For second lien lenders, the ever-intensifying demand for yield in the current low-rate environment created an upswing in competition for high-quality deal opportunities in 2012, as both institutional senior bank debt lenders and high-yield bond investors became more aggressive in extending capital to large, established borrowers. With more capital pursuing fewer attractive opportunities, pricing tightened across the board, resulting in distortions in the balance between risk and return. While this phenomenon occurred in the broadly syndicated bank loan market and public high-yield market through retail capital inflows into mutual funds and ETFs, there was a dramatically lower impact in the private debt markets for senior secured and second lien lenders that focused exclusively on middle-market issuers.

Looking ahead to 2013, we believe that second lien lenders with sharp credit skills and the ability to understand and guard against downside risk will continue to find areas of opportunity. In particular, while capital has become more broadly available to larger borrowers, middle-market companies continue to struggle to obtain financing. Second lien lenders that are able to successfully identify and pursue high-quality middle-market deals (defined here as loans of approximately $25 million to $100 million) in 2013 should continue to enjoy a measure of pricing leverage, as well as the ability to secure proper deal structures.

In this article, we survey the environment for second lien lenders as 2012 comes to a close, and provide our outlook on the opportunities and challenges that lenders in this sector are likely to face in 2013.

Surveying the Landscape: 2012 in Review

One of the driving trends in financial markets over the past four years — namely, persistent low interest rates and investors’ subsequent search for yield — continued unabated in 2012. Signs of this trend included increased funds flows and spread compression in the high-yield bond market, making high-yield instruments more attractive to corporate borrowers.

Accordingly, companies that may have pursued second lien or mezzanine financing as recently as 12 months ago opted to issue bonds instead. According to Dealogic, global leveraged loan issuance declined by 21% over the first nine months of 2012 versus the same period in 2011, while global high-yield bond issuance increased by 4%; U.S. high-yield issuance increased by 15% during the same timeframe.

A second notable trend over the past year was the renewed willingness of banks, mutual funds and ETFs to extend credit to larger borrowers. While bank lenders generally maintained discipline on structuring considerations, this broader availability of capital contributed to pricing compression across the board, including for second lien loans to larger borrowers. At the same time, regional banks and other lenders began to consider smaller first lien lending opportunities, leading to further competition for high-quality deals — and an upswing in covenant-lite and high-multiple transactions in the high-yield and broadly syndicated leveraged loan markets.

The overall result of these converging trends has been a highly challenging scenario for second lien players that focus on larger companies, with similarities to the environment we witnessed in 2007 and 2008. Many second lien lenders are being tested in ways not seen in several years, with extensive pricing compression and intense competition for deals in the large cap market.

Back to the Future? The Outlook for 2013

With the U.S. and global economies still facing significant headwinds, credit markets in 2013 are unlikely to see major short-term shifts. Federal Reserve chairman Ben Bernanke has made it clear that the Fed will do all it can to maintain low domestic interest rates as long as the U.S. remains mired in its present sluggish, high unemployment environment.

From the perspective of macro policy, therefore, we believe that the current “muddle-through” outlook will persist well into next year, regardless of the outcome of the U.S. elections in November. For second lien lenders, this means that the current low-rate environment and resulting hunt for yield will likely persist as well.

Some secular trends among middle-market borrowers, however, mean that there should be no shortage of demand for capital in this sector. Even in the current low-growth environment, we expect 2013 to see a pickup in private equity transactions and refinancing activity around existing loan facilities.

Overall, middle-market companies still suffer from a lack of access to capital in the current environment. In 2012, loans to middle-market companies fell 41% to $7.8 billion as of October 11, compared with loans of $13.2 billion during the same period in 2011, according to Standard & Poor’s Capital IQ Leveraged Commentary & Data.

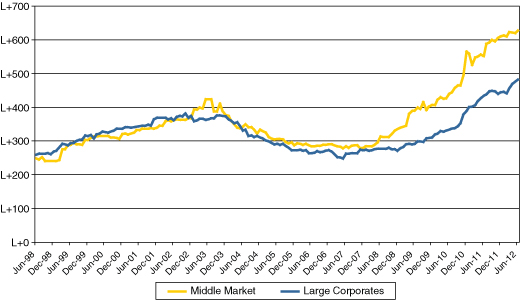

In addition, while middle-market loans saw some pricing compression in 2012, spreads have not tightened as significantly as in the market for larger companies: middle-market loan yields averaged 7.46% as of August 2012, compared with 6.67% on loans to larger companies. The chart below provides further illustration of the persistent spread premium for middle-market loans.

