About the 2012 CFO Outlook — Who participated and how results were gathered:

From September 21 through November 3, 2011, Granite Research Consulting completed 600 interviews with financial executives from U.S. companies with annual revenues between $20 million and $2 billion. Participants are referred to as CFOs throughout the report since more than half have C-suite titles and most are CFOs.

Bank of America Merrill Lynch’s 2012 CFO Outlook survey reveals the changing perceptions and plans of U.S. CFOs in the year ahead. Importantly, it sheds light on the forecast for the American and global economies, as well as the projected revenues, profits, staffing, financial concerns and international activities of U.S. companies.

In its 14th year, the survey finds that despite lower economic confidence and an expanding range of concerns heading into 2012, U.S. CFOs are largely holding firm on employment and hiring projections, research and development spending, new borrowing, and other activities that drive both day-to-day operations and future growth.

EXECUTIVE SUMMARY

Taking a ‘Wait and See’ Approach

Looking ahead to a year that will be marked by U.S. elections, ongoing sovereign debt and deficit issues and a likely Supreme Court ruling on healthcare reform, the 2012 CFO Outlook survey results depict a cautious but not overly reactionary CFO mindset.

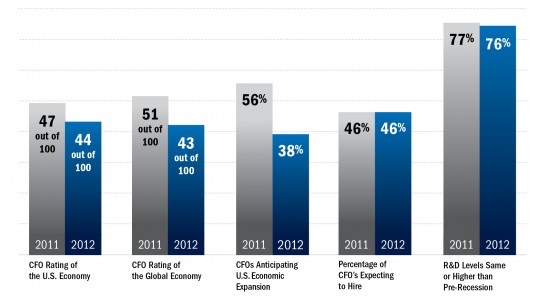

From a “glass-half-full” perspective, more than half of the 600 executives surveyed expect their corporate revenues to grow in 2012. Forty-six percent expect their companies to hire employees, 48% expect to maintain the same employment levels and only 7% anticipate reductions. More than three-fourths of CFOs said their R&D expenses were the same or higher than pre-recession levels. Finally, more CFOs this year say that more credit is available, and fewer CFOs say they expect the cost of capital to increase in 2012.

But as the data snapshot below indicates, the burgeoning optimism from early 2011 has ebbed on several important fronts. CFOs now give the U.S. economy a score of 44 out of 100, down from 47 last year and equal to the 2010 score, which was the lowest in the survey’s 14-year history. A year ago, 55% of U.S. companies expected to be more profitable in 2011, whereas today 41% anticipate profit margin growth and 15% predict declines in the year ahead. In terms of mergers and acquisitions, 18% of all U.S. companies expect to participate in a merger or acquisition in 2012, compared to 26% that forecast M&A activity for 2011.

A Growing Watch List of Concerns

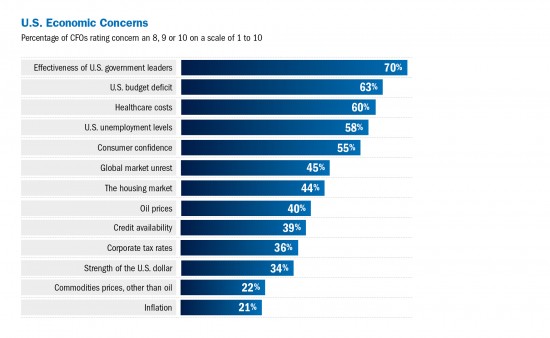

Senior financial executives are more concerned about more factors that could affect the economy than in any previous point in the CFO Outlook survey’s history. Heading into a critical election year, it’s telling that 70% of CFOs cited concern about the effectiveness of U.S. government leaders and 63% cited the U.S. budget deficit. In addition, 60% listed healthcare costs, 58% listed unemployment levels and 55% listed consumer confidence as concerns. By contrast, last year’s top concern regarding the economy was healthcare reform, chosen by 54% of CFOs.

KEY FINDINGS BY CATEGORY

The 2012 survey captures views across five key categories: Economies and Sectors, Performance and People, Financing, Mergers and Acquisitions and International Trade.

Economies and Sectors

- CFOs give the U.S. economy an average score of 44 on a scale of 0 to 100, down from 47 at the beginning of 2011.

- Only 38% of CFOs expect the U.S. economy to expand in 2012, down from 56% in last year’s survey.

- The global economy now rates lower than the U.S. at 43, down from 51 at the beginning of 2011.

- CFOs rate the current state of the U.S. manufacturing sector at 50, up from 48 in the 2011 annual survey, but down from pulse survey ratings in the spring and fall of 2011.

- The annual outlook for the U.S. services sector remains positive at 56, matching its rating for this time last year, but declined steady from subsequent ratings in the spring (63) and fall (60).

- In 2012, 56% of U.S companies are expecting revenue increases and 41% are forecasting profit growth, down from 64% and 55% one year ago.

- Nearly one-third of U.S. companies report that their capital expenditures will be higher than last year; 41% expect no change, 17% anticipate spending less and 11% do not expect to make capital expenditures.

- 60% of companies report 2012 R&D expenses to be the same compared to pre-recession levels, 16% anticipate an increase, while only 11% say R&D spending will be lower

- Half of all companies surveyed intend to increase the prices of their products in 2012, 44% will keep prices steady and only 4% will lower their prices.

- 48% of CFOs anticipate employee levels to remain the same, 46% plan to hire and only 7% anticipate reductions.

- The cost of healthcare is the chief financial concern of U.S. companies (56%), followed by energy costs (43%), consumer confidence (43%), cash flow (42%) and revenue growth (40%).

- 28% expect their borrowing needs to increase in 2012, up from 24% in 2011; 59% anticipate no change and 12% plan to borrow less.

- 62% are considering financing for some purpose in 2012 compared to 67% last year, with capital expenditures cited as the primary purpose (36%) followed by working capital (24%).

- Credit availability is the same as last year according to 53% of CFOs, while 36% report increased access to credit versus 28% last year.

- 68% say financing costs will remain the same, 10% anticipate lower cost of capital and 21% expect a cost increase.

- 18% expect to participate in a merger or acquisition in 2012, down from 26% last year. Of those forecasting M&A activity, 89% expect to be the acquiring company.

- Attractively priced acquisition targets may be harder to find in 2012 than in the aftermath of the global financial crisis; today only 45% of CFOs say there are more businesses available at lower prices versus 71% in 2010 and 55% in 2011.

- 54% of all U.S. companies do business internationally — they buy from foreign markets (47%), sell to foreign markets (34%) and/or have foreign operations (15%).

- 56% of companies that do business internationally are expecting their overseas sales to increase in 2012, 40% expect no change and 5% expect a decrease.

- Driven by sluggish demand, corporate revenue is the biggest concern that American CFOs say is impacting the short- and long-term health of their companies (35%).

- 28% of CFOs cite the economy and 21% say labor costs/availability are the chief corporate concerns with both immediate and farther reaching significance.

The full report and accompanying webcast are available at www.bankofamerica.com/cfooutlook.