Senior Managing Director

Focus Management Group

Recent concerns about supply chain management are the result of an emerging trend impacting businesses today, including increased costs, labor issues (including availability and cost) and extended delivery time frames.

Despite these concerns, the August 2021 Manufacturing PMI from the Institute for Supply Management was 59.9%, indicating 15 months of expansion in the overall economy, and the August 2021 Services PMI from the ISM was 61.7%, also marking the 15th month of expansion.

In addition, according to the third survey of the year from GlobalTranz Enterprises, a third-party logistics solutions provider, U.S. supply chain leaders showed optimism related to supply chain performance, but 70% noted challenges with “final mile”/home delivery issues and nine out of 10 report the need to increase hiring.

Survey participants also weighed in on these issues:

- 47% said salaries and wages will need to increase before the end of the year.

- More than 30% are concerned about having enough resources to meet demand.

- More than 30% cited concerns related to congestion in the supply chain, increasing transportation costs, labor issues and potential lockdowns.

The ISM reports for August 2021 also indicated participants were concerned about certain supply chain issues. The average production materials lead time in August was 91 days, which was up five days from July’s report. The August lead time was the highest since the ISM began collecting that data in 1987. According to ISM, among business survey committee respondents, 62.8 % reported paying higher prices in August, which was down from 73.8% in July but continues to show the expectation of increased costs by more than half of the participants.

Beyond the Surveys

Companies need to move beyond the surveys to evaluate the impact of the trends on the unique situation they experience. To identify risk areas, the mode of transportation a business needs must be considered. Let’s consider marine container transport, trucking and air cargo trends.

Marine Container Transport

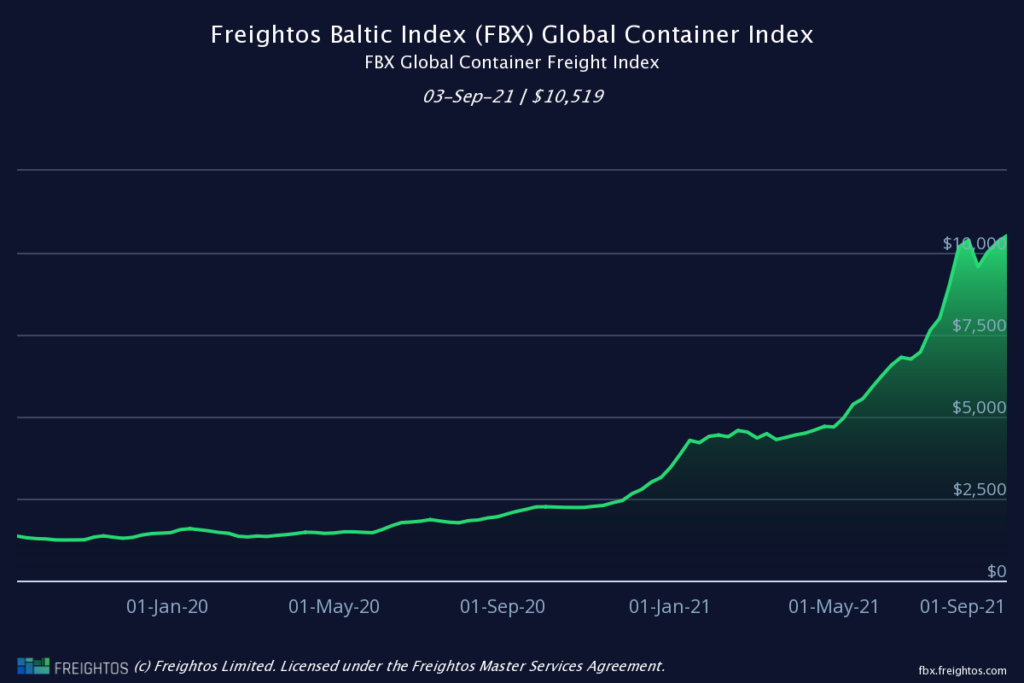

Freightos publishes various container indices which show transportation costs over time. First, consider the Freightos Baltic Index (FBX) Global Container Index, which showed a $10,519 global container shipping cost as of Sept. 3, which is clearly a higher level than previously experienced during the reported time frame.

