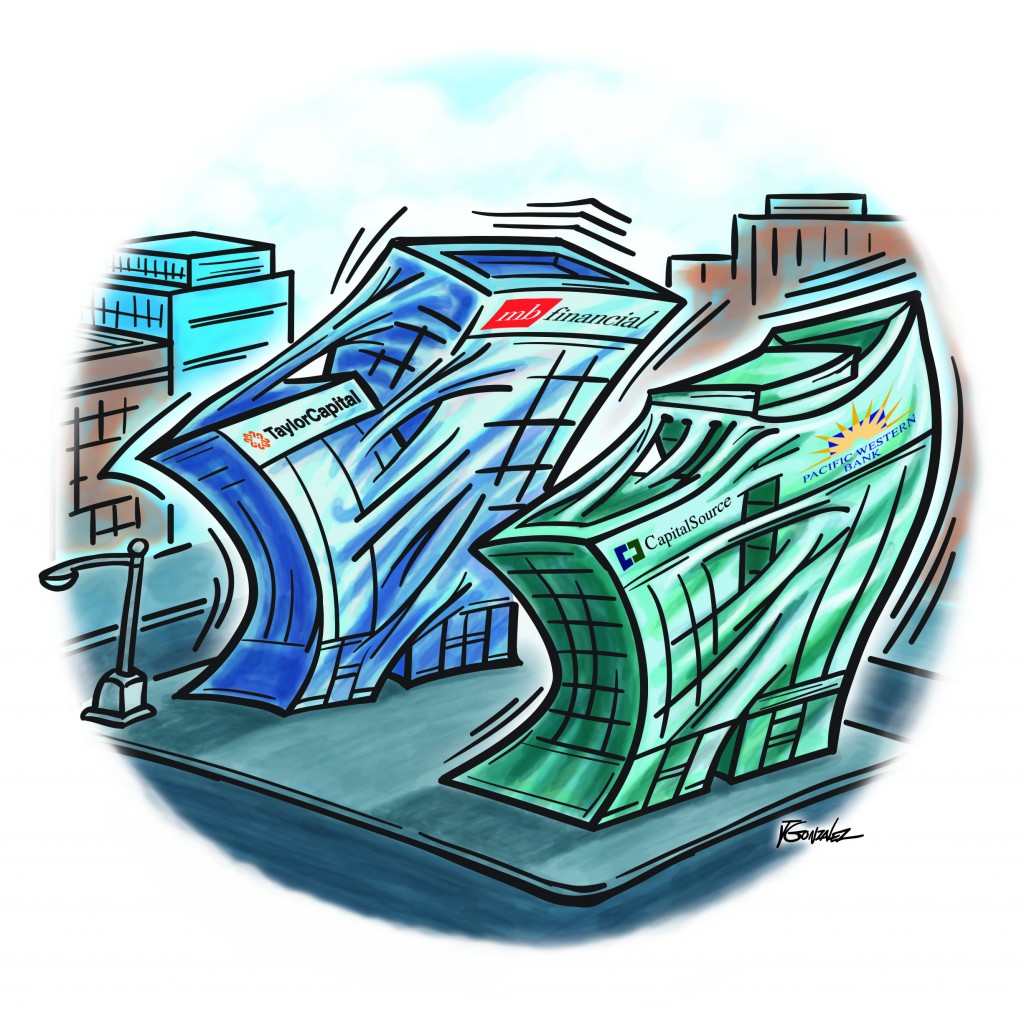

Two bank mergers made headlines recently, catching the attention of ABF Journal readers.

PacWest Bancorp and CapitalSource will merge in a transaction valued at approximately $2.3 billion. The combined company will be called PacWest Bancorp and combined subsidiary bank will be called Pacific Western Bank. The CapitalSource national lending operation will continue to do business under the name CapitalSource as a division of Pacific Western Bank. The transaction is expected to close in Q1/14. The combined company will remain headquartered in Los Angeles and will have senior executives from each of the organizations in key positions.

Matt Wagner, CEO of PacWest Bancorp and chairman and CEO of Pacific Western Bank, will be CEO of the combined company and of Pacific Western Bank. James J. Pieczynski, CEO of CapitalSource, will become president of the new CapitalSource division of Pacific Western Bank, incorporating all of the current CapitalSource lending operations. John Eggemeyer, chairman of PacWest Bancorp, will become chairman of the combined company. Tad Lowrey, chairman and CEO of CapitalSource Bank, will become non-executive chairman of Pacific Western Bank.

In addition, MB Financial will acquire Taylor Capital, the holding company of Cole Taylor Bank, a commercial bank headquartered in Chicago. MB Financial is the Chicago-based holding company of MB Financial Bank. The transaction, valued at approximately $680 million, inclusive of stock option, warrant and restricted stock cash-outs, is expected to close in H1/14. The transaction is expected to nearly double MB Financial’s middle-market commercial banking market share in the Chicago area.

Mark A. Hoppe, president and CEO of Taylor Capital, will become president and CEO of MB Financial Bank. Jennifer W. Steans and C. Bryan Daniels from Taylor Capital’s board of directors will join the MB Financial board.