LLC

After almost a decade of subpar growth we’re finally starting to see a more meaningful uptick in economic activity. While it’s commonly assumed that a rising tide will raise all ships, it actually swamps a lot of boats. More companies are looking for ways to maximize working capital availability to help sustain their businesses as they try to take advantage of new business and increased volume, while dealing with higher input prices. Cash flow and other capital resources are quickly becoming more strained than ever.

As an asset-based lender, there has never been a better time to get up to speed on credit insurance and how it can benefit both you and your clients. Any risk management program that helps your client protect the assets they pledge as security to you is a prudent thing to put in place. However, credit insurance is more than the coverage the policy provides.

Using credit insurance to support a receivablesbased borrowing arrangement is an excellent way to help clients expand their working capital by better leveraging the same base of assets. There are several ways you can use credit insurance to enhance availability, and we’ll look at them briefly here.

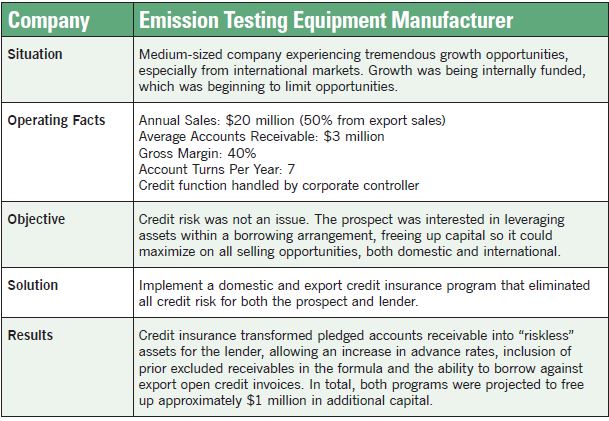

Improved Advance Rates

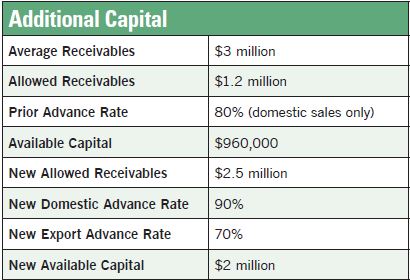

First, one of the most common key benefits of credit insurance is the positive effect it can have on advance rates. Since credit insurance programs can be written around advance rates, and typically indemnify a client or their lender beneficiary up to 90 cents on the dollar, you may find that you can increase your advance rates without increasing your exposure. For example, if you currently lend at 80 cents on the dollar and implement a credit insurance program with 90% indemnity, you could, in theory, raise your advance rate to 90 cents on the dollar and still be fully insured in the event of a credit loss. Even going to 85 cents would free up an additional 5% availability for the client to put to work in their business. With a credit line of several million dollars, this can add up to a significant amount of additional capital available to the client with each turn of their receivables.

Due Default Coverage

A majority of the credit insurance policies issued today include past due default coverage in addition to insuring against insolvency losses. Carriers typically provide clients with a window of time in which to work with a customer before a claim needs to be filed. Because the carriers do provide this protracted default protection, you may find it possible to extend the eligible receivables window. This can be of benefit to clients who have good quality credit risks that just have a history of paying slow, and where the dollar amounts are of sufficient size to affect the borrowing base.

In some cases, clients have significant concentrations of exposure on one or a few key customers. Concentration caps limit the lender’s exposure to such accounts. By insuring the accounts for the proper credit limits, you can eliminate these issues. This will allow the client to gain access to the full potential availability on the total account exposure.

More and more companies are also expanding sales in overseas markets. Since export receivables are typically excluded from the borrowing base, by implementing export credit and political risk insurance, a lender can pull those accounts back into the borrowing base. This could free up significant additional working capital for the client.

Pre-Shipment Coverage

One final area to consider is possible advances on work in progress (WIP) for special or custom orders. Most carriers offer pre-shipment coverage. This reimburses the direct costs associated with filling a custom order up to the point that customer insolvency occurs. In some cases, companies turn down orders because they lack the capital to fund the WIP. By structuring advances on the WIP portion of the process, the client can accept the order and fund the cost of time and material. If the customer goes insolvent, those amounts can be reimbursed under the terms of the policy.

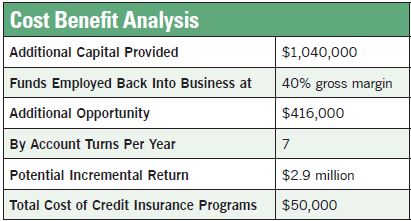

The tables on the right show a typical borrowing enhancement scenario where credit insurance is used to increase the client’s working capital position with less risk and with a program that more than pays for itself on the first advance.

Credit insurance is a great financial tool with significant value for both clients and their lenders. As a custom tailored risk management program, it can be designed around specific coverage needs and to address any or all of the various issues noted above. The policy also provides the client with expert credit decision support, discounted collections support and additional credit risk management expertise to help strengthen the credit practice.

It’s important for lenders to realize they are not adding another cost burden to a deal by requiring the use of credit insurance. They are implementing a financial tool that will more than repay the investment on the first advance and provide the client with proactive benefits. In my experience, a lender who typically wins in a competitive situation is the one who can put the most money on the table. A properly structured credit insurance program is a great way to accomplish this safely.

When exploring this unique type of protection, it is prudent to rely on a specialty broker who knows the markets and policy contracts and can assist in finding the ideal solution for each individual situation. Every case is unique and there are no standardized, one-sizefits-all approaches. With the proper expertise, a client and its lender can realize the benefits credit insurance can offer and enhance the relationship creating long term value for everyone.