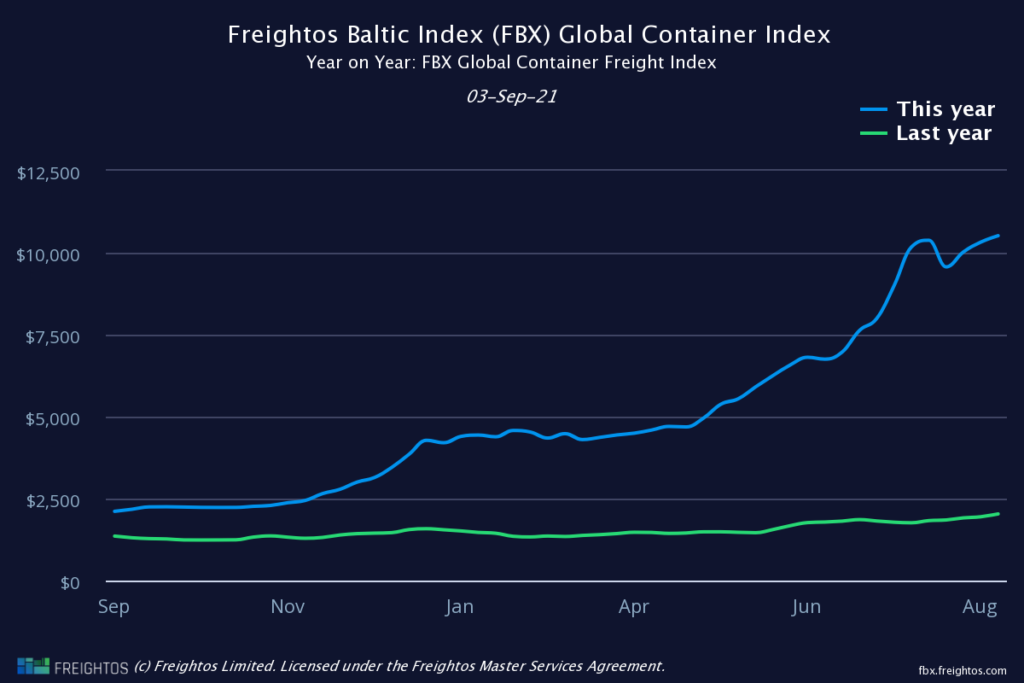

The next chart shows the year-over-year performance of the Global Container Index. Costs today are significantly higher than 2019 levels.

