Partner

ACM Partners

Founder & Managing Director

Ravinia Capital

The past decade has seen a growing convergence between the respective spheres of turnaround and transactional professionals. Capital providers, particularly bank and non-bank lenders, have shown a preference for addressing troubled situations through a transaction, rather than a multi-year turnaround. As a result, most troubled situations can now be resolved more quickly (in months rather than years), and generally out of court. A lack of risk-tolerant capital is no longer a barrier to the resolution of even the most distressed situations. It is now fair to say that there are both equity investors and lenders active across the risk spectrum for companies of all sizes.

The upside of this change is clear. Capital providers are more efficiently sorting themselves based on risk tolerance, and as the perceived risk of portfolio credits changes, those capital providers who find themselves with an uncomfortable risk/return scenario in their portfolio are pushing for some type of transaction (a refinancing or a sale) as a risk transfer mechanism. To paraphrase Milton Friedman, we are all deal professionals now.

Less well appreciated is the fact that the changing nature of turnaround situations calls for a holistic review of the optimal advisory team composition given the new environment. As the length of turnarounds collapses, the ability of a team of advisors to work in concert under sub-optimal conditions is becoming a necessity.

Respective Roles

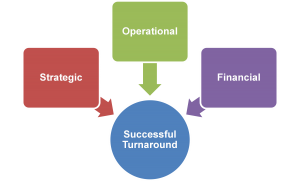

In his book Reversing the Slide, Kellogg School of Management professor James Shein discusses the Turnaround Tripod, or the need to address strategy, operations and finance in order to lead a successful turnaround. While few of the stakeholders in a distressed situation bring a holistic view of the overall solution, collectively the experience and expertise of key stakeholders is what allows a positive outcome in a distressed situation.

In a distressed situation, understanding the roles of the various advisors is crucial to steering to an optimal outcome. The key advisor groups in a distressed situation are as follows:

Turnaround Advisors. Whether serving in an interim management capacity or as untitled advisors to a troubled company, turnaround advisors are the “boots on the ground” in troubled situations. From a strategic perspective, their task is to quickly determine the key drivers of a company, the causes of its current distress and the feasibility as well as likely timing for fixing the problem(s). Tactically, turnaround advisors spend a great deal of their time managing cash and working to first stabilize and then improve operations. Generally, investment bankers will rely on turnaround professionals to understand the feasible amount of time available to complete a transaction.

Investment Bankers. The process of soliciting interest from various capital providers, coordinating their information requests and eventually settling on a buyer or lender is complicated, and the complexity increases geometrically with the size of a company. As a result, investment bankers with distressed expertise are essential role players in a distressed transaction.

Attorneys. Skilled legal representation is key for the completion of a distressed transaction. Whether seeking to negotiate an inter-creditor agreement necessary for rescue financing, structuring a sale that minimizes the owner’s liability while also providing comfort to a prospective buyer, or guiding a company through a pre-packaged bankruptcy filing in order to facilitate a §363 sale, the legal needs of a distressed company are substantial, and the benefit of working with skilled professionals far outweighs the cost.

Accountants. It is not uncommon to see distressed companies, particularly in the middle market, with very poor financial systems and controls. In some cases, a distressed company may even be challenged to provide well-supported historical information. Oftentimes an accounting firm with transaction advisory expertise is brought in to develop a due diligence packet in order to facilitate a transaction. Capital providers generally appreciate the effort put into giving them an additional layer of comfort regarding the accuracy of historical information, and many times the work of accountants in a distressed situation becomes the bedrock on which an eventual deal is structured.

Specialist Advisors. As the size of companies increase, the need for specialist advisors to address key aspects of the business increases. These crucial players provide the subject matter expertise necessary to support and develop a robust turnaround plan.

Depending on a number of factors, one group of advisors tends to become predominant in every distressed situation and drives the strategy that all groups work to support. In situations calling for detailed knowledge of the capital markets, that party might be the investment banker; in other cases it could be the chief restructuring officer, in still others the attorney. The key is that whoever drives the strategy in a distressed situation appreciates the abilities of the full advisory team as well as all other stakeholders and leverages those capabilities in the drive toward an optimal outcome.

