been accrued for by the company as an accounting reserve.

The main reason that the credit lag exceeds the collection period is that credit notes must be validated and approved prior to being granted. Some companies take a more proactive approach to credit lag by recording the potential credit immediately upon receipt of the customer debit memo in a separate accounting reserve. The liability for unprocessed credit notes would be included in this reserve until support has been received, validated, and the credit notes have been processed. As this accounting reserve represents invoices that are potentially 100% dilutive, it should be held ineligible on the Bbase.

Holding Bbase ineligibles for partial payments and/or unissued credit notes does not cover the full potential dilution. A prudent asset-based lender should still anticipate that the borrower’s remaining eligible receivables would be subject to further dilution (estimated by the annual dilution rate). This concept provides the second rule of dilution:

Debit memos, chargebacks, partially paid invoices and reserves for unrecorded credit notes should be held ineligible on the Bbase.

Quantifying Credit Lag on the Bbase

Companies do not necessarily identify partial payments on their A/R aging, nor do they always establish an accounting reserve for unrecorded credit notes. Further, holding these items ineligible may not capture the complete impact of credit lag in situations where customers have yet to request credits from the company. As a result, field examiners must fall back on an independent measure to assess the impact of credit lag on the Bbase.

The credit lag test typically consists of analyzing a sample of credit notes over the dilution period. The examiner reviews source documents to assess the reason for the credit note and how long it took from the date of the sale to record the credit note (credit lag). The impact of credit lag on the Bbase is usually calculated as follows:

Bbase exposure for credit lag = average credit notes processed per day * credit lag in days

For example if the sample of credit notes indicated that it took an average of 60 days from the invoice date to issue a credit note and average credit notes per day over the period tested was $10,000, the Bbase impact of unissued credit notes would be estimated at $600,000. The field examiner is faced with a dilemma, what portion of this $600,000 is already included in dilution rate (i.e., advance rate)?

In Example 1, the company processed $5 of credit notes per month and experienced a credit lag of 91 days. Using the above formula results in the following Bbase exposure for credit lag:

$5 (credit notes per month) / 30 (days per month) * 91 (days credit lag) = $15.

While the exposure for credit lag is equal to the unrecorded dilution of $15 in Example 1, a portion of that dilution is already captured in the annual dilution rate and needs to be excluded from the ineligible.

As stated in rule #1, if the credit lag is greater than the collection period, effective dilution will be greater than the dilution rate, then the portion of credit lag that exceeds the collection period needs to be isolated in the formula as follows:

Bbase ineligible for credit lag = average credit notes per day * (credit lag in days – average collection period in days)

The ineligible for credit lag for Example 1 would be:

$5 (credit notes per month) / 30 (days per month) * (91 [days credit lag] – 31 [average collection period]) = $10.

The $10 ineligible calculated above is equivalent to the unrecorded dilution of $10 that is not captured by the annual dilution rate based on gross sales. This establishes the third rule of dilution.

A Bbase ineligible should be determined for the difference between the credit lag and collection period.

Double counting

If a Bbase ineligible for credit lag is determined, then holding ineligibles for partially paid invoices and unprocessed credit notes may result in double counting.

For a conservative lender this may not be a concern, however for those that want to hold all identified dilutive items from the Bbase without double counting, there is a potential solution which would entail holding all identifiable partial payments and reserves for credit notes as ineligible on the Bbase while reducing the credit lag ineligible.

This is accomplished by changing the method by which the credit lag is calculated. The date that the credit note is recorded would be replaced with the date the receivable is first held ineligible on the Bbase (i.e., when the invoice is first reclassified as a chargeback, debit memo or included in an accounting reserve).

To illustrate this concept we can consider an example where a credit note was issued 60 days after the invoice date but the accounting reserve was recorded immediately upon notification from the customer (i.e., 45 days after the invoice date). In this situation the credit lag ineligible would be based on 45 days resulting in all known potentially dilutive items being held ineligible on the Bbase as well as an adjusted credit lag ineligible.

Based on the above, rule 3 should be modified to the following:

A BBC ineligible should be calculated based on the difference between the credit lag and collection period. Where possible, the credit lag should be based on the date when the related amount is first held ineligible on the BBC.

Bbase credit lag ineligible = average credit notes per day * [credit lag in days (based on date recorded as Bbase ineligible) – average collection period]

In the first two articles of this three part series, we have established the case for holding Bbase ineligibles for partial payments, unprocessed credit notes, as well as calculating a modified ineligible for credit lag. In the final part of this series — to be published in ABF Journal’s Annual Factoring issue — we will examine certain specific situations and discuss rebates and allowances.

Gilles Benchaya is a partner at Richter Consulting Inc., which has specialized over the past 20 years in financial advisory, turnaround and diligence in the retail, consumer goods and distribution sectors. He has led a number of multidisciplinary teams in North America and Europe providing fully integrated transaction support and advisory services to clients. He is a chartered accountant (CA) and graduate of HEC (University of Montreal) Business School. He can be reached at by e-mail at [email protected]

Gregory Anderson is a senior associate at Richter Consulting, Inc. Anderson has extensive experience as an advisor to financial institutions with specific expertise in asset-based lending. He has consulted on field examination and lender monitoring processes as well as loan workouts. Anderson is a CA and certified fraud examiner. He can be reached at by e-mail at [email protected].

Richter Consulting, Inc. is a member of the Richter Group, a full-service business advisory firm, founded in 1926, with over 40 partners and 400 professionals. The company provides a full range of consulting services delivered by a multi-disciplinary group of professionals. Its services include business assessment, financial reorganization, crisis management, turnaround management, transaction advisory, business valuation, insolvency consulting, forensic investigations, and litigation support.