Senior Managing Director

Focus Management Group

By Juanita Schwartzkopf

Inflation has been on the rise for years, but it really surged in 2021 and will continue in 2022, creating an operating environment not seen since the early 1980s. However, inflation can’t be an excuse for poor business performance, particularly when there are strategies to find a successful way forward.

As companies and lenders evaluate performance risk and expectations for 2022, inflationary trends previously considered to be emerging need to be considered a permanent part of the 2022 business environment. At this point, it is unrealistic to consider inflation transitory, and businesses will need to develop tools to plan for and manage through an inflationary period. In this article, we will first review the inflation indicators and then discuss approaches business management can take to survive and thrive in this environment.

Inflation: CPI

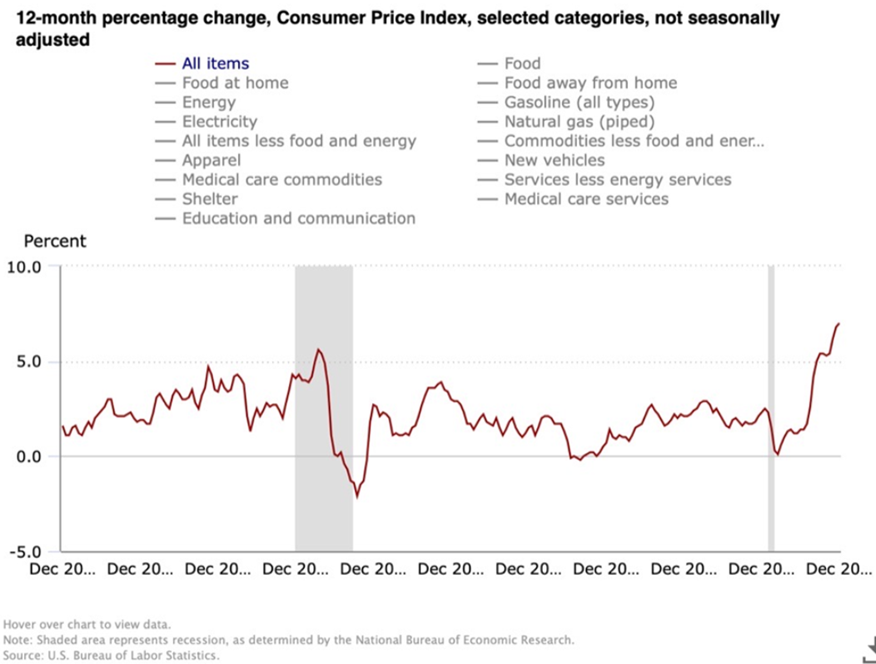

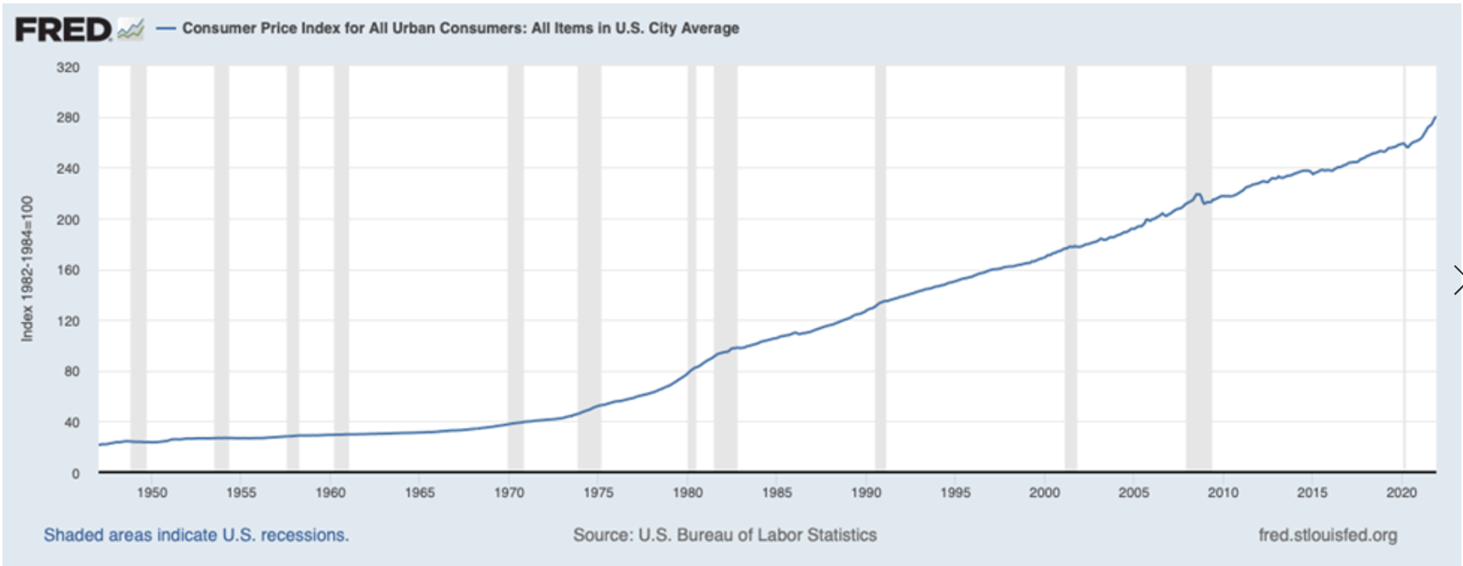

