SVP & Regional Business Development Manager,

First Capital

There is no doubt that the U.S. energy industry is booming, spurred on by the technological advances in horizontal drilling and fracking. The significant growth in the oil and gas industry is an important part of the U.S. economy, driving job creation and moving the U.S. toward energy independence. This fast growth has provided financing opportunities, many of which are to middle market companies that do not meet the lending criteria of traditional commercial banking but can be financed by knowledgeable ABL lenders willing to understand the risks and monitor the collateral to mitigate these risks.

Impact on Job Creation and Energy Independence

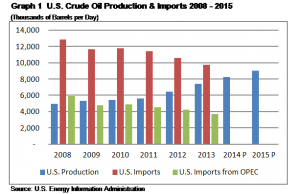

As shown in Graph 1, U.S. crude oil production has increased from 5 MBD (million barrels per day) in 2008 to 7.5 MBD in 2013 and is projected to increase to 8.3 MBD and 9.1MBD in 2014 and 2015, respectively. The 2015 projected production is an 81% increase over 2008 production and has generated significant job growth and capital expenditures in the industry. Between 2008 and 2013, crude oil imports decreased by 24% and imports from OPEC countries decreased by 38%.

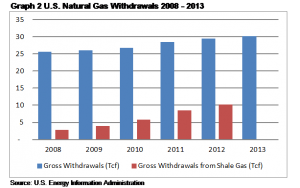

Graph 2 shows the U.S. natural gas withdrawals (production) from 2008 to 2013. Natural gas withdrawals increased from 25.6 Tcf (trillion cubic feet) in 2008 to 30.2 Tcf in 2013 — an 18% increase during the period. However, from 2008 to 2012 natural gas generated from shale increased by 259% from 2.9 Tcf to 10.3 Tcf and made up 34% of 2012 natural gas withdrawals.

The explosive growth in shale generated natural gas has been produced from shale plays throughout the U.S., including Eagle Ford (South Texas), Permian Basin (West Texas), Bakken (ND), Marcellus (PA) and Utica (OH, WV). The abundant supply of U.S. natural gas has decreased natural gas prices. Many economists are predicting that the high supply and low price of natural gas will: 1) increase growth in the chemical industry and other industries that use oil and natural gas as feeder stock for their production, 2) increase natural gas usage for vehicle fuel particularly in commercial vehicles, 3) permit the U.S. to become an exporter of natural gas in the near future resulting in new investments in infrastructure and technology, and 4) provide growth to the U.S. economy and employment. The Investor Business Daily reported that more than 100 new plants and factories in a variety of industries (chemicals, fertilizers, plastics, cosmetics and many others) are planned to come online by 2017, and “When all are up and running, another $300 billion will be pumped into GDP and 1 million more jobs created.”

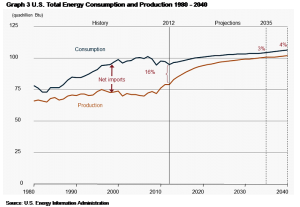

The rapid growth in oil and natural gas production has reduced the U.S. reliance on imported energy sources. As shown in Graph 3, net imports have decreased from 26% in 2007 to 16% in 2012 and are projected to be only 3% in 2035.

Financing Needs

The oil and gas industry is usually divided into three major sectors: upstream, midstream and downstream. Additionally, some oilfield service companies provide services to each of the three major sectors.

- The upstream oil sector is also commonly known as the exploration and production (E&P) sector.

- The midstream sector involves the transportation (by pipeline, rail, barge, oil tanker or truck), storage and wholesale marketing of crude or refined petroleum products.

- The downstream sector commonly refers to the refining of petroleum crude oil and the processing and purifying of raw natural gas.

- Oilfield service companies provide services such as short-term infrastructure construction at drill sites, drill site and pipeline repairs, drilling and maintenance supplies, short-term equipment rental, transportation (mostly trucking), jobsite staffing, and water storage, hauling and reclamation.

