After two years of double-digit drops in sales, the restaurant industry shakeout is continuing with little sign of ending soon. We are in a bifurcated market, split between the haves that are obtaining capital or being sold for high multiples and the have-nots, which are locked in the downward spiral, soon to become casualties in an overbuilt industry.

M&A is Hot, for Some

The recent Burger King Holdings Inc. $4 billion purchase by the private equity group 3G Capital represented a 46% premium over the publicly traded shares at the deal’s announcement. It created some buzz for other restaurant shares, as speculation mounted that private equity groups needing to put capital to work would be potential buyers.

Sales price as a multiple of cash flows are fully valued for the best-run chains. Where traditional sales prices are four-to six times EBITDA, we saw Papa Murphy’s trade at ten times EBITDA. Investment bankers are promising six- to eight-times cash flow to prospective clients. We saw good prices for Wingstop, Dave & Busters and the holding company DKE (Hardee’s, Rubio’s Mexican Grill).

But rather than spelling relief for a distressed sector, the hot deal market underlines the market split. There are too many casual dining seats for the demand. Menu prices are coming down. Value is in vogue. Owners of restaurant chains, including many private equity firms that bought in 2006 during the easy credit boom, are fatigued and want out of their overleveraged investments, which are essentially no collateral businesses with few assets to liquidate.

Many struggling food chains will just be shuttered and written off, as in the September case of Disney’s ESPN Zone family/sports bars. Company officials blamed the poor economy. We suspect that high prices, low value, high real estate costs and too much overhead were the culprits, just as we saw with Planet Hollywood.

The Death Spiral

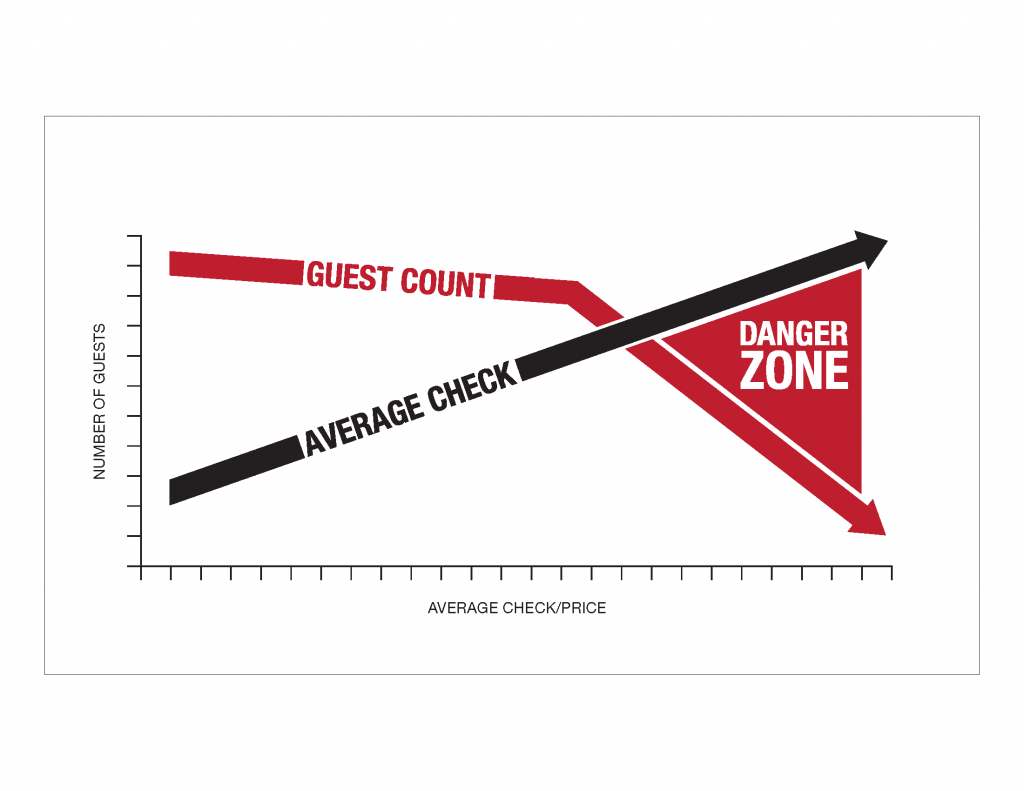

The problems of a distressed restaurant business can be illustrated by a graph. Imagine that on the left side of the graph are the average ticket prices and the bottom side is guest count.

Now remember that many operators tend to focus on their margins. As time goes by, if the cost of food is 32% and beef prices rise, they just raise prices to keep margins at 32%. Or perhaps they reduce their steaks from 8 ounces to 7 ounces. Perhaps they cut corners in other ways, such as reducing maintenance budgets — i.e., clean bathrooms — or delay remodeling the buildings, all to keep that corporate demand of 32% profit margin.

Over time, as prices rise on our chart, quality decreases. So does the guest count because customers notice what’s going on (every time!). You’re in the death spiral illustrated by our chart. Your business is circling the drain of disaster and unless things change, you will fall into that black hole no company wants to enter.

There’s another way that companies enter the death spiral by focusing on margins: They expand where they don’t belong. They increase the number of restaurants that don’t make money. They build the wrong concept in the wrong location. It reaches a tipping point where it all converges and suddenly, the company is cracking loan covenants. Cash is tight so you stop capital investments, accelerating the spiral. At some point, there’s so much deferred capital expenditure and the customer value proposition is so broken, it’s too late to save the company with major capital infusion and lots of time. Companies are literally dead on their feet, kept alive only because banks allow them to violate their loan agreements.

Winners

The best operators focus not on margins, but value. Margins may have slipped a bit, but they don’t discount. Instead, they focus on value: Service, training, nice facilities. Many companies, such as Houston’s and Capitol Grill, could have made more money by levering up and acquiring others, but retained their focus on value by reinvesting in their business, their people, property and customer service. In a turnaround situation, the first order of business is to get sales and guest counts moving the right way. You need some capital first, so cut costs by closing unprofitable stores and reducing overhead to reinvest in adding value back to the customer.

Sales are crucial because in the restaurant business, when more people come in the door, managers manage better. Wait staff is more enthusiastic because they’re making better tips, so they show up to work and do it on time. Their attitudes rub off on customers. The whole experience improves. It all starts building because guest counts increased. Everyone says restaurants are a people business, but when corporate owners focus on margins, that value is lost.

Prognosis

The industry is entering its third year of double-digit sales declines, with some bumping along the bottom. The holiday will be key this year to set the stage for 2011. If the holiday season doesn’t improve, we’ll see more fallout later this year and early next. Then shareholders and lenders will end up with severe losses, causing more credit problems in the industry. Better to avoid the death spiral before they open, or try to close them before it’s too late.

Gene R. Baldwin of CRG Partners’ Dallas office and Craig M. Boucher of the Washington D.C. office have a combined 50 years experience in financial advisory and interim management for middle- to large-market transactions. They can be reached at [email protected] and [email protected], respectively, or at 800.656.5459. CRG Partners recently won the Turnaround Mega Award by the Turnaround Management Association.