Average Nominal Spread of Single B Leveraged Loans

(Excludes facilities in default)

We believe that these dynamics will continue in 2013. Selective second lien lenders with the requisite skill set to compete effectively in the middle market may therefore find that deals in this sector offer the best opportunities to exercise pricing power while securing favorable loan structures in the coming year.

As we have seen in previous market cycles, however, the breakneck pursuit of yield can lead to loosening of covenant requirements and inadequate protection against risk. The opportunity for second lien players to deploy capital among middle-market borrowers, therefore, also poses a distinct set of challenges. Lenders with strong underwriting skills, a deep understanding of asset and enterprise values, and the ability to structure loans to protect against downside risk will be those that successfully differentiate themselves against competitors during the coming year.

Assessing the Middle-Market Opportunity

For second lien lenders, we recommend the following broad guidelines in formulating an approach to middle-market lending opportunities over the next 12 months:

- Maintain Discipline in Structuring Covenants: As competition for deals intensifies in the middle-market arena, lenders may be tempted to relax covenants, take on higher leverage or loosen credit standards in order to secure business. We would urge lenders to avoid “running with the herd,” and to maintain discipline on covenants and structure to the extent possible.

- Keep an Eye Out for New Entrants: While we expect large banks to continue to play in the upper end of the market for the most part, regional banks and other lenders may continue to delve further into the first lien middle-market segment. At the same time, new finance company entrants may emerge targeting middle-market borrowers, although it remains to be seen whether they will be willing to commit significant capital at current pricing levels and whether they possess the appropriate underwriting skill sets. As we have seen in the past, undisciplined players can have a negative impact on borrower expectations and create additional pressure for stronger lenders to relax loan structures.

- Focus on Industries with Positive Fundamentals: In the United States, the extended downturn and subsequent sluggish recovery have encouraged consumers to postpone major purchases pending their own household deleveraging processes and more positive news regarding the employment environment. Industries tied to potentially short-term tax credits, such as green energy and energy-saving construction materials, should be approached with caution.

Since each borrower and lending transaction is unique, deals in the middle market should ideally be structured in a custom-tailored fashion to meet the financing needs of borrowers while providing adequate protection for lenders. In order to appreciate and account for the dynamics facing each borrower, lenders will need to combine an understanding of asset valuation with in-depth industry expertise and an analytical, fact-based approach to assessing the sustainability of free cash flow in various downside scenarios in order to capitalize on the opportunities in this segment in 2013.

Summary

While on the surface, persistently low interest rates and the pursuit of yield at the expense of creditworthiness and other protective covenants seem to have made the broadly syndicated leveraged loan and high-yield debt markets more challenging places in which to compete effectively, there are areas that we expect to offer opportunity based on market trends in 2012 and current macro indications for 2013.

There is no question that middle-market second lien lending continues to offer an attractive risk/reward ratio for those lenders with the right skill set. Second lien lenders should look carefully at these opportunities and make sure they are strategically positioned and well equipped to make the most of them.

Patrick J. Dalton, president, leads the debt investment group of GB Merchant Partners, the investment management affiliate of Gordon Brothers Group. With over 20 years of credit and investment experience, his primary focus is maintaining and growing the debt portfolio. Prior to GB Merchant Partners, he was president, COO and chief investment officer at Apollo Investment Corp. Earlier in his career, he served as a VP of Goldman Sachs & Co.’s GS Mezzanine Funds. Prior to this, he was a VP at Chase Securities and The Chase Manhattan Bank. He holds an M.B.A. from Columbia Business School and a B.S. in Finance from Boston College. He can be reached at 212-218-6804 or at [email protected].

The Debt Investment Group of GB Merchant Partners (www.gbmerchantpartners.com), the investment management affiliate of Gordon Brothers Group, originates, structures and invests in private market debt.