CEO

Small Business Financial Exchange

The past 12 months have been tumultuous, with COVID-19 affecting the way we live and operate in nearly every capacity. The small business lending ecosystem, a workhorse of the United States’ economy, was not exempt from the impact.

“It is important to reflect upon how the COVID-19 pandemic and the related economic disruption has affected the way millions of small businesses operate and fulfill their credit needs,” Elisabeth Hughes MacDonald, CEO of the Small Business Financial Exchange (SBFE), says. “It may be difficult to draw direct comparisons to the impacts of previous economic downturns on the health of these small businesses and even more complicated to predict what may be on the horizon as the United States transitions back to some kind of a new normal state.”

MacDonald leads the Small Business Financial Exchange (SBFE), which is a trade association that recives credit payment performance data from small business lenders on approximately 30 million businesses in the United States. It operates a “give-to-get” financial exchange with approximately 140 trade association members, including U.S. credit providers to small businesses. SBFE members include credit card issuers, banks, credit unions, alternative lenders, leasing companies and other furnishers of small business credit. As part of its operating model, the SBFE provides its data to four of the largest U.S. credit bureaus, which use the data to provide credit scoring and portfolio monitoring products to trade association members. In addition, the SBFE examines key metrics that are indicators-by-proxy of small business health. Specifically, the SBFE reviewed credit usage and payment performance data during 2020.

“Given the breadth of small business credit data compiled over 20 years, SBFE is uniquely positioned to report trends seen in small business credit usage,” MacDonald says. The data gathered by the SBFE create an aggregation of small business payment performance data in the United States.

Business Analyst

Small Business Financial Exchange

The credit data gathered by the SBFE during 2020 did not reflect business as usual. Loans funded under the Paycheck Protection Program (PPP) added “noise” to the dataset. Yet, in the long run, the SBFE believes that credit payment information will remain the most predictive element in assessing a small business’ financial viability. The SBFE also believes that lenders and credit bureaus should explore new and additional data elements that can be combined with credit payment information to further enhance and ensure a true picture of a small business. This is good news for credit providers and small businesses alike.

2020 Small Business Credit Trend Analysis

Credit Origination Growth

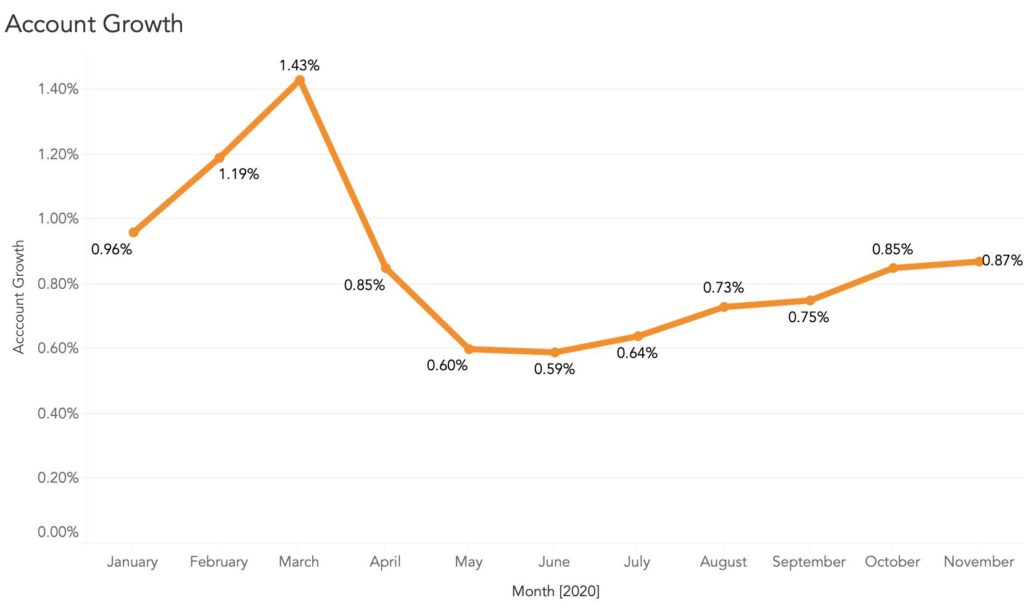

Unsurprisingly, the SBFE’s data showed that typical credit originations slowed during the spring of 2020, which has been the period of greatest economic uncertainty during the COVID-19 pandemic. Less predictably, the SBFE’s data showed a slight rebound at year-end 2020, although activity remained well below the levels of Q1/20. In addition, the data showed that growth has been slow but consistent month over month since May 2020.

As outlined in Figure 1, there was a notable increase in lending activity in March directly before initial PPP lending activity began. Looking back, this could be interpreted as a distress signal, with small businesses securing funding before businesses received PPP loans. April and May saw many lending institutions heavily focused on providing PPP assistance, which would explain the lack of growth in all other account types.

Although there has been growth since May 2020, account growth has not yet reached pre-pandemic levels; this could be attributed to many possible factors, including small businesses not applying for new credit (whether because PPP funds were sufficient, or the business closed, either temporarily or long-term) or lending institutions limiting their risk during uncertain times.