Getting the Deal Done

The role of a turnaround advisor in the shifting distressed landscape is that of a facilitator. Turnaround advisors are the “boots on the ground,” working with company management to steer toward a successful transaction.

Few distressed situations are purely the result of market dynamics. Whether the issue is an underperforming core business, an ill-conceived expansion initiative, a stalled real estate development, etc., the presence of a skilled advisor experienced in the short deadlines, contentious negotiations, overwhelming information requests and persistent operational issues that mark a distressed situation can be the difference between success and failure.

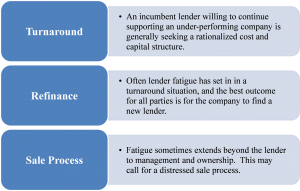

In a distressed transaction, whether a refinancing or a sale, a turnaround advisor will often work closely with management on a day-to-day basis, facilitating the process. While every situation is different, in most deals, one can expect the following:

Increased Communication: A turnaround advisor will initiate regular update calls with the incumbent lender and other key stakeholders.

Assess the Problem and Act on It: Following an analysis of the situation, a turnaround advisor will begin implementing initiatives to reduce costs and maximize cash-flow.

Develop and Execute Turnaround Plan: Working with all stakeholders, the turnaround advisor will develop and manage a realistic turnaround plan.

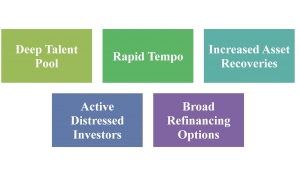

Deep Talent Pool

As the turnaround industry has developed, those in need of a turnaround advisor have found that there are a number of talented professionals available. When considering retaining a turnaround advisor, the following questions are of paramount importance:

• What is the likely scope of the project?

• Is industry expertise likely to add significant value?

• Are there weak spots in the management team that may necessitate an interim manager?

Rapid Tempo

The tempo of turnaround situations, especially from the time that an advisor is retained, has undeniably increased in recent years. Company management can and should expect an objective assessment of a company’s near-term outlook, an action plan for managing through any liquidity pressures and the outlines of a long-term plan to fix or sell the business within weeks.

Increased Asset Recoveries

Asset recoveries have historically tended to be inversely correlated with levels of macro-economic distress (i.e., liquidations are broadly more successful in good economic times than bad). As the broader U.S. economy has improved, asset recoveries have strengthened considerably from the lows seen in 2009.

Savvy turnaround advisors are frequently able to negotiate additional concessions from incumbent lenders when their loans are over-collateralized.

Active Distressed Investors

The growing size of distressed asset investment funds has created a large number of potential acquirers of distressed companies. With a pool of savvy financial buyers willing to pursue distressed acquisitions, whether out of court or in the context of a §363 sale, nearly any troubled company is a potential acquisition candidate for some buyer.

Broad Refinancing Options

The growing risk tolerance of many banks, as well as the increased activity of traditional non-bank commercial lenders and more opportunistic special situations lenders, has created an environment in which many troubled credits can be refinanced if the incumbent lender is seeking an exit.

Conclusion

Options for troubled companies of all sizes have expanded considerably in the past decade. Denial, not a lack of options, remains the biggest enemy of a favorable outcome in these situations. It is crucial that a company be proactive in addressing signs of underperformance or distress. Failing to do so risks having a sub-optimal solution imposed by incumbent capital providers. Generally speaking, it is a rare management team that is both knowledgeable and objective enough to recognize distress and take steps to address it. That role commonly falls to trusted advisors, including attorneys.

David Johnson (@TurnaroundDavid) is a partner with ACM Partners, a boutique financial advisory firm providing due diligence, performance improvement, restructuring and turnaround services. He has been involved with organizations in transition as an advisor, board member, interim manager, investor and operator. He can be reached at 312-505-7238 or at [email protected].

Tom Goldblatt is founder and managing director of Ravinia Capital, a corporate finance advisory firm. He previously worked in private equity at Monomoy Capital Partners and Pfingsten Partners and was a turnaround consultant at High Ridge Partners. He is a regular conference speaker on alternative capital raises in challenging situations, distressed investing and business development and networking. He can be reached at 773-336-2833 or at [email protected].