The consumer price index (CPI) and producer price index (PPI) continued to increase in December, with the CPI posting its highest increase since June of 1982. The 12-month change in the CPI, as reported in December, was 7%. To have experienced this level of inflation before, a business owner or lender would have had to been working nearly 40 years ago.

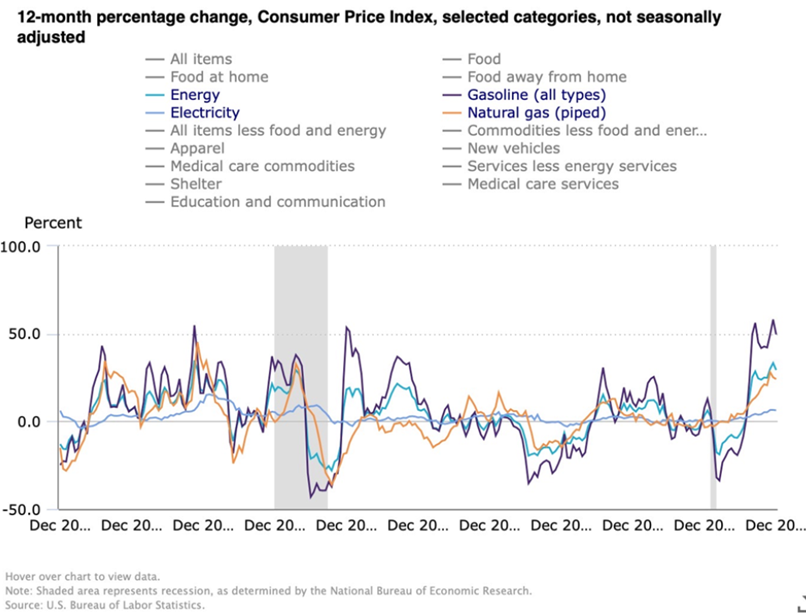

Businesses are feeling the impact of rising energy costs, which experienced an overall year-over-year increase of 29.3% in December. This level was down from the November inflation index for energy of 33.3%, yet it is clear that businesses are experiencing increasing year-over-year costs to operate and employees are experiencing stress. The latter factor furthers the impact of rising costs on businesses, as the financial standing of employees those businesses need to source and retain has increased. In December, the inflation factor for gasoline was 49.6%, while the rate for natural gas was 24.1% and the rate for electricity was 6.3%.

Individuals are certainly feeling these increases as they heat their homes and buy gasoline to take them to work. In addition, companies need to heat their facilities, run their plants and purchase fuel for their vehicles.