The upstream and downstream sectors consist primarily of large international and national companies, most of which are publicly traded. These companies typically have access to public debt markets or have large syndicated bank lines of credit to finance their operations. The midstream sector consists of large international or national companies, as well as some middle market companies (mostly truck transportation) that compete in this sector. However, the oilfield services industry consists of some large companies but mostly of national or regional middle market companies that are privately held. These companies typically do not have access to public debt or large syndicated bank loans.

Characteristics of Oilfield Service Companies

The fast growth of the oil and gas industry combined with the fact that large upstream, midstream and downstream companies normally only use a limited number of service suppliers (particularly at any given drill site), causes many middle market oilfield service companies to have these common characteristics:

- Fast revenue growth (10% to 30% per year is not uncommon).

- High customer A/R concentration; services are typically provided to a limited number of customers at one time (Two or three customers can make up 75% to 90% of total A/R).

- High A/R credit quality (Most customers are large publicly traded companies).

- High working capital demands since operating expenses (labor, fuel, etc.) are paid with short terms, and A/R collections may take 30 to 70 days to collect.

- Fast revenue growth has increased working capital assets and capital expenditure needs for equipment-related service companies.

- Asset growth has out-stripped equity levels making companies highly leveraged.

The above financial characteristics have created financing needs that exceed the lending criteria of most commercial banks and have created opportunities for alternative financing structures such as asset-based lending or factoring solutions.

Additional Risks and Collateral Concerns

In addition to the risks caused by the previously described characteristics (customer concentration, tight working capital, high financial leverage), many lower-middle market oilfield service companies are privately held or family-owned businesses that have experienced fast revenue growth. This rapid growth has strained the operational and financial management talents of these companies. Also, the pressure to make sure large customers are completely satisfied causes management to focus attention and resources on operational issues sometimes to the detriment of financial and accounting practices and reporting. Many of these companies have paper-intensive business practices that require in-field signatures and approvals by the customer in order to prepare and submit invoices for services rendered. These business practices are more prone to paper mistakes that can delay the issuance of invoices and the payment approval of invoices by the customer, which extend the company’s cash cycle (time from service provided to payment for services).

Potential offset due to contract risk is another issue the ABL lender needs to understand and monitor. Many companies have signed contracts to provide a particular service for a certain period of time or amount of production (e.g., repair X miles of pipeline or deliver Y gallons of water per week for Z months). While the service company typically only invoices for services already delivered or completed, in the event of a company liquidation, the customer may have damages related to any uncompleted work remaining on the underlying contract. These potential damages can cause a payment dispute or potential offsets to the outstanding A/R used as collateral for the loan.

While these lending risks are real, a knowledgeable and proactive ABL lender can mitigate these risks by: 1) reviewing customer credit quality, 2) setting concentration limits, 3) reviewing current and future contract terms (e.g., billing requirements, length of time for job completion, the potential offset amount for damages on uncompleted contracts), 4) performing A/R verifications, 5) monitoring of collections and credit memos, and 6) performing regular field exams that include an evaluation of billing, and financial methods and reporting.

The U.S. oil and gas industry has grown rapidly in the past six years and is projected to grow and become a significant segment of the U.S. economy. This growth will provide new opportunities for ABL lenders particularly with fast-growing middle market oilfield service companies. The challenge is to understand and mitigate the inherent industry risks in order to receive the benefits of a profitable loan portfolio in this industry. By providing the much needed working capital financing for this growing industry, ABL lenders can participate in U.S. job growth and assist the U.S. to achieve energy independence.

Harry R. Novak is a senior vice president and regional business development manager for First Capital managing the Chicago office, which services the Upper Midwest region.

First Capital is a non-bank commercial finance company providing ABL and factoring solutions with ABL loans ranging from $2 million to $25 million to various industries throughout the U.S. Since its founding in 1988 in Oklahoma City, First Capital has financed many oilfield services companies particularly in the Texas and Oklahoma oil patch. Through this experience First Capital is currently focused on expanding into the new opportunities provided by the Bakken (ND), Marcellus (PA) and Utica (OH, WV) shale plays.