Managing Director

Monroe Capital

Although a relatively large market, it’s surprising how little is known about Employee Stock Ownership Plans (ESOPs) among borrowers who are exploring their financing options. At Monroe Capital we work with companies across numerous industries and of all sizes. Our borrowers are looking for financing for multiple reasons, including, but not limited to, financing a sale of their business, recapitalizing their company, financing for a potential acquisition, or funding working capital requirements. When implemented correctly, ESOPs offer tremendous tax advantages that improve a company’s cash-flow while strengthening operational performance through increased employee morale and retention. While an ESOP is not always the right structure to accomplish a company’s strategic objectives, it should often be considered as one corporate finance option to achieve these objectives.

Economist Louis Kelso is credited with the creation of the ESOP. In 1956, he implemented the first ownership transfer to employees by means of what would later become known as The Kelso Plan at a San Francisco newspaper. Congress adopted ERISA in 1974; this legislation included attractive tax and financing advantages to induce company owners to sell company stock to employees, thus establishing the ESOP as a means to supplement Social Security. According to the National Center for Employee Ownership (NCEO), today there are more than 11,000 ESOPs in virtually every industry across the United States, representing more than 13 million employees.

An ESOP is a qualified, defined contribution employee benefit plan that invests primarily in the stock of the employer company. As a result, ESOP sponsors receive various tax benefits. Companies can use ESOPs for a variety of purposes. However, ESOPs are most commonly used to provide a market for the shares of owners of successful closely held companies who are leaving their businesses. They are also used to motivate and reward employees, or to take advantage of incentives to borrow money for acquiring new assets with pretax dollars. In addition to facilitating an ownership transfer, many companies have used ESOPs as a corporate finance technique for a variety of purposes, including: financing expansion, making an acquisition, spinning off a division or taking a company private, etc. Furthermore, in a small number of cases ESOPs have been used to facilitate the restructuring of failing businesses by creating a structure that offers significant tax advantages, which increases cash-flow, and enables companies to pay down debt more quickly and provide additional capital for investment in key areas of the business.

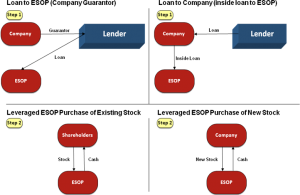

According to the ESOP Association, the majority of ESOPs, approximately 70%, are leveraged. Meaning these ESOPs utilize either third-party debt or seller financing to facilitate a transaction. A leveraged ESOP borrows money based on the credit of the employer or other related parties to buy company stock. It is the only qualified employee benefit plan that can do so. A loan from an outside lender can be to the ESOP itself, but most often are made directly to the employer, which then relends the money to the ESOP. Lenders generally prefer lending to the employer due to the employer’s assets and ability to secure the financing. The diagram below illustrates the ESOP financing process:

As noted above, an ESOP’s tax advantaged structure offers compelling financial benefits to any company. In addition, from an operations perspective, studies of ESOPs in closely held companies show that relative to comparable companies, ESOP companies’ sales, employment and productivity grow about 2% to 3% faster per year after setting up an ESOP than they had been growing relative to the same companies before establishing the ESOP. As evidence of this improved performance, during the Great Recession of 2010, employees of ESOPs were laid off at a rate more than four times less than employees of conventionally-owned companies. Specifically, the 2010 General Social Survey — a joint study performed by the NCEO and Employee Ownership Foundation — showed that employee stock-owned companies laid off employees at a rate of only 2.6% in 2010, whereas the rate for conventionally-owned companies was much higher at 12.1%. In addition, the 2010 GSS data indicated that 13% of the employees with employee stock ownership intended to leave their companies in the coming months, whereas the rate was 24% for employees without employee stock ownership.

Perhaps the most important financial benefit from a lender’s perspective is the company’s ability to deduct principal payments for tax purposes on debt used to acquire the stock for the plan. While there are certain restrictions to this deductibility, generally this benefit can result in up to a 40% improvement in cash-flow to service debt. That, in turn, provides for shorter amortization periods and higher leverage multiples than with non-ESOP owned businesses. This improved cash-flow also allows for adequate reinvestment in the business for working capital and capital expenditure purposes, enabling the business to capitalize on growth opportunities that might not otherwise have been available through traditional third party financing arrangements.

An ESOP can borrow money to facilitate a transaction, as long as the transaction is at least as favorable to the ESOP trust as an arm’s length transaction. Finance companies, such as Monroe Capital, are the most common third-party financing sources for ESOP transactions. Alternative structures include a company loaning funds to the ESOP or even the sellers of the stock taking a note back from the ESOP. It is imperative when putting an ESOP structure in place that the ESOP’s managers select the proper advisors, and perhaps more importantly, an educated financing source with ESOP experience. It can be a very costly mistake to try to structure an ESOP transaction with financing professionals who lack deep expertise in structuring an ESOP.

Monroe Capital is one of a few independent middle-market finance companies that have a dedicated ESOP lending practice. For Monroe Capital, the tax advantages ESOPs offer together with the stability they promote to a borrower’s underlying business is a key reason we have a dedicated practice in this area. In fact, according to a 2009 study conducted by the NCEO, the historical default rate for ESOPs is significantly lower than default rates on other commercial loans. According to the study, the default rate on ESOP loans was less than one-half of one percent. Moreover, a Moody’s study found that private equity-owned companies in comparison logged a 19.4% default rate between January 2008 and September 2009, while 186 private equity-owned companies and non-sponsor-owned companies defaulted at a rate of roughly 18.6% over the same period.

As a result of this favorable default rate, lenders that have experience in this area typically will view ESOPs more favorably than other highly leveraged transactions. It is critical that borrowers looking for financing through an ESOP structure, though, work with a seasoned lender who understands the complexities of ESOP transactions. Ultimately, the lender should be part of a team of experienced ESOP advisors that includes attorneys, valuation professionals and third-party trustees who can structure and implement the appropriate ESOP plan to meet their strategic objectives. It is for these reasons that Monroe Capital has decided to dedicate the resources necessary to grow its national ESOP lending practice.

While ESOPs do offer an attractive financing structure, it is important to make sure that an ESOP is right for your company’s strategic goals. It is also important to understand that ESOPs result in immediate dilution to existing shareholders through the sale of company stock to employees and, as a result, create a modest financial and administrative obligation on the company. Most often ESOPs are used in conjunction with achieving short- or long-term ownership transition goals, but in some situations the tax advantaged structure creates improved cash-flow to service debt, which can be used to meet multiple corporate finance objectives. The resulting structure offers considerable tax benefits, improved cash-flow and a culture of employee ownership that promotes operational improvement and greater employee motivation/retention.

Ty Dealy is managing director for Monroe Capital in the firm’s Atlanta office. He is responsible for leading Monroe’s national ESOP lending efforts in addition to originating cash-flow and enterprise value-based loans in private equity sponsored and non-sponsored transactions throughout the Southeast. Dealy has more than 20 years of financial experience with middle-market companies across numerous industries. Dealy received a B.S. in accounting from Wake Forest University and an MBA from Emory University’s Goizueta Business School. To learn more about Monroe Capital LLC, visit www.monroecap.com.