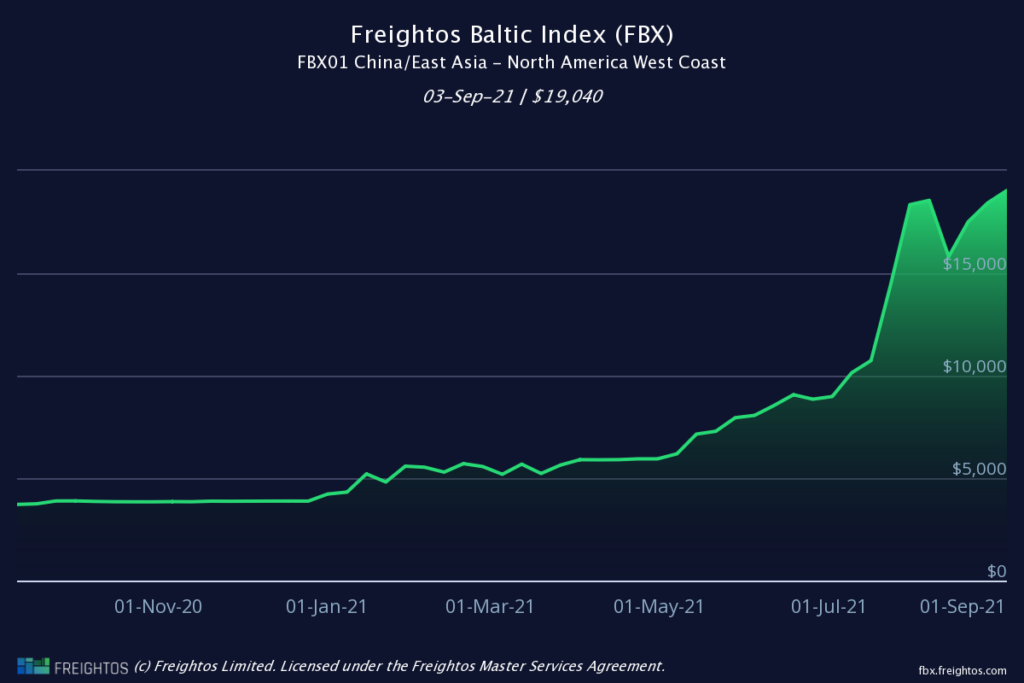

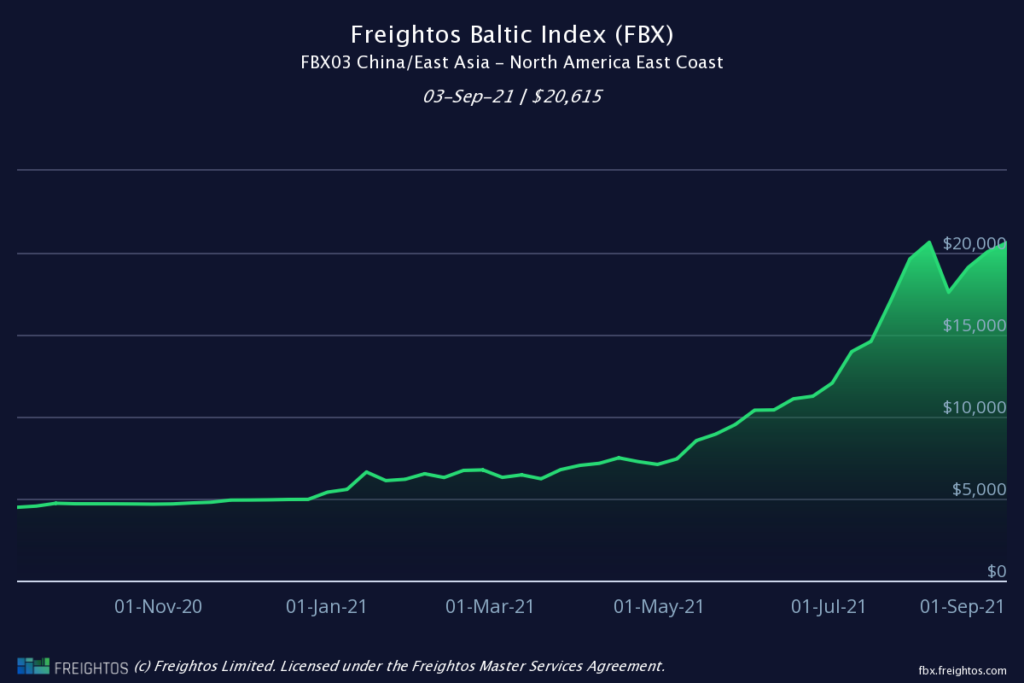

Using the global index does not tell the entire story. For U.S. businesses, it is important to consider the China/East Asia – North America West Coast Index and the China/East Asia – North American East Coast Index. Both of these indices are experiencing higher prices and higher upward movements.

First, the China/East Asia – North American West Coast Index showed a cost of $19,140 as of Sept. 3, which was double the July 2021 level.

And the China/East Asia – North American East Coast Index showed a cost of $20,615 as of Sept. 3, which was double the July 2021 level and much higher than the $5,000 level experienced up to January of 2021.

The 10 largest ports in the world in 2019, as defined by 20-foot equivalent units (TEU), which is the basis of measurement for cargo capacity for containerships and ports.

Since COVID-19 impacts began, various ports have been closed at different times for different periods. For example, the Chinese port of Ningbo was recently closed for two weeks beginning on Aug. 11 and the Yantian port was closed for a month earlier this year.

In addition to port closures, staffing levels have been challenging and some ports are operating at less than full capacity because of government mandates or as a result of a smaller available work force.

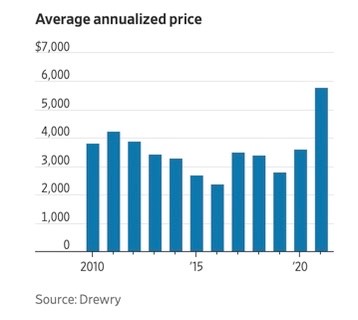

The actual container boxes have also been in short supply and their costs are rising. According to Drewry, the price of a standard 40-foot shipping container made in China has more than doubled from $2,375 in 2015 to $5,795 in 2021.