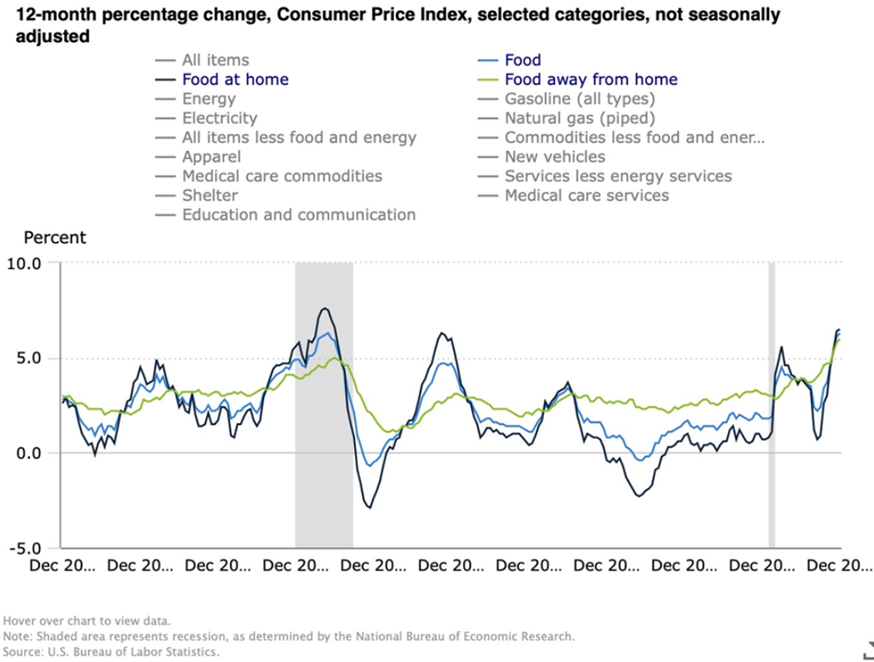

Individuals are also being significantly impacted by food price changes. Between December 2020 and December 2021, the CPI for food at home increased 6.5%, food away from home increased 6.0% and overall food increased 6.3%

Businesses that are using food in their production and businesses that are providing benefits that involve food for employees are feeling these increases firsthand and all businesses are feeling the inflation in food prices at least second hand.

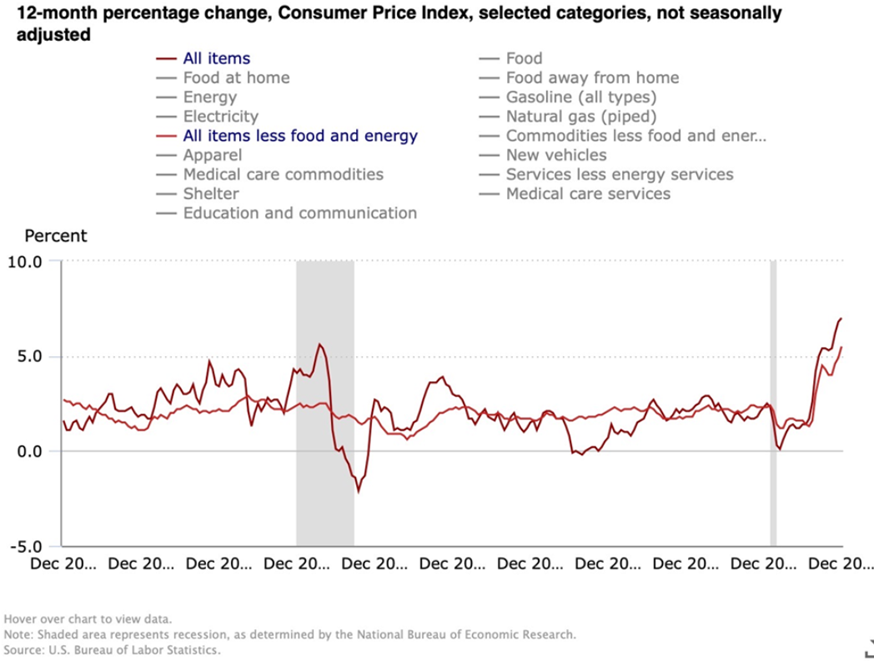

Excluding food and energy from the CPI, the index is at 5.5%, marking its highest level in at least 20 years.

The economy has been experiencing increased CPI trends since May of 2020, with the steepest spike in prices occurring from April to December of 2021. The easing of shutdowns and lockdowns related to the COVID-19 pandemic mean inflation was expected; however, the level of rising prices and the speed of those increases has surprised many.

The Fed Reserve is talking about a rate increase as early as March of 2022, and it is expected that the Fed will shrink its own balance sheet; however, businesses should not expect prices to return to previous levels. There may be specific components of the CPI that reduce during certain times, but a review of the overall cost of the market basket of goods in the CPI shows that prices only come down for short periods of time when there are stresses in the economy.

The next chart shows the cost of the CPI market basket of goods from April of 1947 to December 2021. During the financial crisis in 2008 and 2009, there was a decrease in costs, but to expect that to happen in 2022 is not realistic unless the economy experiences a repeat of that level of upheaval. And, if that would happen, history tells us the price reduction would be temporary and prices would quickly return to earlier levels.