Credit Delinquencies

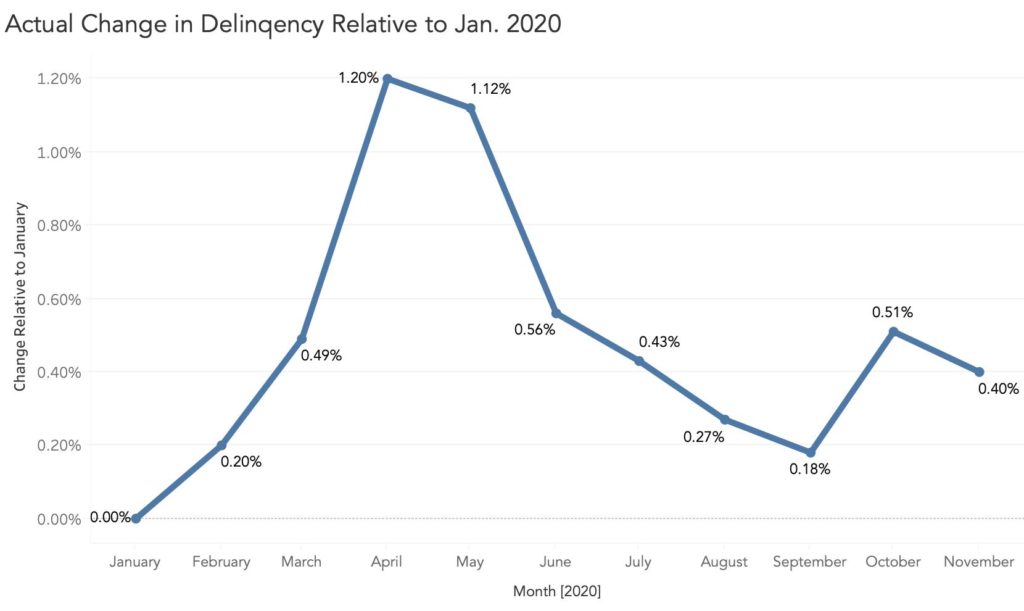

Excluding PPP accounts, 2020 delinquency rates were as expected. (If PPP loans were included, the trends would reflect increased loan totals and artificially deflated delinquency rates.) Peak months of delinquency were April and May, with a corresponding decrease through September 2020, which was in line with pre-pandemic delinquency. This may signify how PPP dollars were helpful for a short period of time and reflect the ability of lenders to work with borrowers and provide assistance with short-term deferrals or other assistance programs. Q4/20 reflected an increase in delinquent accounts, which may lend some credence to the effectiveness of temporary assistance, as it coincides with the end of phase one of the PPP. Figure 2 displays the actual change in delinquency in relation to January 2020. For example, the delinquency rate in April 2020 was 1.2% higher that it was in January 2020.

Small Business Credit Utilization

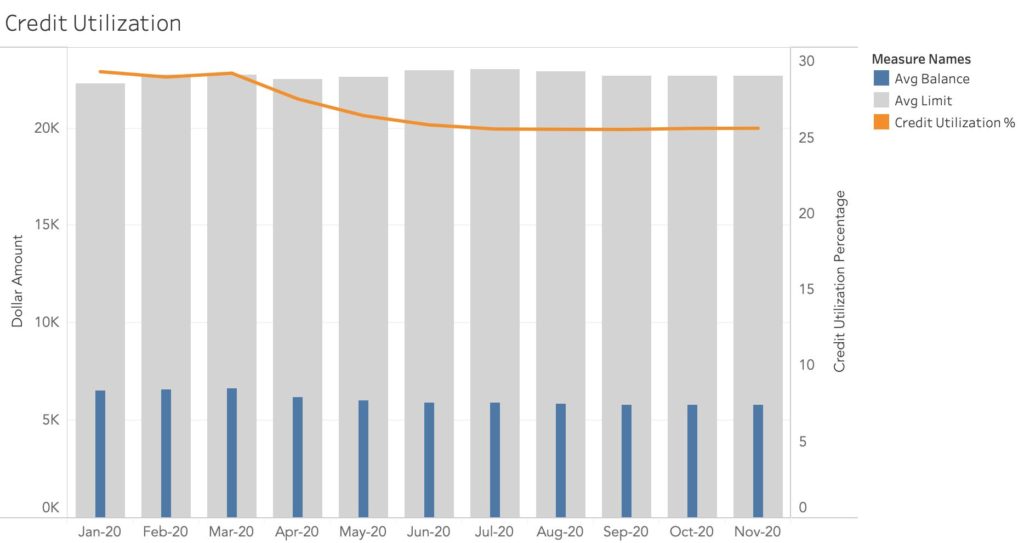

Open balances for credit cards and lines of credit peaked in March 2020 as the impact of the pandemic accelerated. Thereafter, this trend declined for six straight months, reaching a low point in September. When measuring against the loan assistance cycle, this trend is behaving as expected. April 2020 showed a decrease in credit limits, which could be attributed to a number of factors, such as lending institutions scaling back limits to align with their risk appetite. As the first PPP funding cycle came to an end in September, the SBFE’s data reflect balances slightly rising, credit limits moderating and utilization flattening in the fourth quarter.

Expectations for 2021

The PPP and a variety of lender assistance initiatives have had significant short-term impacts on the small business lending ecosystem. These efforts have aided in stabilizing delinquency rates and credit utilization after the initial and dramatic impact of the pandemic. With the reopening of the PPP in early 2021, the SBFE is hopeful that, similar to the first round, these funds will act as a stabilizing force for the small business ecosystem.

“We are hearing from our trade association members that, in 2021, lenders hope to resume more normal origination activities,” MacDonald says. “While volumes may never reach pre-pandemic levels in the short term, there is acknowledgement that continuing to provide credit to small businesses is paramount to the recovery and health of the U.S. economy.”