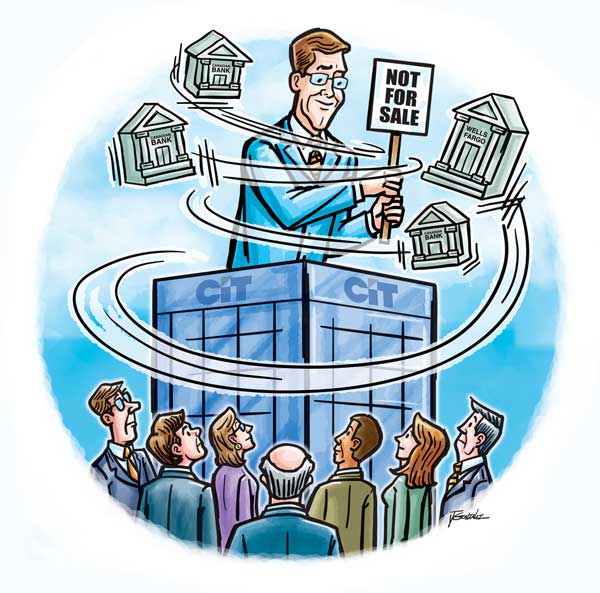

According to a CNBC transcript of Maria Bartiromo’s September 27 interview with CIT’s CEO John Thain, when asked if he was looking for a buyer for CIT, he replied “absolutely not.”

Thain’s denial came in response to a Fox Business Network piece a few days earlier that reported, according to investment bankers with direct knowledge of the matter, that Thain had been quietly shopping the firm to a larger player with the goal of selling possibly to a big bank and emerging as a player to run the bigger company. Fox noted that bankers were saying Thain began putting out feelers to sell CIT after the firm failed in its bid to purchase ING Direct, which was bought by Capital One earlier this year in a $9 billion deal.

The Fox report also noted that the firm BTIG LLC put out a research note recently that said well-capitalized Canadian banks would be in the best position to purchase CIT, largely because “the company has re-established itself as a leader in the U.S. middle-market lending space as evidenced by over $4 billion in new loan commitments last year.”

Meanwhile, according to a related Fox News story, Stifel Nicolaus analyst Christopher Mutascio said Wells Fargo should consider expanding by acquiring CIT, though bankers said Wells is looking to add to its asset management business, not expanding its lending unit. “CIT would make a financially attractive acquisition target” for Wells Fargo, allowing the banking giant to scoop up CIT’s tax-sheltering $4 billion of net operating loss carry forwards, the analyst said, according to Fox.