Inflation: PPI

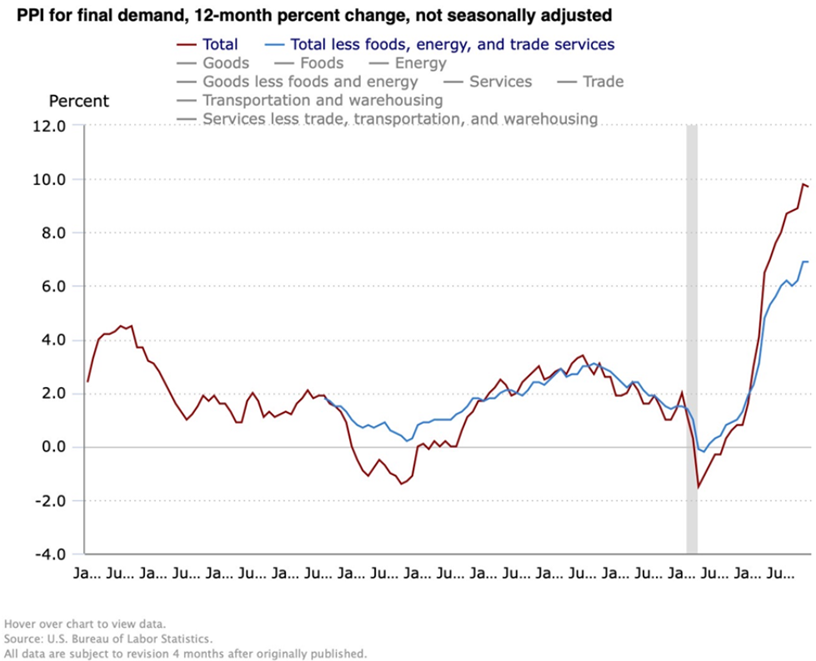

The December PPI was reported at 9.7%, which is similar to the 9.8% reading from November. However, the December PPI reading remains more than double the previous 10-year high of 4.5%, which occurred in July and September of 2011.

The PPI for energy in December was reported at 31.4%, which was a decrease from 43% in November. Meanwhile, the PPI for transportation and warehousing was at 16.6%, which was a further increase over the 14.5% reported in November. These categories represent direct cost impacts for most businesses.