Trucking Transport

Trucking costs have also increased. In an interview in August with Yahoo Finance, Eric Fuller, CEO of US Xpress, said the company had raised pay 30% to 35% over the previous 12 months and expected more increases to be needed to attract and keep employees. Fuller also explained that employees are evaluating being able to spend more time at home and as a result, US Xpress and other trucking companies are competing with manufacturers for the same employees, forcing trucking companies to increase pay to offset the lifestyle differences between the jobs in the two industries.

In addition to increasing labor costs, trucking companies are also dealing with increased fuel prices, increasing demand because inbound container shipments are up and reduced load volume. The July Cass Information Systems Transportation Index Report showed that July year-over-year shipments increased 15.6%, down from the June year-over-year increase of 26.8%, due to driver and equipment shortages. Cass does expect to see more truck and driver capacity moving forward.

In addition, according to DAT Freight & Analytics, on Aug. 9, national van rates were $2.76 per mile and July year-over-year rates experienced a 33.4% increase.

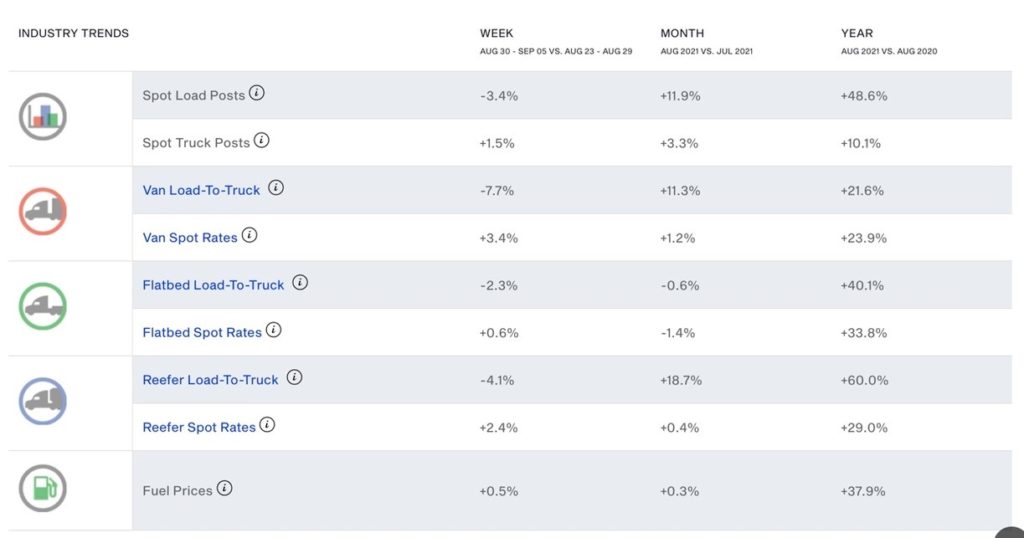

The next table shows August year-over-year increases for split load, van, flatbed and reefer trucking. The year-over-year increases ranged from 10.1% for spot truck posts to 60% for reefer load to truck.

Air Cargo Transport

Air freight costs are based on weight and volume, with charges based on either volumetric weight (dimensional weight) or actual weight. If the volumetric weight exceeds the actual weight, the shipping charges are based on volumetric weight.