Inflation: PCE

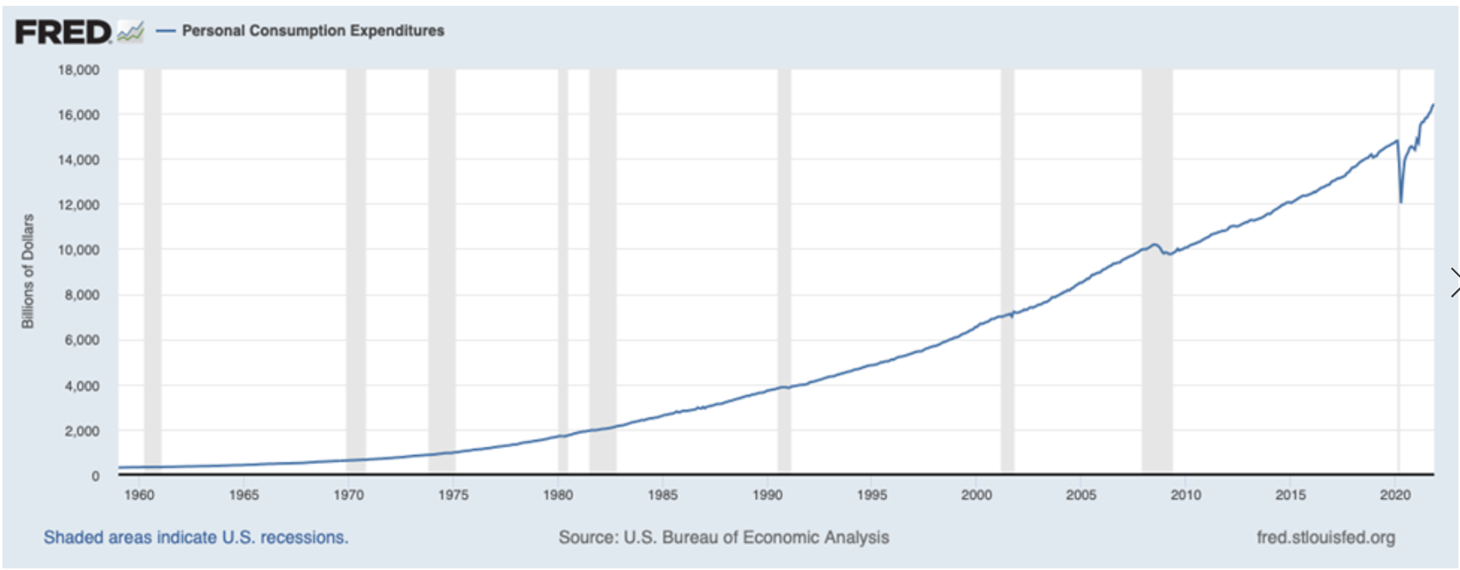

The Fed uses the Personal Consumption Expenditure (PCE) Price Index to measure inflation, in part because this index is thought to provide less volatility. The most recently reported PCE is the November index of 5.7%, which was an increase over the previous high of 5.1% in October. The PCE market basket of goods was at $16,423.2 billion in November compared with pre-COVID-19-pandemic peak of $14,769.9 billion in January of 2020.

Analysis Tools

Even if the CPI and PPI increases begin coming down or if the indices show a percentage decrease, the currently high inflationary levels are unlikely to be reduced to the extent that costs return to previous levels. It is unreasonable to expect a period of negative price changes to offset the price growth the economy experienced in 2021. As a result, businesses and consumers need to expect higher prices to continue and should not expect prices to return to historic dollar levels. The percent increase may reduce, but expecting a negative CPI and PPI to counteract this inflationary period should not be part of the financial planning process for a business. A business must consider inflation’s impact on both costs and revenues in 2022.

To do so effectively, business management must move past the excuse of inflation and develop an analysis and a plan. Businesses needs to ask questions of their management teams and challenge those teams to anticipate issues and plan for solutions. A management meeting where the discussion topics are inflation’s impact on each line item of the income statement will be an important first step. Here are some examples of questions to ask:

Contracts

- What contracts are tied to changes in the CPI or components of the CPI?

- Are there some contracts that are not tied to the CPI that should be?

Bidding

- What escalation clauses are in existing price quotes?

- What should be included?

Pricing

- What opportunities does a business have to increase prices?

- What is competition doing with pricing?

Utility Costs

- If natural gas is used for heating or production, what does the spike in prices mean for utility costs?

- What do fuel prices mean for transportation expenses?

Food Costs

- If the business uses food in its operation, how can we evaluate and adapt to changing food prices?

Commodity Prices

- Does the business have fixed input or fixed sale prices?

- Are there ties to commodity prices?

- Is hedging being used?

Income Statements

- How is each expense line item (including uniform prices, cleaning costs, travel and entertainment and anything else) on the income statement being impacted?

Performance Monitoring

Once these questions have been asked and answered, management needs to track and analyze performance.

For month-end reporting, waiting three weeks after a month ends for month-end performance reporting does not give management time to respond to issues. Instead, consider tracking key prices and volumes weekly.

In addition to the actual monthly reporting, reforecasting for the remainder of the year must occur. In the middle of a current quarter, a business needs to reforecast the remainder of the year and continue to track performance to the original plan while being aware of the impact of changing prices and costs on performance as the year progresses.

When it comes to weekly reporting, working capital tracking is key. Use roll forwards of working capital components, including accounts receivable, inventory, accounts payable and cash and perform weekly cash flow management and BBC tracking.

It is also important to look at key performance indicators (KPIs) and determine if the current ones in use are sufficient and if they are being produced fast enough to allow time to react.

This is a time to emphasize best practices. Management cannot accept the excuse of inflation. The entire management team needs to engage in strengthening their analysis tools to respond as quickly as possible to changing prices. Inflation does not spell doom for companies; lack of planning and response to inflation is what does.

Most business managers today have not experienced this level of inflation, which hasn’t been around for nearly 40 years. Helping management teams deal with stress and uncertainty will be important for achieving performance goals for 2022 and beyond.

This article first appeared at focusmg.com.

Juanita Schwartzkopf is senior managing director of Focus Management Group.

Schwartzkopf has more than 35 years of experience in commercial banking, business management and financial and management consulting. During her career, she has handled projects involving financing strategies, strategic planning, forecasting, cash management, creditor relationships, information management, bankruptcy, crisis management and business plan development.

Schwartzkopf has held key operating and management positions in many types of companies, from startup to mature businesses. Throughout her career, she has worked on improving performance in severely troubled and stable, healthy companies. She has negotiated lending arrangements on behalf of both creditors and debtors.