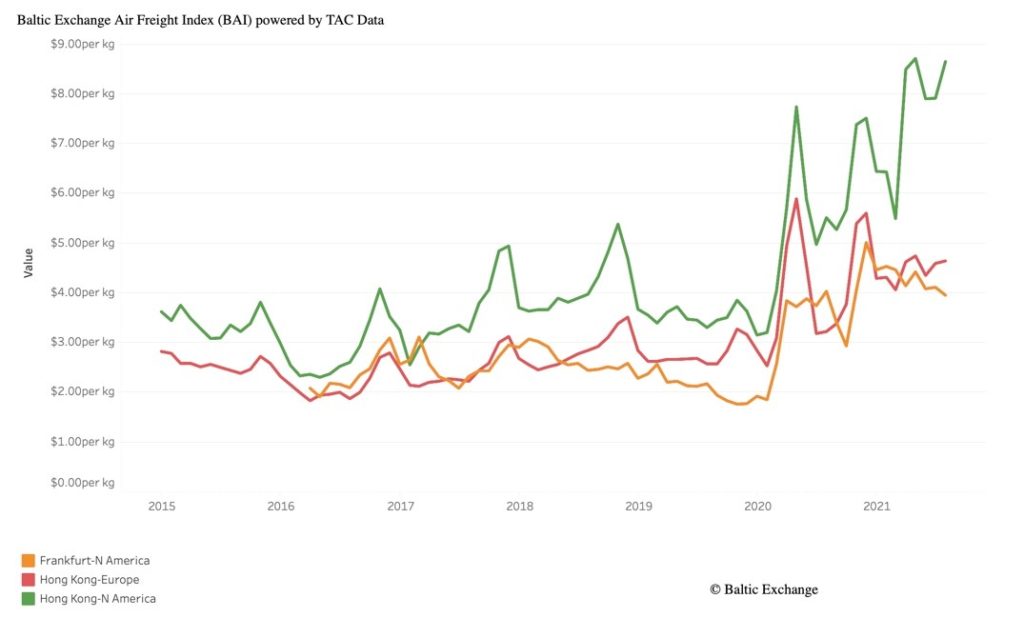

The Baltic Exchange Air Freight Index reported that after steep increases in 2020, the rates for certain routes have come down in 2021. Though, as the next graph shows, the Hong Kong to North America rates continue to rise and are nearly double 2019 levels.

Emerging Trends and the Supply Chain

Emerging trends combining to increase shipping costs and slow down shipping times are impacting the supply chain. These emerging trends include the labor shortages and resulting impacts on costs, as well as overall inflation and specific commodity price changes such as the costs of energy. Additional supply chain disruption has occurred as a result of cyber-attacks on important infrastructure supporting the supply chain. In addition, the impact of COVID-19 related shutdowns has materially impacted the supply chain.

Next Steps

How businesses respond to these supply chain disruptions will be the key to success. Businesses need to continue to monitor supply chains and develop response strategies. Some of the strategies to reduce supply chain risk include:

- Sourcing alternative suppliers on different shipping routes or closer to home

- Reshoring and near shoring

- Using transportation options such as trucking versus inland waterways or using different ports

- Staffing planning

- Warehouse sizing

- Investing in technology to ensure data availability

Businesses need to be monitoring their costs to ensure they are responding to evolving cost structures. Supply chain challenges may mean a company needs to elect to invest in capex to reduce reliance on labor and to monitor inventory levels throughout the procurement to delivery to customer delivery process.

The additional stress on a business may result in increased working capital needs to support higher levels of inventory and to augment existing supplier lines of credit, which could be capped out more frequently. These changes in working capital management could impact the line of credit structure, including needing increased line maximums, allowing for slower inventory turns, changing relationships between asset classes and alternative ineligible calculations.

Overall, supply chain management is a business management category that requires the use of best practices and detailed tracking and analysis to ensure a business is positioned to survive these trending issues. Best practices include:

- Performing sensitivity analysis to identify impacts of labor cost increases, benefit cost increases, transportation cost increases and energy cost increases

- Clearly laying out and regularly updating plan B and plan C shipping and inventory management options

- Evaluating inventory turnovers by SKU and/or by inventory categories

- Reviewing contracts for the ability to increase prices, both with customers and by suppliers

- Regularly updating contract listing and identifying key aspects of the contracts, such as automatic renewal dates, current escalation capabilities, expiration dates, etc.

- Evaluating bid procedures to ensure increasing costs are immediately impacting the bids in process.

- Evaluating the capability to escalate costs in bid agreements

- Incorporating working capital management best practices:

- Accounts receivable: collection efforts, customer credit lines

- Inventory: turnover by SKU/category

- Accounts payable: supplier line evaluation, extended terms

- Line of credit: availability forecast by asset category and evaluation of size and structure.

The combination of emerging trends outlined in this article is impacting all companies and each one needs an internal champion to focus resources on the key best practices to ensure a company’s success during these uncertain times.

This article first appeared at focusmg.com.

Juanita Schwartzkopf is senior managing director of Focus Management Group.

Schwartzkopf has more than 35 years of experience in commercial banking, business management and financial and management consulting. During her career, she has handled projects involving financing strategies, strategic planning, forecasting, cash management, creditor relationships, information management, bankruptcy, crisis management and business plan development.

Schwartzkopf has held key operating and management positions in many types of companies, from startup to mature businesses. Throughout her career, she has worked on improving performance in severely troubled and stable, healthy companies. She has negotiated lending arrangements on behalf of both creditors and debtors.